Still overwhelmed by exam stress? You've come to the right place!

We know exam season has you totally swamped. To support your studies, access Gold Membership for FREE until December 31, 2025! Normally £29.99/month. Just Log In to activate – no strings attached.

Let us help you ace your exams efficiently!

Questions

Unknown Question Type

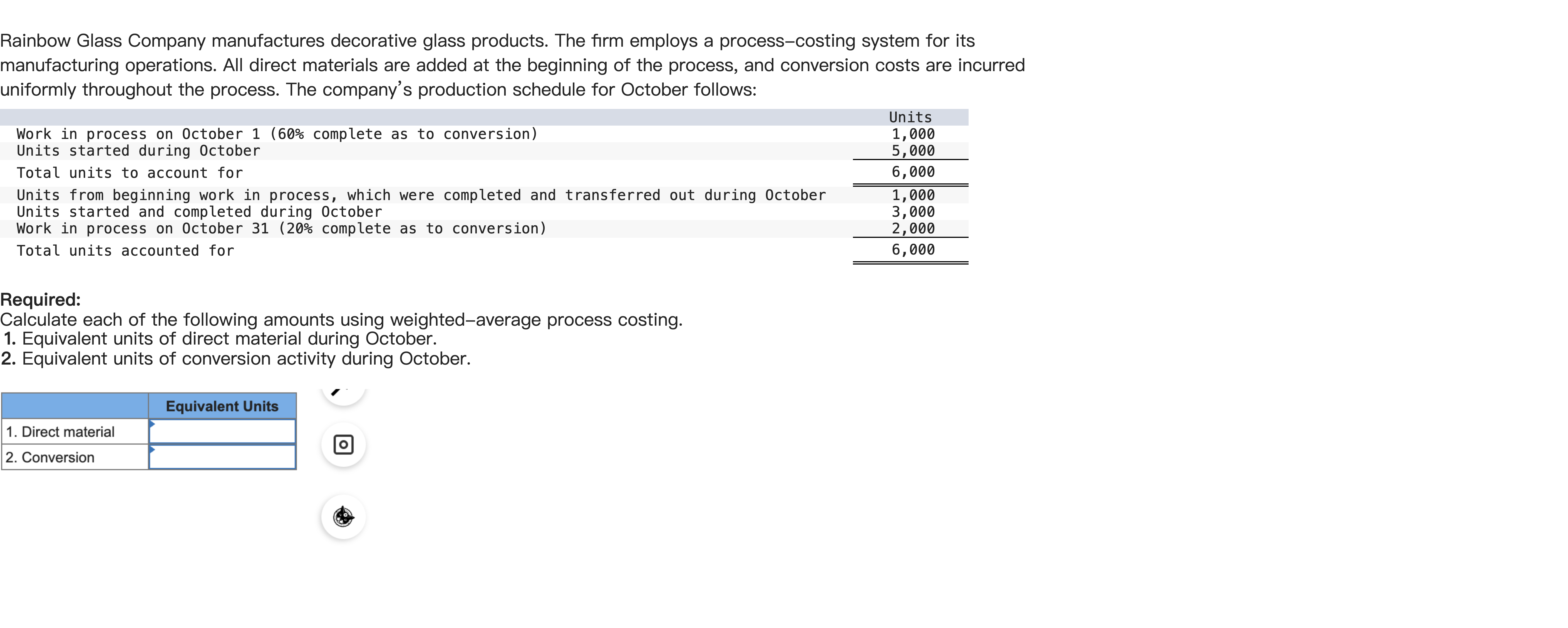

Rainbow Glass Company manufactures decorative glass products. The firm employs a process-costing system for its manufacturing operations. All direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. The company’s production schedule for October follows: Units Work in process on October 1 (60% complete as to conversion) 1,000 Units started during October 5,000 Total units to account for 6,000 Units from beginning work in process, which were completed and transferred out during October 1,000 Units started and completed during October 3,000 Work in process on October 31 (20% complete as to conversion) 2,000 Total units accounted for 6,000 Required: Calculate each of the following amounts using weighted-average process costing. Equivalent units of direct material during October. Equivalent units of conversion activity during October.

View Explanation

Standard Answer

Please login to view

Approach Analysis

Let's restate the problem data and what is being asked, then evaluate each component step by step.

Question restatement:

- Direct materials are added at the beginning of the process.

- Conversion costs are incurred uniformly over the process.

- October activity:

- Beginning work in process (WIP): 1,000 units, 60% complete as to conversion

- Units started during October: 5,000

- Units completed and transferred out during October: 1,000 (from beginning WIP) + 3,000 (started and completed)

- Ending WIP (Oct 31): 2,000 units, 20% complete as to conversion

- Required using weighted-average: (1) Equivalent units of direct materials; (2) Equivalent units of conversion during October.

Option-by-option analysi......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Required information Skip to question [The following information applies to the questions displayed below.] Timing Technology, Incorporated, manufactures timing devices. During 20x1, 900,000 units were completed and transferred to finished-goods inventory. On December 31, 20x1, there were 300,000 units in work in process. These units were 50 percent complete as to conversion and 100 percent complete as to direct material. Finished-goods inventory consisted of 200,000 units. Materials are added to production at the beginning of the manufacturing process, and overhead is applied to each product at the rate of 60 percent of direct-labor costs. There was no finished-goods inventory on January 1, 20x1. A review of the inventory cost records disclosed the following information: Units Direct Material (Costs) Direct Labor (Costs) Work in process, January 1, 20x1 (80% complete as to conversion) 200,000 $ 200,000 $ 315,000 Units started in production 1,000,000 Direct-material costs $ 1,300,000 Direct-labor costs $ 1,995,000 Required: 1. Complete the following schedule as of December 31, 20x1, to compute the physical flow of units.

Idaho Lumber Company grows, harvests, and processes timber for use in construction. The following data pertain to the firm’s sawmill during November. Work in process, November 1 Direct material $ 65,000 Conversion 180,000 Costs incurred during November Direct material $ 425,000 Conversion 690,000 The equivalent units of activity for November were as follows: 7,000 equivalent units of direct material and 1,740 equivalent units of conversion activity. Required: Calculate the cost per equivalent unit, for both direct material and conversion, during November. Use weighted-average process costing.

Idaho Lumber Company grows, harvests, and processes timber for use in construction. The following data pertain to the firm’s sawmill during November. Work in process, November 1 Direct material $ 65,000 Conversion 180,000 Costs incurred during November Direct material $ 425,000 Conversion 690,000 The equivalent units of activity for November were as follows: 7,000 equivalent units of direct material and 1,740 equivalent units of conversion activity. Required: Calculate the cost per equivalent unit, for both direct material and conversion, during November. Use weighted-average process costing.

Bixby Manufacturing commenced production as of August 1st and utilizes a process-costing system, and conversion cost is incurred evenly throughout manufacturing. At the end of August, Bixby had completed 62,000 units. Which of the following statements is true about the ending work-in-process inventory if equivalent units for conversion cost for August totaled 65,000 units?

More Practical Tools for International Students

Making Your Study Simpler

To make preparation and study season easier for more international students, we've decided to open up Gold Membership for a limited-time free trial until December 31, 2025!