Questions

Single choice

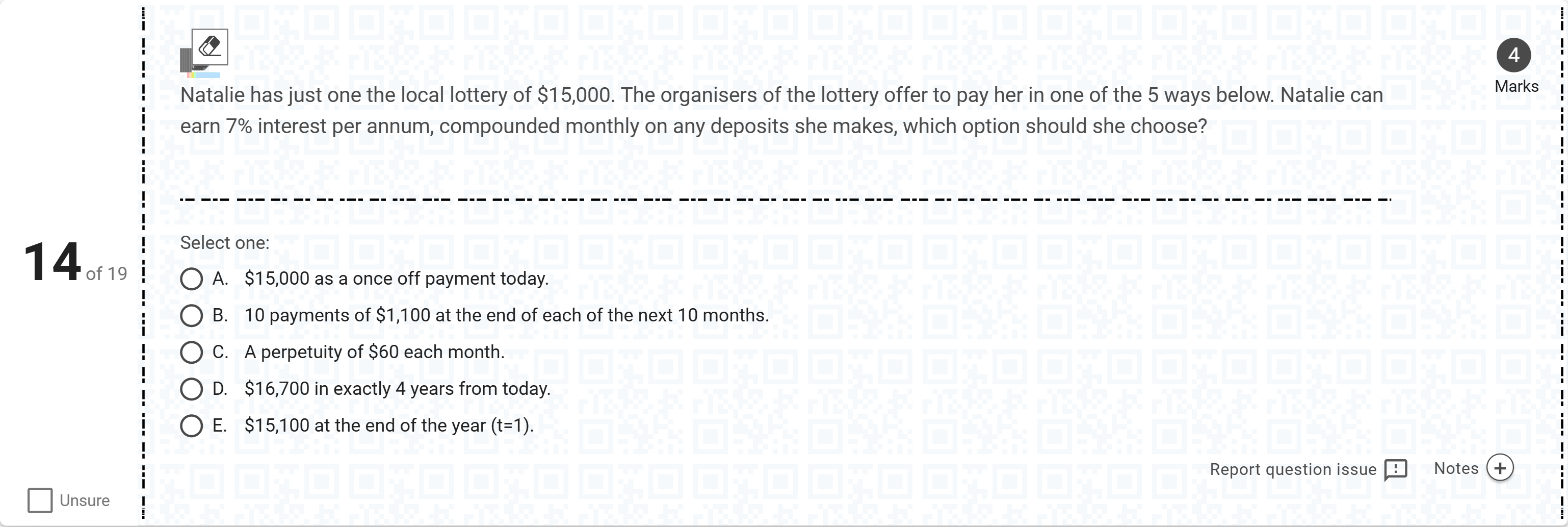

Natalie has just one the local lottery of $15,000. The organisers of the lottery offer to pay her in one of the 5 ways below. Natalie can earn 7% interest per annum, compounded monthly on any deposits she makes, which option should she choose?[Fill in the blank]

Options

A.A. $15,000 as a once off payment today.

B.B. 10 payments of $1,100 at the end of each of the next 10 months.

C.C. A perpetuity of $60 each month.

D.D. $16,700 in exactly 4 years from today.

E.E. $15,100 at the end of the year (t=1).

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Question restatement: Natalie can choose among five payment options after winning $15,000, with an opportunity to earn 7% interest per year compounded monthly. We evaluate the present value of each option using i = 0.07/12 per month (monthly compounding).

Option A: $15,000 as a once off payment today.

- This is a payment received today, so its present value is simply $15,000. There is no discounting needed because the money is already in hand right now.

Op......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Assuming two investments have equal lives, a high discount rate tends to favour

Present and future value concepts are used to determine the wealth provided by an investment.

What is the future value at the end of Year 5 for the following cash flow stream, assuming an interest rate of 5.0%? Beginning of Year 1 = $5,000 Beginning of Year 2 = $20,000 End of Year 3 = $15,000 End of Year 5 = $20,000

Part 1A twominus−year investment of $3500 is made today at an annual interest rate of 5.75%. Which of the following statements is TRUE? Part 1 A. The present value would be greater if the interest rate was higher. B. The future value would be greater if the interest rate was higher. C. The future value would be greater if the interest rate was lower. D. The future value does not change as the interest rate changes.

More Practical Tools for International Students

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!