Questions

Single choice

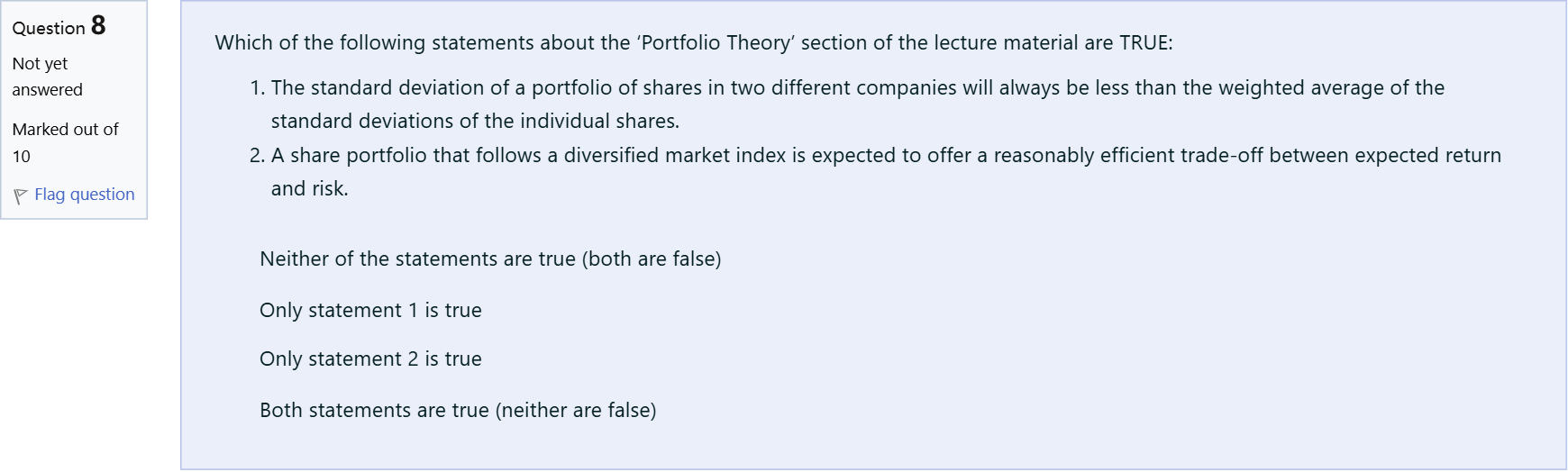

Which of the following statements about the ‘Portfolio Theory’ section of the lecture material are TRUE: The standard deviation of a portfolio of shares in two different companies will always be less than the weighted average of the standard deviations of the individual shares. A share portfolio that follows a diversified market index is expected to offer a reasonably efficient trade-off between expected return and risk.

Options

A.Neither of the statements are true (both are false)

B.Only statement 1 is true

C.Only statement 2 is true

D.Both statements are true (neither are false)

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Let's break down each statement and evaluate it against portfolio theory concepts.

Option 1: 'The standard deviation of a portfolio of shares in two different companies will always be less than the weighted average of the standard deviations of the individual shares.'

- This claim asserts a universal inequality that the portfolio’s risk (standard deviation) is always smaller than the simple weighted average of the individual ris......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

The market portfolio has an expected return of 10% and a standard deviation of 24%. The risk-free rate is 4%. What is the standard deviation of the returns of a complete portfolio with an expected return of 19%? Round your final answer to a percentage with two decimal places and do not use the “%” sign, i.e. if the answer is 1.23% then write 1.23

The expected return and standard deviation (risk) of two financial assets (Alpha Pty Ltd & Beta Corp) are as follows:Investor A develops a RISKY portfolio comprised of 70% of Alpha Pty Ltd and 30% of Beta Corp. The correlation coefficient between the returns from Alpha and Beta is 0.80. Assume the risk-free rate of return is 4% per annum.[Fill in the blank]

Which of the following statements regarding the capital allocation line (CAL) is false?[Fill in the blank]

Question text 6Marks Tina has the following additional information regarding Stock X and Y [table] Stock | Expected Return | Standard Deviation X | 10% | 15% Y | 15% | 20% [/table] Stock X and Y are perfectly negatively correlated offering a hedged position. If Tina wants to construct a risk-free portfolio consisting Stock X and Y, what must be the weight for each stock in the portfolio? Weight of Stock X: Answer 5[select: , 57.14%, 42.86%, 62.84%, 44.55%, 35.28%] Weight of Stock Y: Answer 6[select: , 57.14%, 42.86%, 37.16%, 64.72%, 55.45%] What must return of this risk-free portfolio? Answer 7[select: , 12.14%, 11.75%, 12.86%, 15.33%, 13.5%] Notes Report question issue Question 9 Notes

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!