Still overwhelmed by exam stress? You've come to the right place!

We know exam season has you totally swamped. To support your studies, access Gold Membership for FREE until December 31, 2025! Normally £29.99/month. Just Log In to activate – no strings attached.

Let us help you ace your exams efficiently!

Questions

FINA2720.MERGED.202610 Final Exam- Requires Respondus LockDown Browser

Short answer

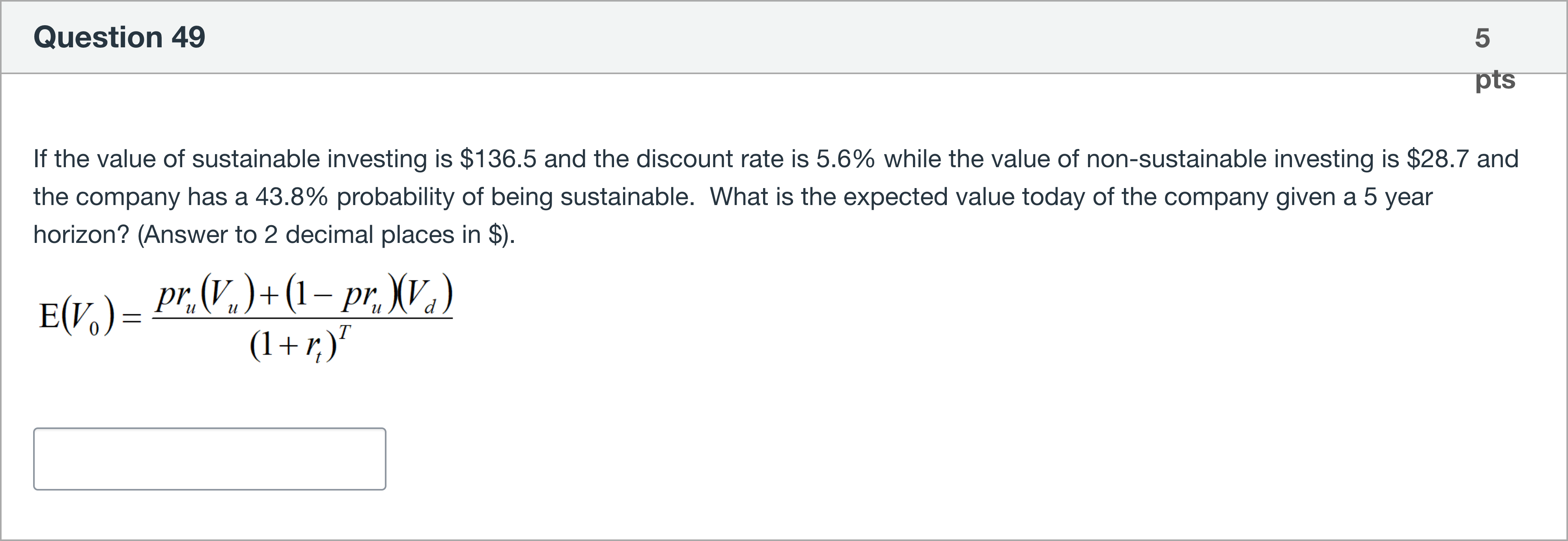

If the value of sustainable investing is $136.5 and the discount rate is 5.6% while the value of non-sustainable investing is $28.7 and the company has a 43.8% probability of being sustainable. What is the expected value today of the company given a 5 year horizon? (Answer to 2 decimal places in $).

View Explanation

Standard Answer

Please login to view

Approach Analysis

The question provides the following values: sustainable investment value (V_u) = 136.5, non-sustainable investment value (V_d) = 28.7, probability of being sustainable p = 0.438, discount rate r = 5.6% (0.056), and a 5-year horizon T = 5.

First, determine the expected value at the 5-year horizon ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

A client offers you the following deal: You will receive $6,000 for the next three years, one payment per year (that is, $6,000 at Year 1, Year 2, and Year 3). In exchange, you will pay $15,000 at Year 4. The current market prices of the following zero-coupon bonds (each with $100 face value) are: Bond A (1-year): price $95.24 Bond B (2-year): price $89.00 Bond C (3-year): price $81.63 Bond D (4-year): price $73.50 Using these bond prices, compute the net value today (Year 0) of the client’s deal to you. Enter your final answer rounded to two decimal places. For example, enter 1.23 if your answer is $1.234, and enter -1.23 if your answer is -$1.234.

Consider a $1,000,000 cash flow to be paid in 5 years. How would you compute the present value? Assume the five-year USD swap rate is 3.5%.

If the value of sustainable investing is $152.9 and the discount rate is 10.5% while the value of non-sustainable investing is $33.6 and the company has a 67.7% probability of being sustainable. What is the expected value today of the company given a 18 year horizon? (Answer to 2 decimal places in $).

If you receive $439 each 6 months for 1 year and the discount rate is 0.07, what is the present value?

More Practical Tools for International Students

Making Your Study Simpler

To make preparation and study season easier for more international students, we've decided to open up Gold Membership for a limited-time free trial until December 31, 2025!