题目

ECON3107-Economics of Finance - T2/2025

单项选择题

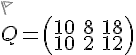

There are two future states and three securities with the associated payments matrix (states by securities) The first security current price is 9, the second security current price is 5 and the third security current price is 14. Are there any arbitrage opportunities? Hint: the calculations do not require matrix inverse.

选项

A.Yes, there are arbitrage opportunities

B.The market is incomplete, and therefore it is not possible to answer this question

C.No, all securities are fairly priced and there are no arbitrage opportunities

查看解析

标准答案

Please login to view

思路分析

First, restating the setup in my own words: there are two future states and three traded securities. The current prices are given as P1 = 9, P2 = 5, and P3 = 14. The payments matrix (states by securities) is mentioned but not displayed in the prompt, and the question asks whether arbitrage opportunities exist.

Key point to consider: arbitrage in a finite-state, finite-asset setting typically hinges on whether there exists a portfolio weights vector w such that the portfolio’s payoffs in all states are nonnegative and at least one state has a strictly positive payoff, while the initial cost is nonpositive (or negative). Equivalently, after discounting by state prices or using payoff vectors, arbitrage would show up if the current price vector lies outside the ......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

In a consumer society, many adults channel creativity into buying things

Economic stress and unpredictable times have resulted in a booming industry for self-help products

People born without creativity never can develop it

A product has a selling price of $20, a contribution margin ratio of 40% and fixed cost of $120,000. To make a profit of $30,000. The number of units that must be sold is: Type the number without $ and a comma. Eg: 20000

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!