Questions

Single choice

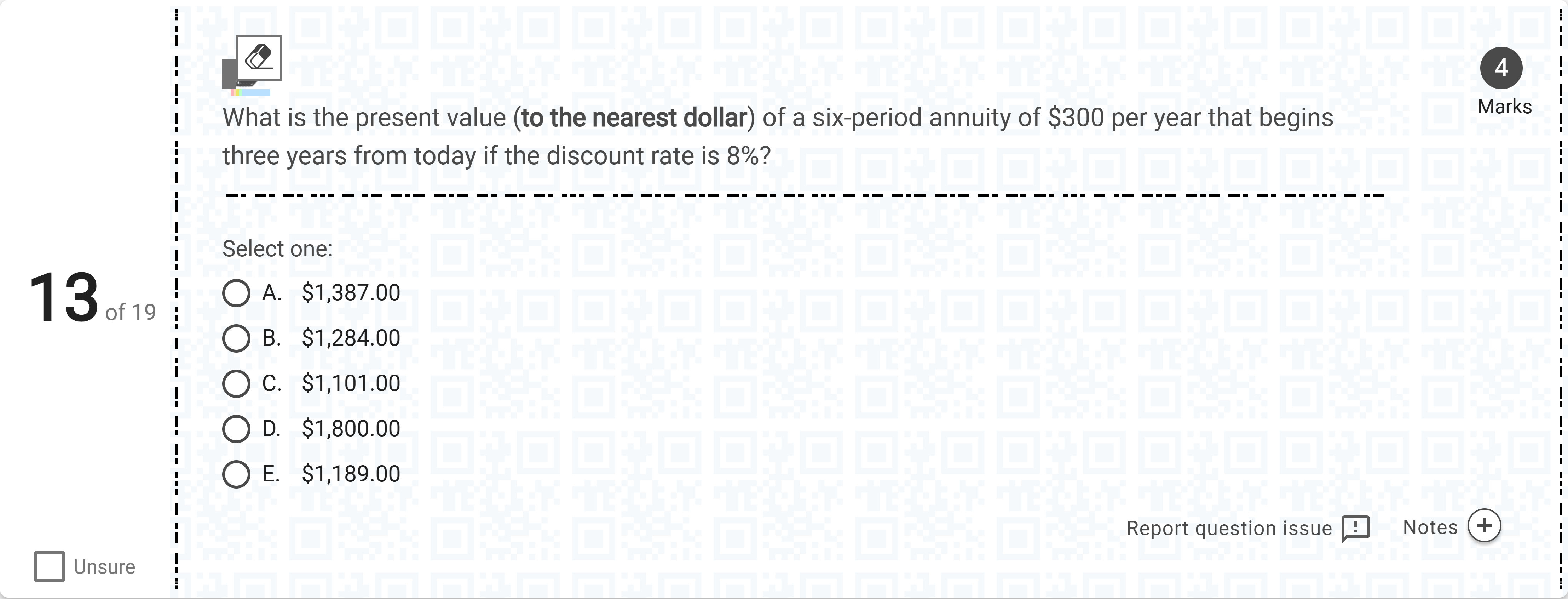

What is the present value (to the nearest dollar) of a six-period annuity of $300 per year that begins three years from today if the discount rate is 8%?[Fill in the blank]

Options

A.A. $1,387.00

B.B. $1,284.00

C.C. $1,101.00

D.D. $1,800.00

E.E. $1,189.00

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this problem, I’ll break down the cash flow timing and the present value calculation step by step.

First, identify the payment pattern: it’s a six-period annuity of 300 per year that begins three years from today. This means there will be six payments of 300 each, spread one per year, starting at year 3 and ending at year 8.

Next, compute the value of the six payments at the time just before their first payment (time 2) if we treat the six payments as a standard six-period annuity-immediate starting at time 3. The present value at time 2 of six payments of 300 each, wit......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

If you receive $99 each quarter for 8 years and the discount rate is 0.1, what is the present value?

If you receive $102 each month for 4 years and the discount rate is 0.06, what is the present value?

If you receive $223 each month for 12 months and the discount rate is 0.11, what is the present value?

If you receive $58 each quarter for 15 years and the discount rate is 0.09, what is the present value?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!