Questions

MUF0022 Accounting Unit 2 - Semester 2, 2025 Quiz: BDA: Revenues

Single choice

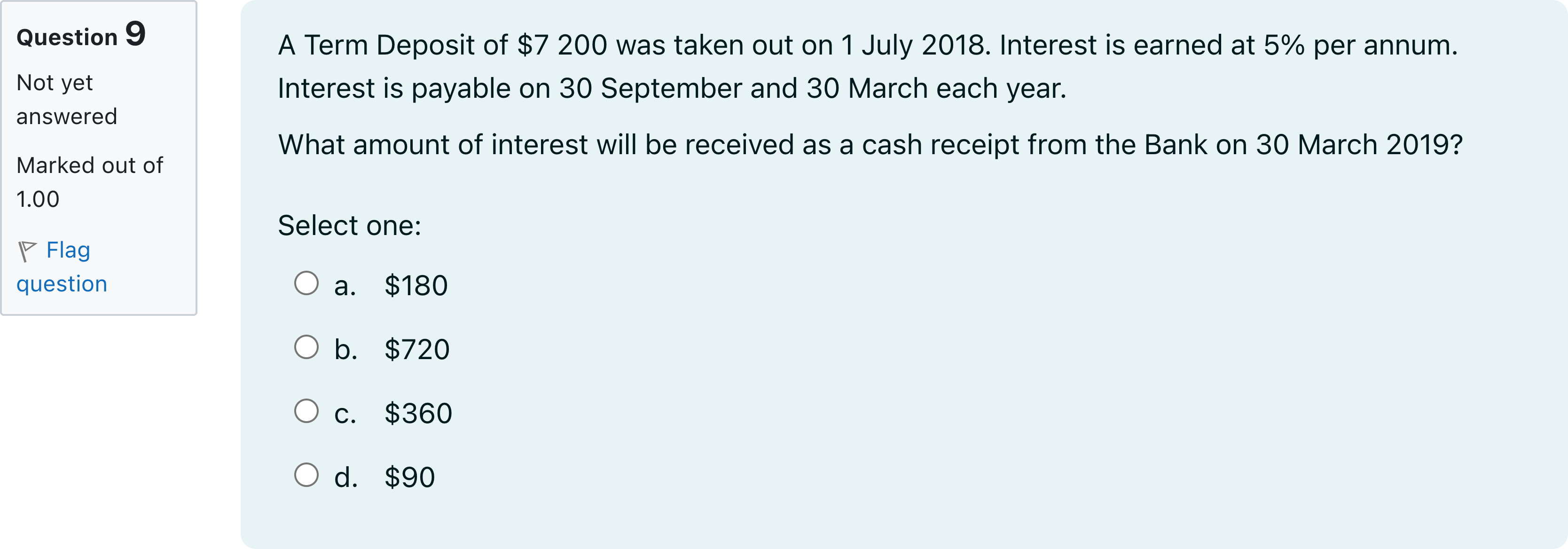

A Term Deposit of $7 200 was taken out on 1 July 2018. Interest is earned at 5% per annum. Interest is payable on 30 September and 30 March each year. What amount of interest will be received as a cash receipt from the Bank on 30 March 2019?

Options

A.a. $180

B.b. $720

C.c. $360

D.d. $90

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by identifying the key details of the deposit and the timing of interest payments. The term deposit is 7,200 at 5% per year, with interest paid on 30 September and 30 March each year. The question asks for the cash receipt on 30 March 2019.

Option a: "a. $180". This corresponds to the interest earned from 1 October 2018 to 30 March 2......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Simple interest grows exponentially over time.

If you had a loan for $30,000 at an annual interest rate of 8 percent with a 90-day interest prepayment penalty, what would be the amount of your penalty?

Question23 Parachute Pty Ltd issues a 60-day bill with a face value of $500,000, which is currently yielding 6.2% p.a. If a finance company purchases this bill immediately, what is the interest received if they held this to maturity? [4 marks] Invalid input. Enter a numerical value.[input] Your response must be entered as a numerical value with 2 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 4 Flag question undefined

If you take out a loan for $2,000 at an annual interest rate of 10%, how much interest will you pay each year?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!