Questions

FNDN Accounting 2025 STD O2

Single choice

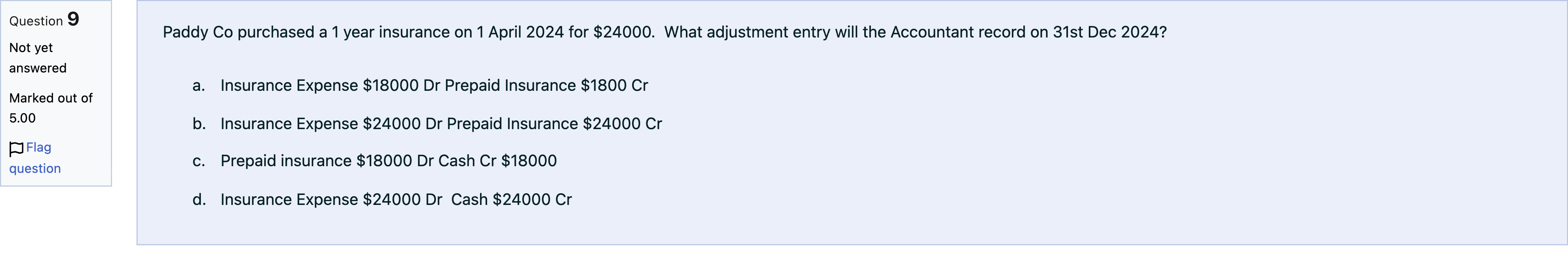

Paddy Co purchased a 1 year insurance on 1 April 2024 for $24000. What adjustment entry will the Accountant record on 31st Dec 2024?

Options

A.a. Insurance Expense $18000 Dr Prepaid Insurance $1800 Cr

B.b. Insurance Expense $24000 Dr Prepaid Insurance $24000 Cr

C.c. Prepaid insurance $18000 Dr Cash Cr $18000

D.d. Insurance Expense $24000 Dr Cash $24000 Cr

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by identifying the facts: Paddy Co bought a 1-year insurance policy on 1 April 2024 for 24000. This is a prepaid asset because the benefit extends over the year. By 31 December 2024, nine months have elapsed (April through December), so nine months of the policy have been consumed, leaving three months of prepaid insurance remaining (January to March 2025).

Now we evaluate each option:

Option a: Insurance Expense 18000 Dr; Prepaid Insurance 1800 Cr

- This option attempts to recognize the expense fo......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Paddy Co. bought a 1 year insurance on 1 October 2024 for $12000. What adjustment entry will Paddy record on 31 October 2024?

Mountaineer Excavation operates in a low-lying area that is subject to heavy rains and flooding. Because of this, Mountaineer purchases one year of flood insurance in advance on March 1, paying $33,600 ($2,800 per month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0).

On April 1, 2024, the premium on a one-year insurance policy was purchased for $3,000 cash with the insurance coverage beginning on that date. The books are adjusted only at year-end. Which of the following correctly describes the effect on the financial statements of the December 31, 2024 adjusting entry?

Eve's Apples opened its business on January 1, 2027, and paid for two insurance policies effective that date. The policy for equipment damage was $37,260 for 18 months, and the crop damage policy was $12,600 for a two-year term. What is the balance in Eve's prepaid insurance as of December 31, 2027?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!