题目

未知题型

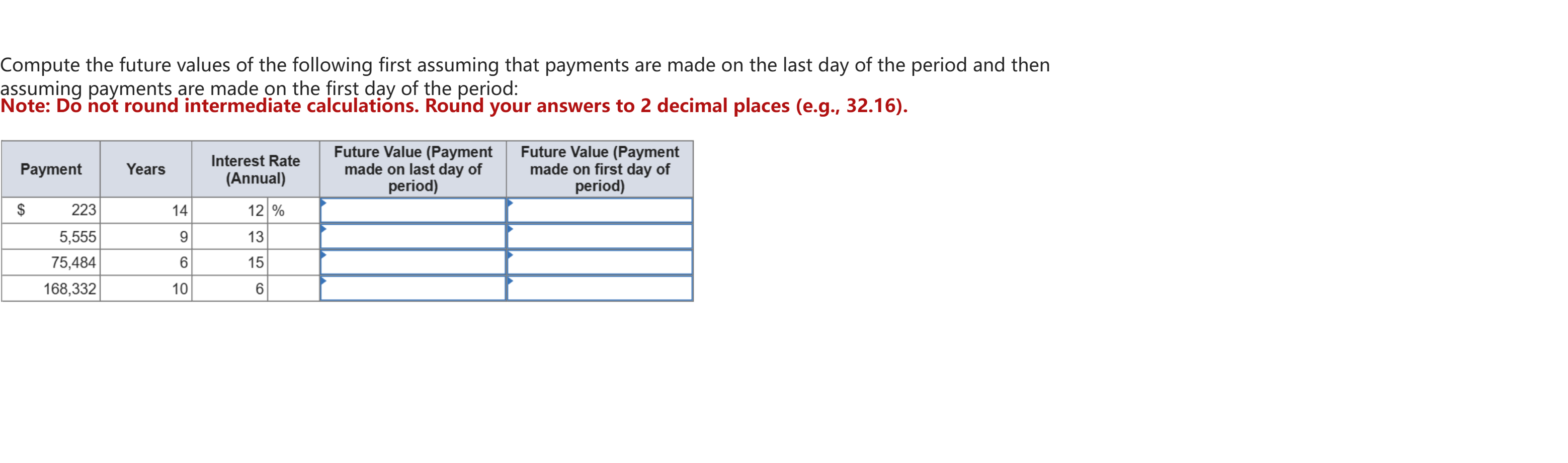

Compute the future values of the following first assuming that payments are made on the last day of the period and then assuming payments are made on the first day of the period: Note: Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).

查看解析

标准答案

Please login to view

思路分析

Here is a structured analysis of the possible future value results for the two scenarios (payments made on the last day of the period vs. payments made on the first day of the period), based on the four given payments, their years, and annual interest rates.

First, restating the data for clarity (as presented):

- Row 1: Payment = 223, Years = 14, Interest Rate = 12%

- Row 2: Payment = 5,555, Years = 9, Interest Rate = 13%

- Row 3: Payment = 75,484, Years = 6, Interest Rate = 15%

- Row 4: Payment = 168,332, Years = 10, Interest Rate = 6%

A standard approach to compare the two scenarios is:

- Ordinary annuity (payments at the end of each period): FV_ordinary = P × [((1 + i)^n − 1) / i]

- Annuity due (payments at the beginning of each period): FV_due = FV_ordinary × (1 + i)

Where P is the periodic payment, i is the annual interest rate (as a decimal), and n is the number of periods (years).

Given four rows, you would compute four FV values for the ordinary annuity (last-day payments) and then four FV values for the annuity due (first-day payments) by multiplying each FV_ordinary by (1 + i).

Now examine each candidate value as if it were one of the options you might select:

- Option group A: 7223.55, 8090.38, 85634.25, 96766.71

• These look like rela......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

Assuming two investments have equal lives, a high discount rate tends to favour

Present and future value concepts are used to determine the wealth provided by an investment.

What is the future value at the end of Year 5 for the following cash flow stream, assuming an interest rate of 5.0%? Beginning of Year 1 = $5,000 Beginning of Year 2 = $20,000 End of Year 3 = $15,000 End of Year 5 = $20,000

Part 1A twominus−year investment of $3500 is made today at an annual interest rate of 5.75%. Which of the following statements is TRUE? Part 1 A. The present value would be greater if the interest rate was higher. B. The future value would be greater if the interest rate was higher. C. The future value would be greater if the interest rate was lower. D. The future value does not change as the interest rate changes.

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!