Questions

Single choice

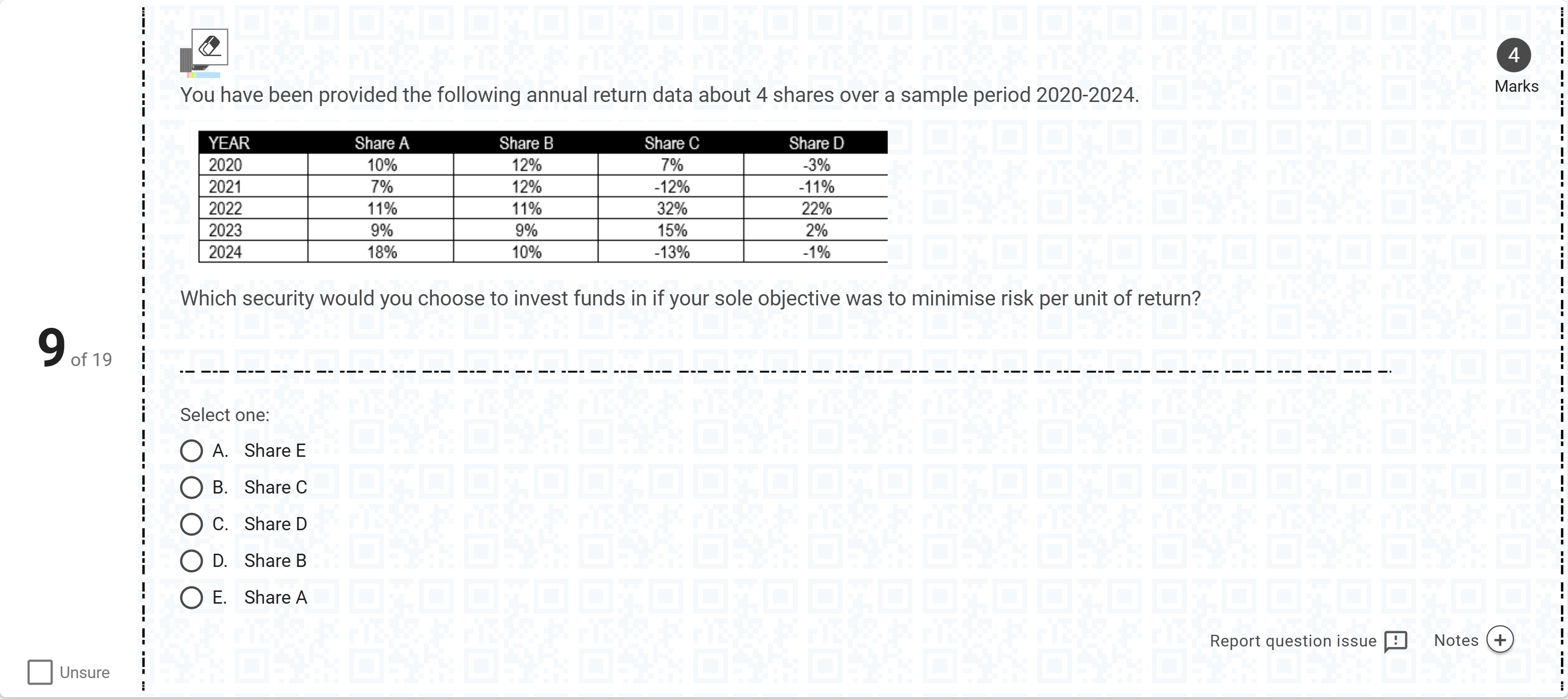

You have been provided the following annual return data about 4 shares over a sample period 2020-2024.Which security would you choose to invest funds in if your sole objective was to minimise risk per unit of return?[Fill in the blank]

Options

A.A. Share E

B.B. Share C

C.C. Share D

D.D. Share B

E.E. Share A

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating the data and the task to ensure clarity: you are given annual return data for four shares (A–D) over 2020–2024 and asked which security minimizes risk per unit of return. The goal is to pick the share with the smallest risk relative to its return, i.e., the lowest risk-to-return ratio (roughly, standard deviation of returns divided by mean return).

Option A: Share E. This option is not directly supported by the table provided, which only lists Shares A–D. Since Share E is not present in the data, evaluating......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

The following data has been collected to appraise the following four funds: Fund A Market Index Return 8.25% 8.60% Beta 0.91 1.00 Standard deviation 3.24% 3.55% Tracking error* 0.43% Tracking error is the standard deviation of the difference between the Fund Return and the Market Index Return. The risk-free rate of return for the relevant period was 4%. Use the above information to solve the following questions: The M2 is_______

The following data has been collected to appraise the following four funds: Fund A Market Index Return 8.25% 8.60% Beta 0.91 1.00 Standard deviation 3.24% 3.55% Tracking error* 0.43% Tracking error is the standard deviation of the difference between the Fund Return and the Market Index Return. The risk-free rate of return for the relevant period was 4%. Use the above information to solve the following questions: The M2 is_______

RAROC (Risk-Adjusted Return on Capital) is calculated as:

The Sharpe ratio

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!