Questions

Single choice

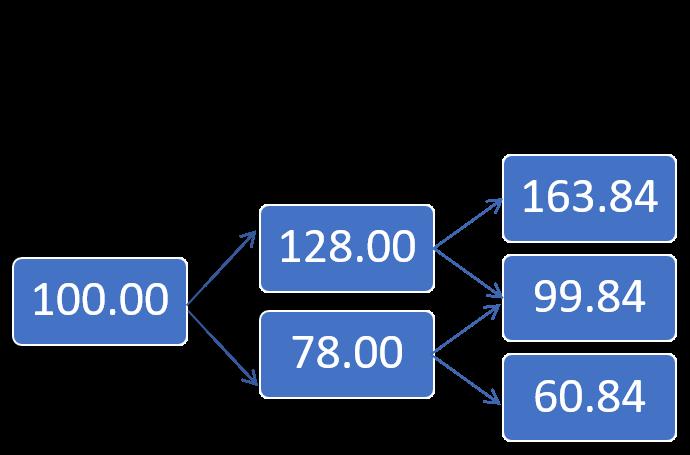

The following binominal tree for a project without flexibility is given (values are in millions and the time interval between nodes is one year):The risk-free rate is 7.00%. There is an option to expand operations once by 25.00% at any time during the next two years (t=1 or t=2) by investing additional 20 million. Round probabilities to two digits after the decimal separator (e.g., xx.xx%). What is the expansion option's value closest to?

Options

A.A. 15.85

B.B. 7.02

C.C. 7.56

D.D. 8.27

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating the problem setup and all answer choices to ensure we are evaluating the right items.

Question and options:

- The option allows expanding operations once by 25% at t=1 or t=2, by investing an additional 20 million.

- The risk-free rate is 7.00% and the time step is one year.

- The binomial tree values (in millions) are: at t=0 = 100; at t=1 the upward node is 128 and the downward node is 78; at t=2 the higher-up outcome is 163.84 and 99.84, and the lower-down outcome is 60.84 with their corresponding branches.

- The correct answer among the choices is stated as C. 7.56, with options A. 15.85, B. 7.02, C. 7.56, D. 8.27.

Now, I will analyze each answer option in turn, explaining why it could be plausible or not, without assuming the correct one upfront.

Option A: 15.85

- This value is substantially larger than the immediate成本 of expansion (20) when considering a discounting effect, and in a two-year binomial framework the risk-neutral value of a real option such as an expansion tends to be a fraction of the asset’s current price unless there is a very high leverage from the expansion payoff.

- The given tree shows relatively moderate scaled payoffs (the next-year node values around 128, 78, with subsequent outcomes arou......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

You are selecting between two NPV positive projects for the new investment: Project A and Project B. To incorporate flexibility you decide to conduct valuation using Real Option Analysis (ROA). Which of the following parameters is most likely not needed for the Real Option Analysis (ROA) valuation?

Which statement regarding the valuation of real options is most likely true?

What are the factors that affect the value of a real option?

In a consumer society, many adults channel creativity into buying things

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!