Questions

Single choice

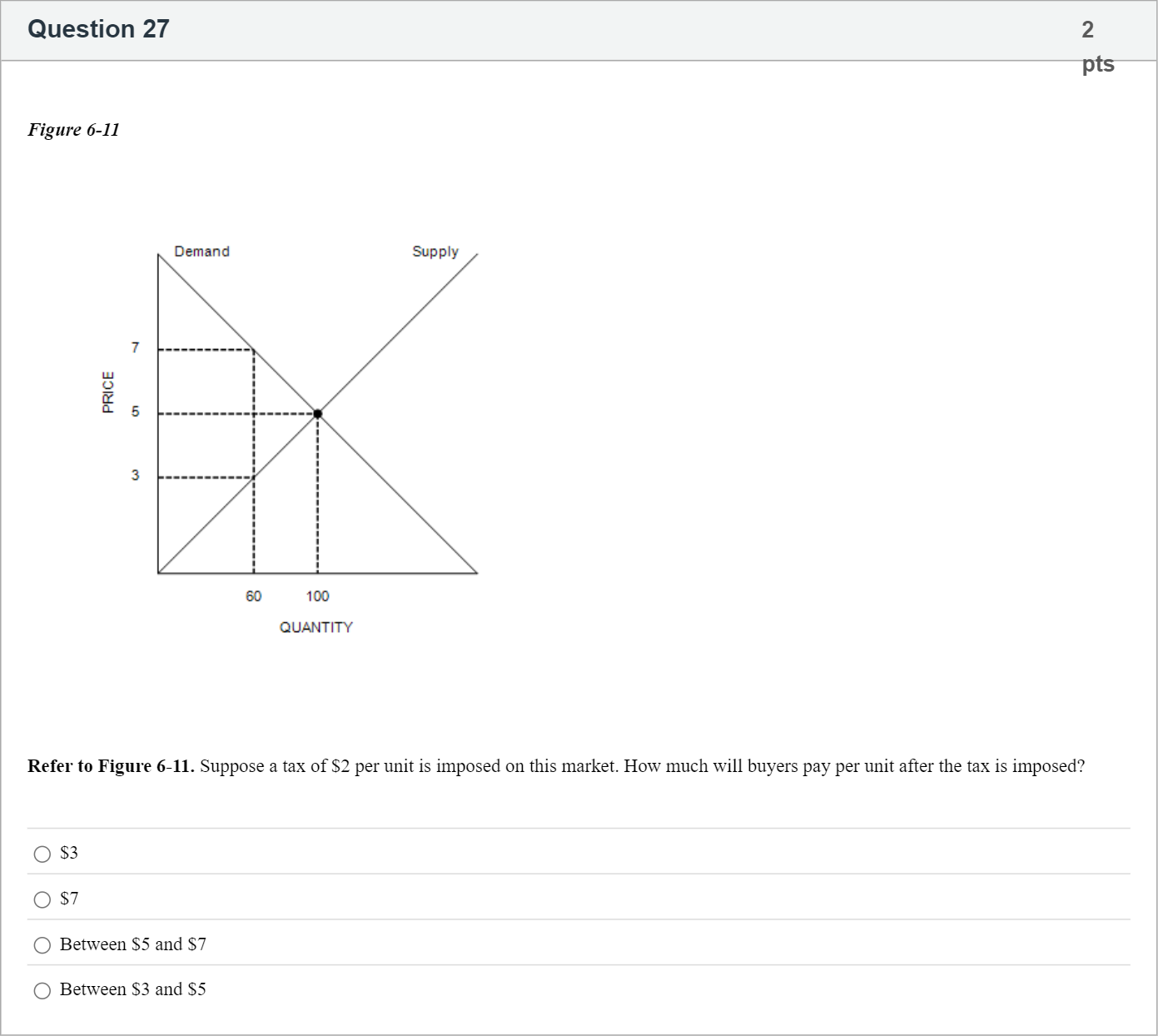

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

Options

A.$3

B.$7

C.Between $5 and $7

D.Between $3 and $5

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

First, I’ll restate the question and the options to set the stage for analysis.

Question: Figure 6-11 shows a market with a demand curve and a supply curve. A tax of $2 per unit is imposed on buyers. How much will buyers pay per unit after the tax is imposed?

Answer choices:

- $3

- $7

- Between $5 and $7

- Between $3 and $5

Now, let’s analyze each option step by step.

Option 1: $3

- This would require the price buyers pay after tax to drop to $3. Since a tax on buyers raises the price they pay relative to the price sellers receive (Pb = Ps + 2), a price of $3 for buyers would imply a seller receives $1, which is inconsistent with the original supp......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

If the market demand for a good is inelastic and the supply is elastic, which of the following is true when there is an increase in sales tax?

After the government imposed a $0.20 per gallon tax on gasoline, the price of a gallon of gasoline increased from $1.00 to $1.15. Which of the following statements is true?

Figure 6-11 Refer to Figure 6-11. Suppose a tax of $2 per unit is imposed on this market. Which of the following is correct?

Part 1The graph shows the market for tulips.Draw a point at the equilibrium price and equilibrium quantity. Label it 1.Suppose that tulips are taxed $6 a bunch and that the tax is on the sellers of tulips.Draw a curve that shows the effect of the tax. Label it.Draw a point to indicate the price paid by buyers and the quantity bought. Label it 2.Click toenlargegraph Part 1Sellers pay $[input]enter your response here of the tax. The tax revenue for the government is $[input]enter your response here per week. Part 1 020406080100120140681012141618202224Quantity (bunches per week)Price (dollars per bunch)1480Upper DDUpper SS 11 Upper S plus taxS+tax Edit coordinates interactive graph>>> Draw only the objects specified in the question.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!