Questions

My home Progress Check

Single choice

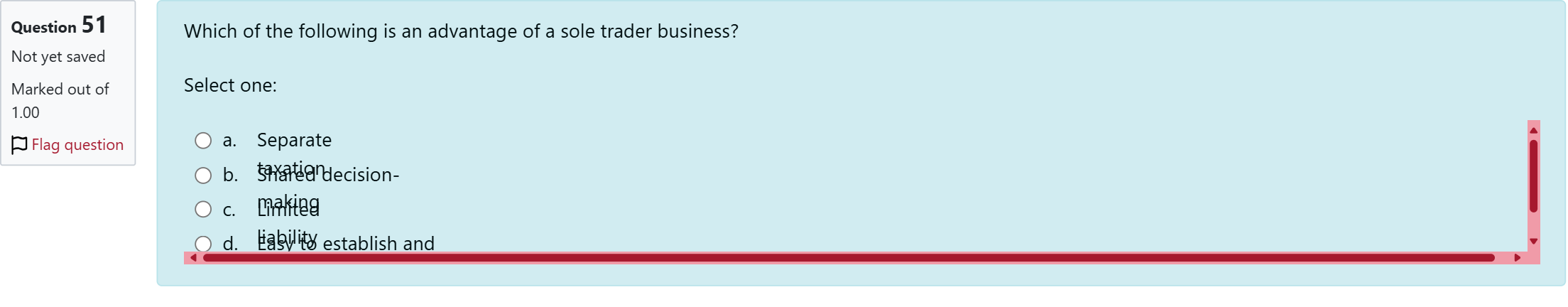

Which of the following is an advantage of a sole trader business?

Options

A.a. Separate taxation

B.b. Shared decision-making

C.c. Limited liability

D.d. Easy to establish and manage

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks to identify an advantage of a sole trader business from the given options.

Option a: Separate taxation. This is incorrect because a sole trader’s income is taxed as the owner’s personal income; there is no sepa......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

What is a key feature of a sole trader business?

A sole proprietor has Blank ______ personal liability for all business debts and obligations.

Which of the following entities is a “sole trader”?

Which of the following statements are not true for the sole traders? I. They are not generally a reporting entity (an entity that must produce GPFR)II. They are single owner businessIII. The sole trader entities pay tax.IV. They are separate legal entities.V. They are relatively simple and cheap to set up.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!