题目

MUF0022 Accounting Unit 2 - Semester 2, 2025 Quiz: BDA: Revenues

单项选择题

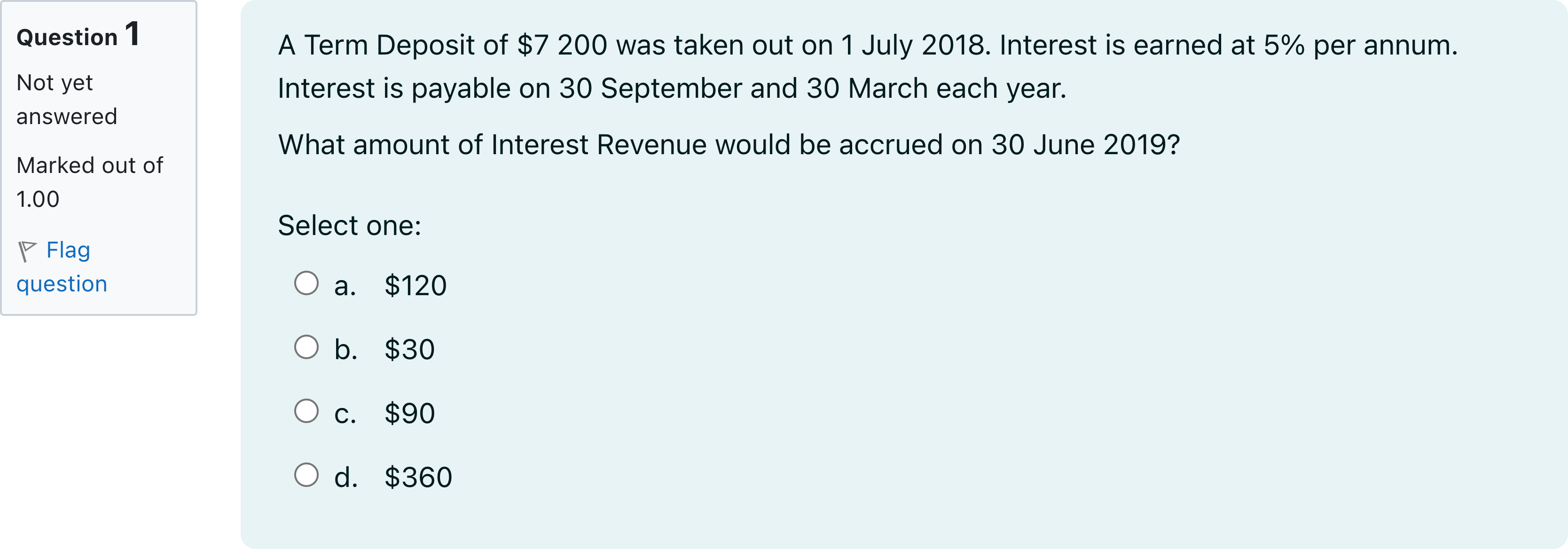

A Term Deposit of $7 200 was taken out on 1 July 2018. Interest is earned at 5% per annum. Interest is payable on 30 September and 30 March each year. What amount of Interest Revenue would be accrued on 30 June 2019?

选项

A.a. $120

B.b. $30

C.c. $90

D.d. $360

查看解析

标准答案

Please login to view

思路分析

We start by restating the essential details: a term deposit of $7,200 earns interest at 5% per year, with interest paid semi-annually on 30 September and 30 March. We need the Interest Revenue accrued as of 30 June 2019.

Option a: $120. To see if this is correct, compute the interest for the period between the last pay......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Which of the following transactions that impact current liabilities has a corresponding entry on the income statement?

On 1 September 2019, Cindy's Jewellery deposited $10 000 in a Term Deposit at a fixed rate of 12%. Interest on the Term Deposit is only paid once per year on 1 January. On balance day (30 September 2019) identify the amount of accrued revenue Cindy's Jewellery had earned on the Term Deposit.

Q8 Kekich & Associates borrowed $6,000 on 1 April 20X2 at 8% interest with both principal and interest due on March 31, 20X3. Which of the following journal entries should the firm use to record the interest incurred by 30 April 20X2?

Kekich & Associates borrowed $6,000 on 1 April 20X2 at 8% interest with both principal and interest due on 31 March, 20X3. Suppose Kekich & Associates makes adjustment to their accounting accounts at end of each calendar month, which of the following journal entries should the firm use to record the payment of interest on 31 March 20X3?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!