Questions

Single choice

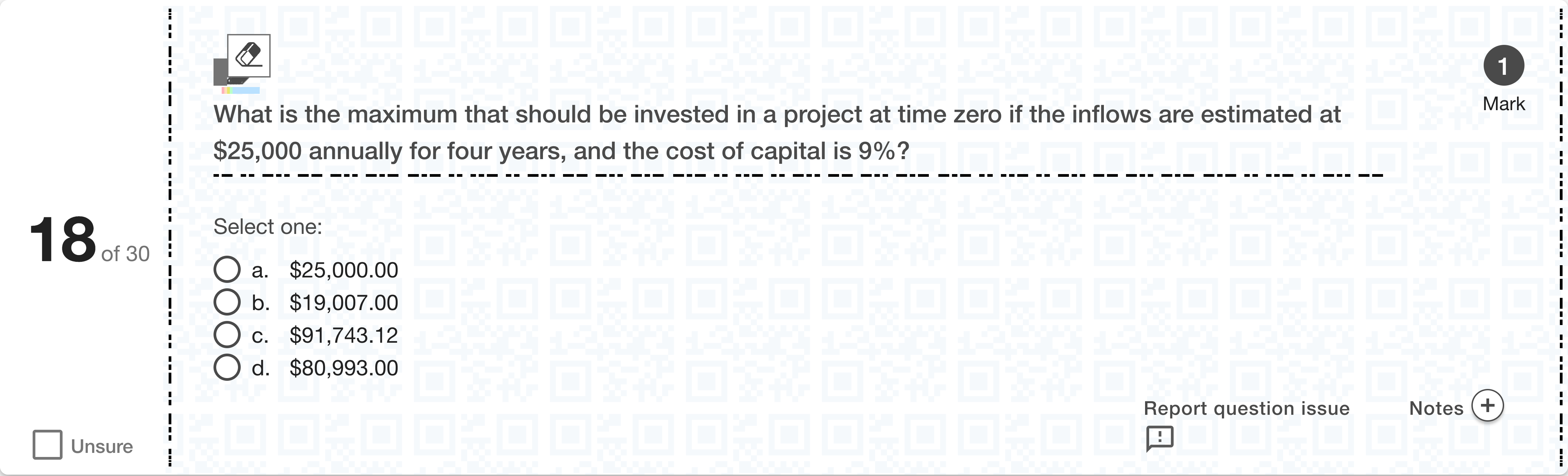

What is the maximum that should be invested in a project at time zero if the inflows are estimated at $25,000 annually for four years, and the cost of capital is 9%?[Fill in the blank]

Options

A.a. $25,000.00

B.b. $19,007.00

C.c. $91,743.12

D.d. $80,993.00

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We need the maximum amount to invest at time zero given a 9% cost of capital and four annual inflows of 25,000. This is the present value of an ordinary annuity with payment PMT = 25,000, i = 9%, n = 4.

Option a: $25,000.00

- This would imply that the project’s present value equals one year’s i......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

If you receive $99 each quarter for 8 years and the discount rate is 0.1, what is the present value?

If you receive $102 each month for 4 years and the discount rate is 0.06, what is the present value?

If you receive $223 each month for 12 months and the discount rate is 0.11, what is the present value?

If you receive $58 each quarter for 15 years and the discount rate is 0.09, what is the present value?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!