Questions

Single choice

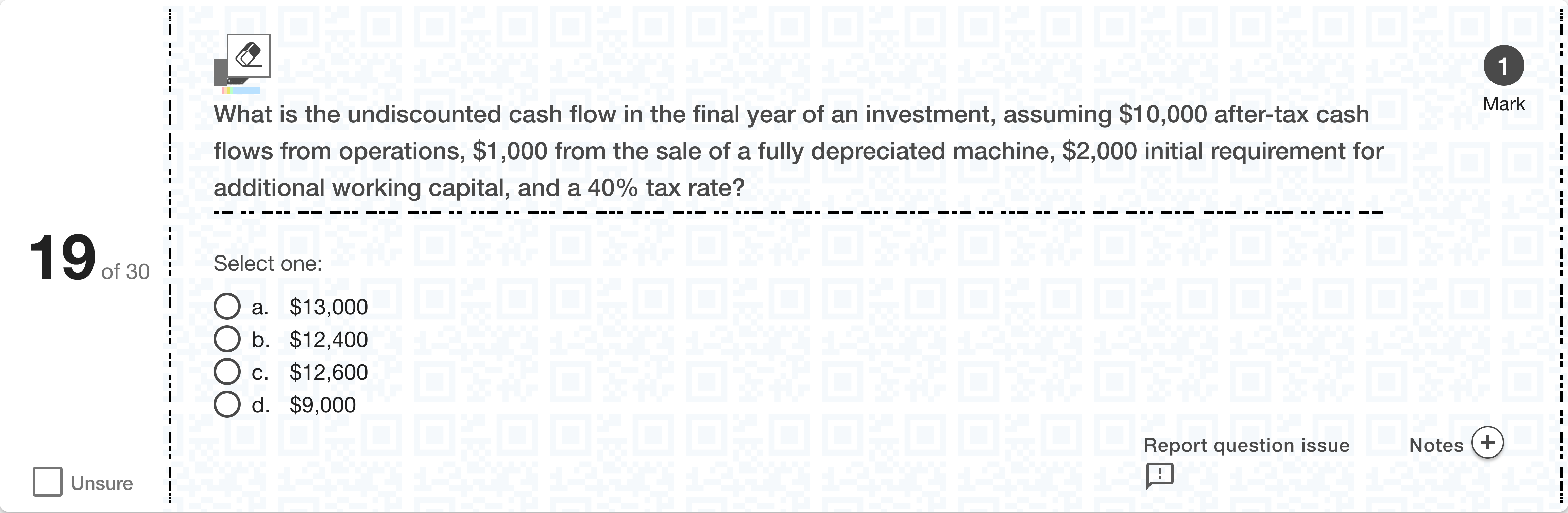

What is the undiscounted cash flow in the final year of an investment, assuming $10,000 after-tax cash flows from operations, $1,000 from the sale of a fully depreciated machine, $2,000 initial requirement for additional working capital, and a 40% tax rate?[Fill in the blank]

Options

A.a. $13,000

B.b. $12,400

C.c. $12,600

D.d. $9,000

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To solve this, we need to sum all the cash flows that occur in the final year of the project. Start by identifying each component:

Option analysis begins with the operating cash flow: the problem states $10,000 of after-tax cash flows from operations in the final year. Since this is after-tax cash flow, no further tax adjustments are needed for this component.

Next, consider the sale of the machine: the asse......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

What is the terminal cash flow of the project?

What is the terminal cash flow of the project?

Use the following information to answer this question. ABC Company is considering the purchase of new equipment. The following information is relevant to the decision: The cost of the new machine is $220,000. Installation will cost $10,000. The company spent $10,000 on a market analysis 2 months ago. The project will require an immediate increase in working capital of $10,000; the working capital will be fully recaptured at the end of the life of the project. The project will increase annual revenues by $125,000 and annual operating costs by $45,000. The project has an estimated life of 5 years. The machine will be depreciated via straight-line depreciation to a salvage value of $0 over the 5-year life of the asset. Realizable salvage value in 5 years is $50,000. The cost of capital is 14%, and the marginal tax rate is 34%. The old machine has a book value of $0. The old machine will be thrown away at no cost. What is the terminal cash flow of the project?

A project has an annual operating cash flow of $45000. Initially, this four-year project required $3800 in net working capital, which is recoverable when the project ends. The firm also spent $21500 on an asset with an useful life of 5 years to start the project. What is the cash flow for Year 4 of the project if the equipment can be sold for $5400 and the tax rate is 30%?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!