Questions

Single choice

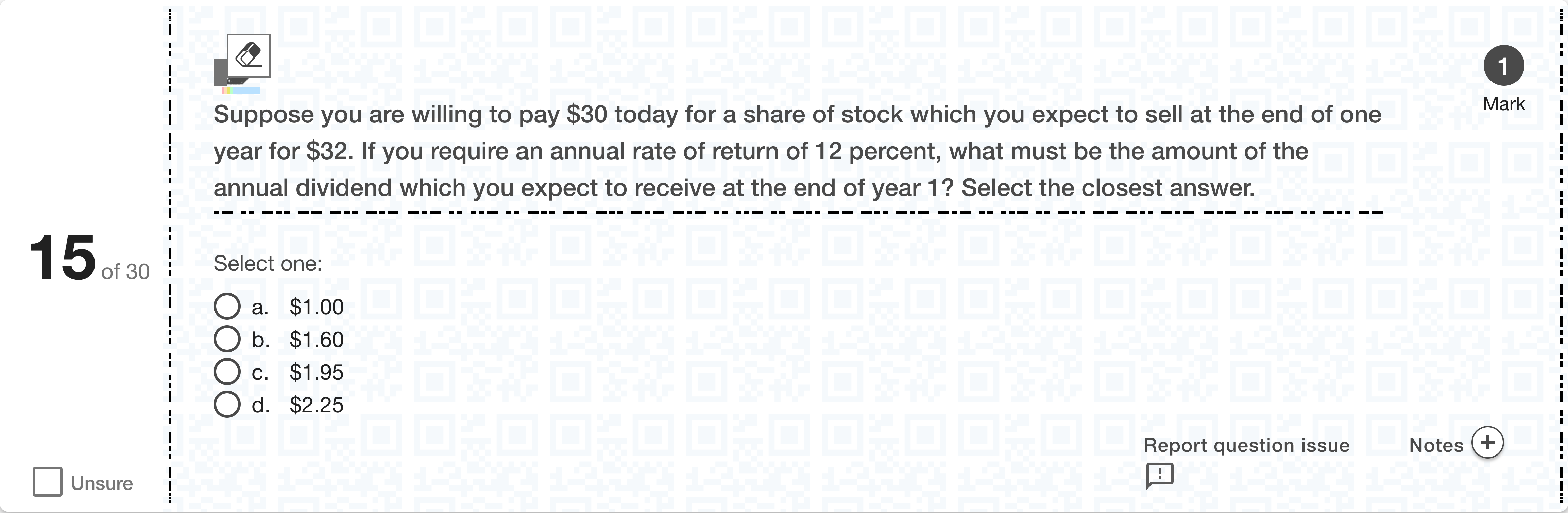

Suppose you are willing to pay $30 today for a share of stock which you expect to sell at the end of one year for $32. If you require an annual rate of return of 12 percent, what must be the amount of the annual dividend which you expect to receive at the end of year 1? Select the closest answer.[Fill in the blank]

Options

A.a. $1.00

B.b. $1.60

C.c. $1.95

D.d. $2.25

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To begin, consider the cash flows from holding the stock for one year: you receive a dividend D at the end of year 1 and you sell the stock for 32. The required return is 12%, so the present value of the combined cash flows must equal your initial price of 30.

Option a. $1.00: If the dividend were $1.00, the total cash received at year end would be 1.00 + 32 = 33.0......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following are reasons that you should care about stock valuation (according to the text)?

If the current risk free-rate is 6%, what should the current price of a stock be if its price and dividend next year are forecast to be $122 and $7, respectively, and its risk premium is 4%.

Assume that your valuations lead to an estimated share price of $39.80. Quizzer’s actual current share price is $37.90. Would you recommend buying or selling shares in Quizzer?

Part 1How much would you pay for a share of stock paying a dividend (cash payout C) of $44 to be paid in one year, a known selling price in one year (P) of $5050, and expected return (R) of similar assets of 44%? You would pay $[input]enter your response here . (Round your response to the nearest penny.)

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!