Still overwhelmed by exam stress? You've come to the right place!

We know exam season has you totally swamped. To support your studies, access Gold Membership for FREE until December 31, 2025! Normally £29.99/month. Just Log In to activate – no strings attached.

Let us help you ace your exams efficiently!

Questions

FINS3635-Options, Futures & Risk Mgmt - T3 2025

Single choice

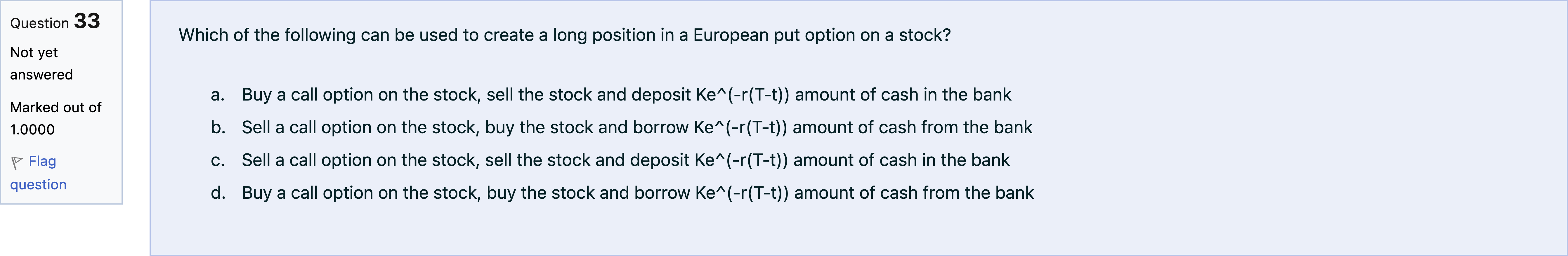

Which of the following can be used to create a long position in a European put option on a stock?

Options

A.a. Buy a call option on the stock, sell the stock and deposit Ke^(-r(T-t)) amount of cash in the bank

B.b. Sell a call option on the stock, buy the stock and borrow Ke^(-r(T-t)) amount of cash from the bank

C.c. Sell a call option on the stock, sell the stock and deposit Ke^(-r(T-t)) amount of cash in the bank

D.d. Buy a call option on the stock, buy the stock and borrow Ke^(-r(T-t)) amount of cash from the bank

View Explanation

Standard Answer

Please login to view

Approach Analysis

We need to analyze how to construct a portfolio that delivers the payoff of a long European put on a stock.

Option a: Buy a call on the stock, sell the stock, and deposit K e^(-r(T-t)) in the bank. This matches the put-call parity rearrangement P = C − S + K e^(−rT). Here you hold a long call (C), you are short the s......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Consider a European call option on a non-dividend-paying stock. The call has a strike price of $99.98 and expires in two years. The spot price of the underlying stock is $91.4. The no-arbitrage price of the call is $12.84. The 2-year spot interest rate 2.25% (APR compounded annually). A European put option on the same non-dividend-paying stock, with the same strike price ($99.98) and maturity (two years) as the call, is currently overpriced by the market, resulting in an arbitrage profit of $1.94. Calculate the market price of this put. Enter your final answer rounded to two decimal places. For example, enter 1.23 if your answer is $1.234, and enter -1.23 if your answer is -$1.234.

You observe the following prices European options on a non-dividend-paying stock: Current stock price: $20 Strike price (both options): $22 Time to maturity: 1 year Option prices (each option is written on 1 share): European call price: $1.23 European put price: $1.98 You know that both options are correctly priced. Using these prices, compute the implied one-year effective risk-free interest rate. Enter your final answer rounded to two decimal places. For example, enter 1.23 if your answer is $1.234, and enter -1.23 if your answer is -$1.234.

Which relationship holds with the most precision?

Consider a put and a call on a stock with price S. The stock does not pay dividends. Interest rates are zero. Both options have the same expiration date. Between Monday and Tuesday, S does not change, but the call price falls by $2. What happens to the put price?

More Practical Tools for International Students

Making Your Study Simpler

To make preparation and study season easier for more international students, we've decided to open up Gold Membership for a limited-time free trial until December 31, 2025!