Questions

FINS5513-Investments & Portfolio Sel. - T3 2025

Single choice

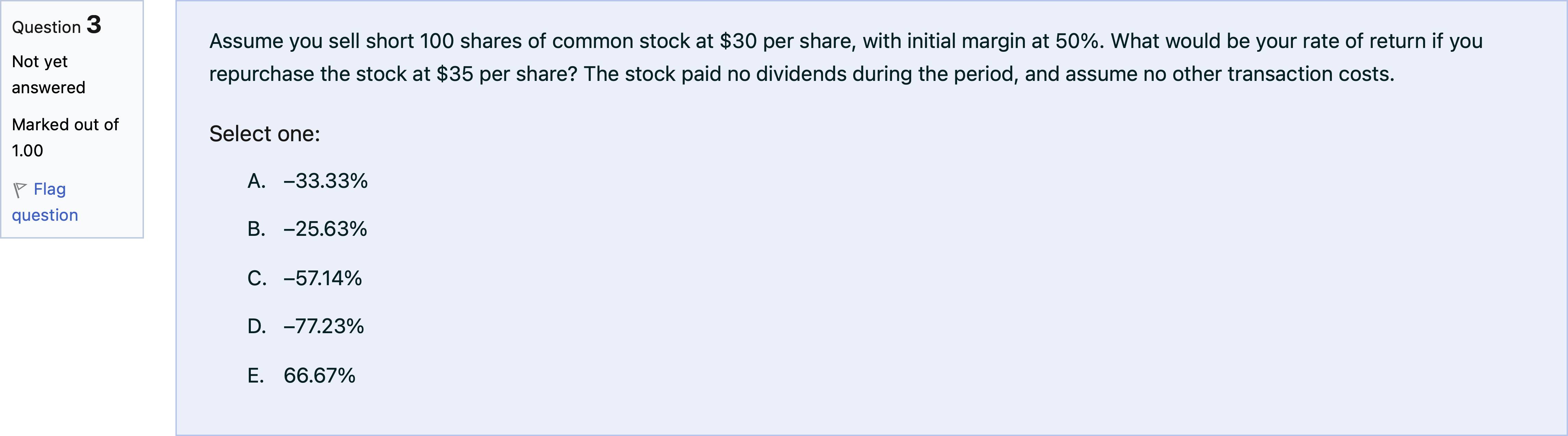

Assume you sell short 100 shares of common stock at $30 per share, with initial margin at 50%. What would be your rate of return if you repurchase the stock at $35 per share? The stock paid no dividends during the period, and assume no other transaction costs.

Options

A.A. –33.33%

B.B. –25.63%

C.C. –57.14%

D.D. –77.23%

E.E. 66.67%

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this problem, I’ll lay out the scenario and then evaluate each answer choice.

First, consider the initial trade: you short 100 shares at $30 each. This generates proceeds of 100 × $30 = $3,000. You must post an initial margin of 50%, which means you commit 50% of the short value as collateral: 0.50 × $3,000 = $1,500. So your account at the outset has $3,000 in proceeds from the short plus $1,500 of your......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Question1 Old McDonald has sold apples that he does not currently hold or expect to harvest anytime soon. He has entered into a: A short put option A plain vanilla swap A holding position in apples A short position in apples A long forward contract ResetMaximum marks: 1 Flag question undefined

Question1 Old McDonald has sold apples that he does not currently hold or expect to harvest anytime soon. He has entered into a: A short position in apples A plain vanilla swap A long forward contract A short put option A holding position in apples ResetMaximum marks: 1 Flag question undefined

Question10 Old McDonald has sold apples that he does not currently hold or expect to harvest anytime soon. He has entered into a: A short put option A long forward contract A short position in apples A plain vanilla swap A holding position in apples ResetMaximum marks: 1 Flag question undefined

Question1 Old McDonald has sold apples that he does not currently hold or expect to harvest anytime soon. He has entered into a: A long forward contract A holding position in apples A short put option A short position in apples A plain vanilla swap ResetMaximum marks: 1 Flag question undefined

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!