Questions

ECON1-TTh Chapter 10 Assignment

Single choice

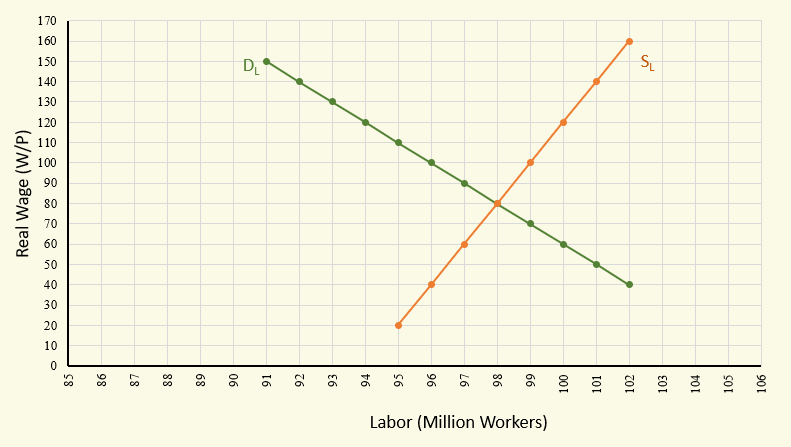

In order to reach the social optimum, the government could

Options

A.impose a tax of $8 per unit on plastics

B.impose a tax of $6 per unit on plastics

C.offer a subsidy of $6 per unit on plastics

D.impose a tax of $2 per unit on plastics

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To reach the social optimum in a market with a negative externality, government intervention often involves a tax (Pigouvian tax) equal to the marginal external cost at the socially optimal output, so that the private cost plus tax equals the social cost.

Option 1: impose a tax of $8 per unit......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Question54 Who wins from implementing an output tax on a good with negative environmental externality? Producers Government Consumers All of the other options ResetMaximum marks: 1 Flag question undefined

You have the following PMC, MD and SMB: PMC = 15 + 2Q MD = 1.2Q2 SMB = 70 - 3Q Find the Pigouvian tax t*

Assume that the extraction of water from an aquifer by a coal mining company imposes a cost on farmers that grow citrus crops. Assume that the supply curve for coal is given by the following: p = 240 +2Q. Further, assume that the demand curve for coal is given by the following: p = 900 – 3Q. If the marginal external cost (MEC) of coal mining is equal to 0.5Q, which of the following is true?

Now the government is considering imposing extra tax on polluting industry. From the first table, what is the optimal tax?

More Practical Tools for International Students

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!