Questions

Short answer

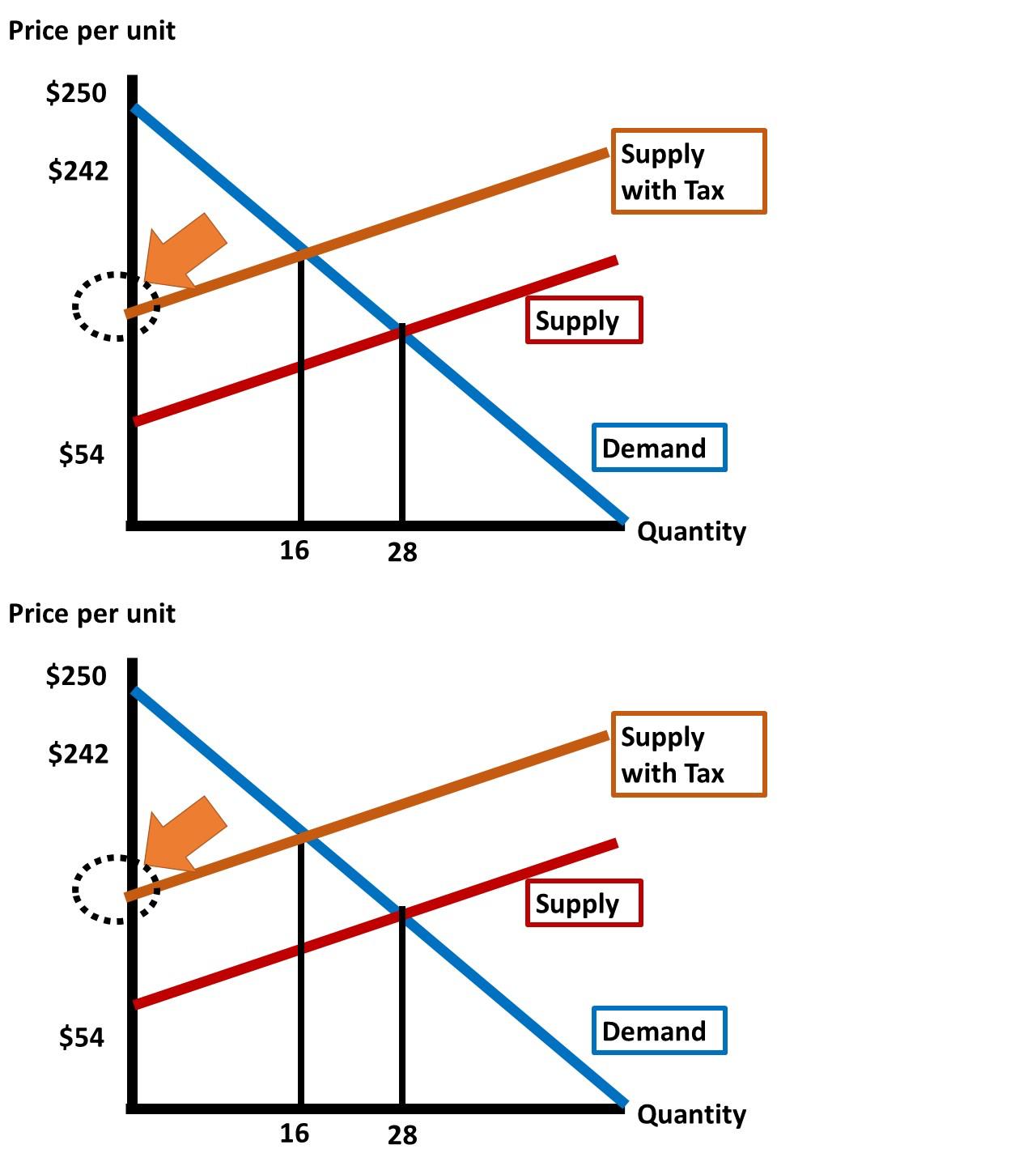

Question at position 4 Think about the production of cattle. There are private costs to this action in raising and feeding the cattle. There are also spillover costs from the cattle in the form of methane emissions. The Total Spillover Cost of the methane is given by: TSpC = 20Q + 2Q2. The Marginal Spillover Cost of methane is given by: MSpC = 20 + 4Q. The demand for cattle is given by: QD = 50 -0.2P. The supply of cattle is given by: QS = 0.5P -27. The inverse demand function is given by: P = 250 -5Q. The inverse supply is given by: P = 54+2Q. The marginal social cost function is given by: MSC = 74 +6Q. The market quantity (QMKT)of cattle is 28 units while the efficient quantity (QE) is 16 units. The optimal Pigovian tax is $84 per unit. Calculate the price-intercept of the Supply Curve with tax. (Do not include "$" sign in your response.) Hint: The tax is added to the inverse supply function.Answer Think about the production of cattle. There are private costs to this action in raising and feeding the cattle. There are also spillover costs from the cattle in the form of methane emissions. The Total Spillover Cost of the methane is given by: TSpC = 20Q + 2Q2. The Marginal Spillover Cost of methane is given by: MSpC = 20 + 4Q. The demand for cattle is given by: QD = 50 -0.2P. The supply of cattle is given by: QS = 0.5P -27. The inverse demand function is given by: P = 250 -5Q. The inverse supply is given by: P = 54+2Q. The marginal social cost function is given by: MSC = 74 +6Q. The market quantity (QMKT)of cattle is 28 units while the efficient quantity (QE) is 16 units. The optimal Pigovian tax is $84 per unit. Calculate the price-intercept of the Supply Curve with tax. (Do not include "$" sign in your response.) Hint: The tax is added to the inverse supply function.[input]

Options

A.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To find the price-intercept of the supply curve with the Pigovian tax, first recall the original inverse supply function given: P = 54 + 2Q. Thi......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Another policy approach to externalities is for government to levy a tax or place a charge specifically on the related good.

Question at position 5 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. The optimal Pigovian tax is $60 per ton of SO2 emitted. Determine the total tax revenue generated by the tax. (Do not include "$" sign in your response.) Hint: Multiply the tax rate by the quantity with tax.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. The optimal Pigovian tax is $60 per ton of SO2 emitted. Determine the total tax revenue generated by the tax. (Do not include "$" sign in your response.) Hint: Multiply the tax rate by the quantity with tax.[input]

Question at position 4 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. Determine the optimal Pigovian Tax. (Do not include "$" sign in your response.) Hint: Plug the efficient quantity into the inverse demand function.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. The emissions cause damages around the firms that emit SO2. The marginal social cost (MSC) of the damages from SO2 are given by: MSC = 20 +0.25Q. Determine the optimal Pigovian Tax. (Do not include "$" sign in your response.) Hint: Plug the efficient quantity into the inverse demand function.[input]

Question at position 1 Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. Determine the quantity of emissions if there is no Pigovian Tax. Hint: Plug a price of zero into the demand function because firms do not have to pay for a good with a missing market.Answer Various production processes result in the emission of sulfur dioxide (SO2) gas which is a greenhouse gas and is toxic to breathe. Firms have a derived demand to emit SO2 because being able to emit the gas allows them to produce a good that has value to buyers. This allows the firm to make a profit. The demand for being able to emit SO2 is given by: QD = 400 - 4P where Q is measured in tons of gas emitted. The inverse demand function is given by: P = 100 -0.25QD. Determine the quantity of emissions if there is no Pigovian Tax. Hint: Plug a price of zero into the demand function because firms do not have to pay for a good with a missing market.[input]

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!