Questions

MCD2160 - T3 - 2025 MCD2160: Mid Test Practice Quiz

Single choice

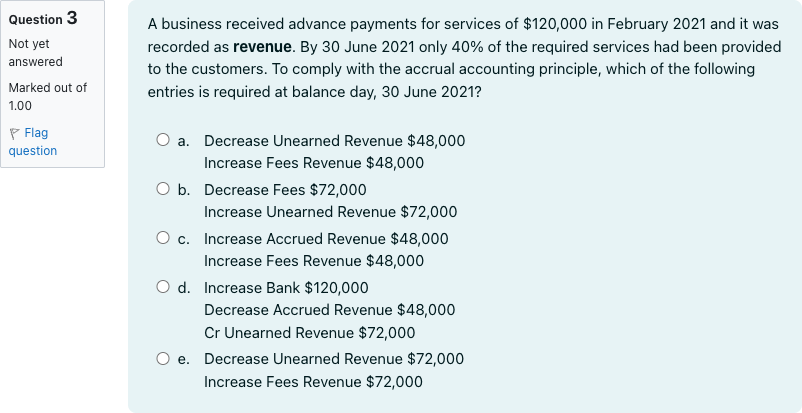

A business received advance payments for services of $120,000 in February 2021 and it was recorded as revenue. By 30 June 2021 only 40% of the required services had been provided to the customers. To comply with the accrual accounting principle, which of the following entries is required at balance day, 30 June 2021?

Options

A.a. Decrease Unearned Revenue $48,000 Increase Fees Revenue $48,000

B.b. Decrease Fees $72,000 Increase Unearned Revenue $72,000

C.c. Increase Accrued Revenue $48,000 Increase Fees Revenue $48,000

D.d. Increase Bank $120,000 Decrease Accrued Revenue $48,000Cr Unearned Revenue $72,000

E.e. Decrease Unearned Revenue $72,000 Increase Fees Revenue $72,000

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Context: The business initially recorded advance payments of 120,000 as revenue in February 2021. By 30 June 2021 only 40% of the services had been provided, so only 40% of the 120,000 (i.e., 48,000) should be recognized as revenue. The remaining 72,000 should be recorded as a liability (unearned revenue) until the services are delivered. The journal entry needed at balance day is a reversal of the portion previously recognized as revenue and a transfer to unearned revenue.

Option a: Decrease Unearned Revenue $48,000; Increase Fees Revenue $48,000. Explanation: This would imp......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Sandhill Media Company typically sells subscriptions on an annual basis and publishes 6 times a year. The magazine sells 88200 subscriptions in January at $8 each. What entry is made in January to record the sale of the subscriptions?

The receipt of cash in advance from a customer

Hangry Donuts hires Lara-Ann to handle corporate orders as the business grows. Lara-Ann negotiates a deal to have their donuts in the breakfast buffet at the Four Points Sheraton Central Park hotel - just opposite UTS on George Street. The hotel agrees to pay $500 in advance each month for donuts. Hangry Donuts receives the first payment. Select the flows and accounts that the business would use to record this transaction. Please choose a drop-down selection for every box. Assets = Liabilities + Equity [ Select ] Accounts payable Unearned revenue Inventory Cash Raw materials Accounts receivable Account not required [ Select ] Cash Revenue Bank loan Unearned revenue Account not required [ Select ] Cash Expenses Revenue Cost of sales Unearned revenue Account not required [ Select ] -500 +500 0 [ Select ] -500 +500 0 0

Hangry Donuts hires Lara-Ann to handle corporate orders as the business grows. Lara-Ann negotiates a deal to have their donuts in the breakfast buffet at the Four Points Sheraton Central Park hotel - just opposite UTS on George Street. The hotel agrees to pay $500 in advance each month for donuts. Hangry Donuts receives the first payment. Select the flows and accounts that the business would use to record this transaction. Please choose a drop-down selection for every box. Assets = Liabilities + Equity [ Select ] Accounts payable Unearned revenue Inventory Cash Raw materials Accounts receivable Account not required [ Select ] Cash Revenue Bank loan Unearned revenue Account not required [ Select ] Cash Expenses Revenue Cost of sales Unearned revenue Account not required [ Select ] -500 +500 0 [ Select ] -500 +500 0 [ Select ] -500 +500 0

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!