Questions

Single choice

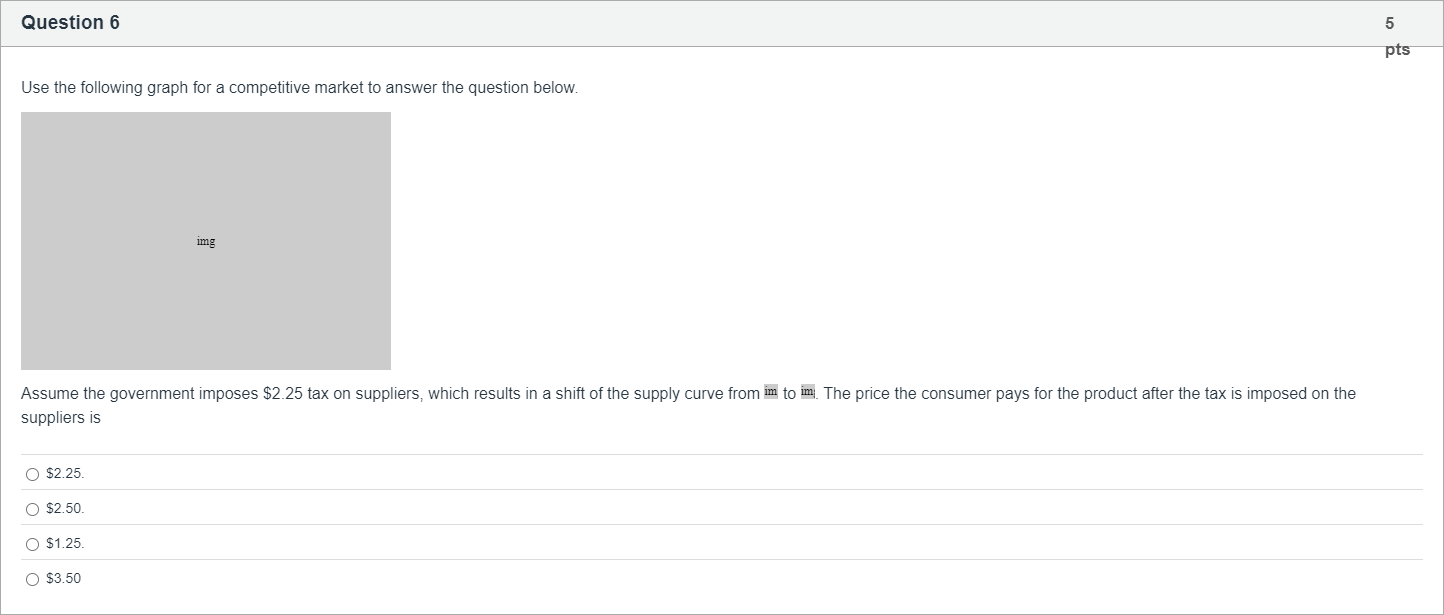

Use the following graph for a competitive market to answer the question below. Assume the government imposes $2.25 tax on suppliers, which results in a shift of the supply curve from to . The price the consumer pays for the product after the tax is imposed on the suppliers is

Options

A.$2.25.

B.$2.50.

C.$1.25.

D.$3.50

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this question, I’ll walk through each option and explain what the tax on suppliers does to the market price paid by consumers, using the idea of a tax wedge.

Option 1: $2.25

- This would mean the consumer price equals the tax per unit, which implies the entire tax is borne by consumers and the pre‑tax price to producers is unchanged. In a typical supply shift caused by a per‑unit tax on suppliers, the tax wedge is divided between buyers and sellers depending on relative elasticities. If the graph shows some sharing of the tax, this option would be incorrect ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!