Questions

Multiple fill-in-the-blank

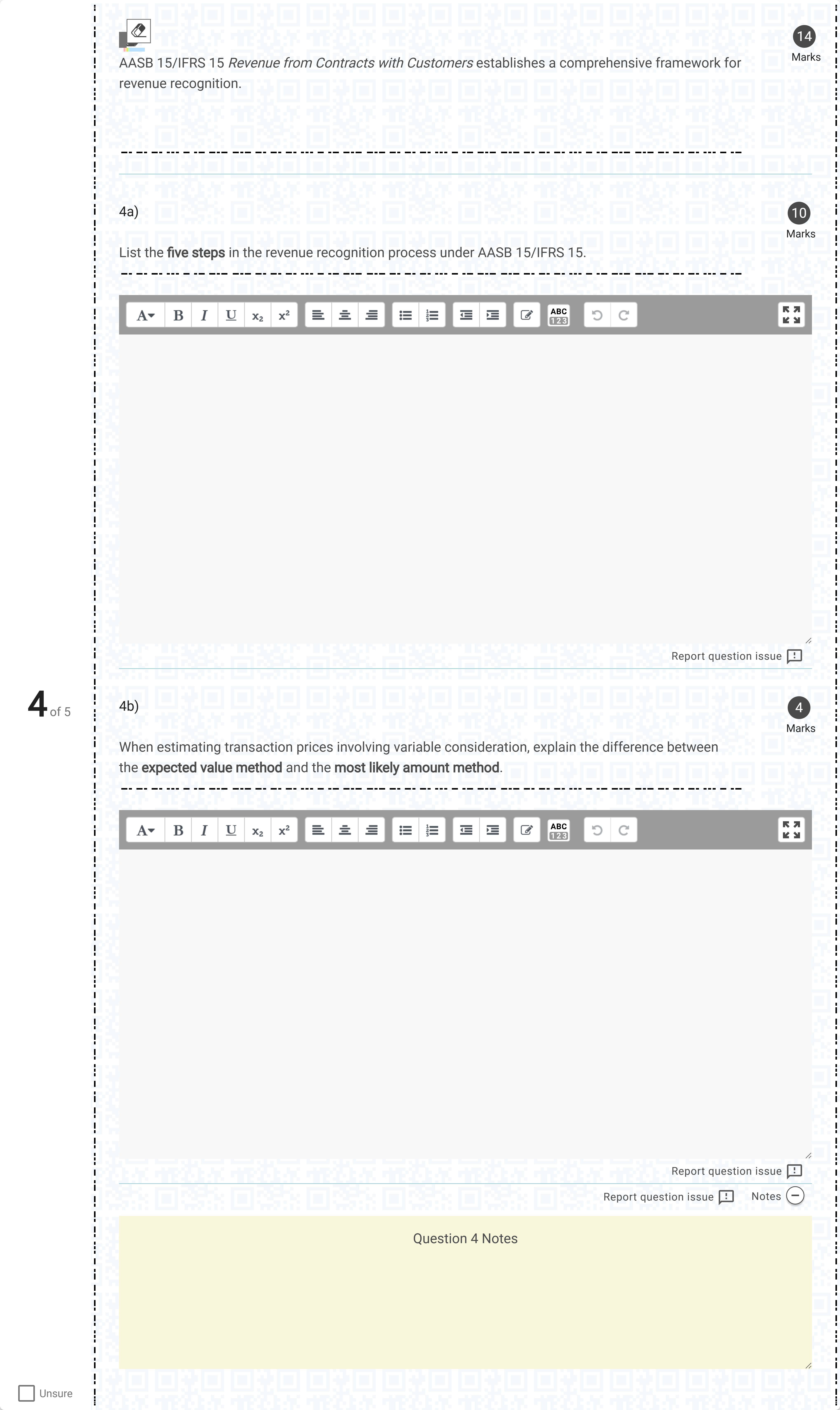

AASB 15/IFRS 15 Revenue from Contracts with Customers establishes a comprehensive framework for revenue recognition.[Fill in the blank] List the five steps in the revenue recognition process under AASB 15/IFRS 15.[Fill in the blank] When estimating transaction prices involving variable consideration, explain the difference between the expected value method and the most likely amount method.[Fill in the blank]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks you to fill in three related areas about IFRS 15/AASB 15 revenue from contracts with customers: (a) the five steps in the revenue recognition process, (b) the five steps again as a list, and (c) the difference between the expected value method and the most likely amount method when estimating variable consideration.

First, consider the standard five-step model for recognizing revenue under IFRS 15/AASB 15. Step 1 is to identify the contract with a customer, which establishes the legal enforceability basis for revenue and the performance obligations that may arise. Step 2 requires identifying the performance obligations in the contract, i.e., the promises to tran......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following is not part of the FASB criteria for revenue recognition?

In the financial statement audit, who is responsible for using accurate revenue recognition accounting estimates to prepare the financial statements of publicly traded companies (issuers)?

Question1(c) On 1 July 2019, XYZ Ltd received $100,000 in cash from customer ABC for an order of 100,000 units of its product. By the end of the financial year (assume the financial year starts on 1 July 2019 and ends on 30 June 2020), XYZ Ltd had delivered 35,000 units of product to ABC (selling price per unit is $1). The rest of the cash received in in advance from ABC relates to goods that will be provided in the next financial year. XYZ sets its selling price by employing a 100% mark up on the cost of inventory.Which of the following statements is true for transactions between XYZ and ABC for the financial year ended 30 June 2020? XYZ’s COGS was $35,000 XYZ’s inventory decreased by $35,000 The closing balance of unearned revenue relating to ABC was $35,000 XYZ generated sales revenue of $65,000 from ABC XYZ’s COGS was $17,500 ResetMaximum marks: 1 Flag question undefined

In 2021, Estelle's Star Makers agreed to build a movie theater for $200,000. Expected costs for the theater follow: 2022, $10,000; 2023, $40,000; and 2024, $30,000. Assume that Estelle completed the theater on time and on budget, that Estelle's performance obligation for the theater is fulfilled over time, and that the costs incurred provide a close approximation of the value conveyed to the customer.Answer the following question(s) by filling in the blanks. Do not include any symbols besides decimals in your answers (do not input commas).Compute revenues and expenses for each year 2022 through 2024. Year 2022 2023 2024 Revenue [R2022] [R2023] [R2024] Expense [E2022] [E2023] [E2024] [R2022] =

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!