题目

AEM2500/ENVS2500 Quiz #10 (pollution control, climate change)

单项选择题

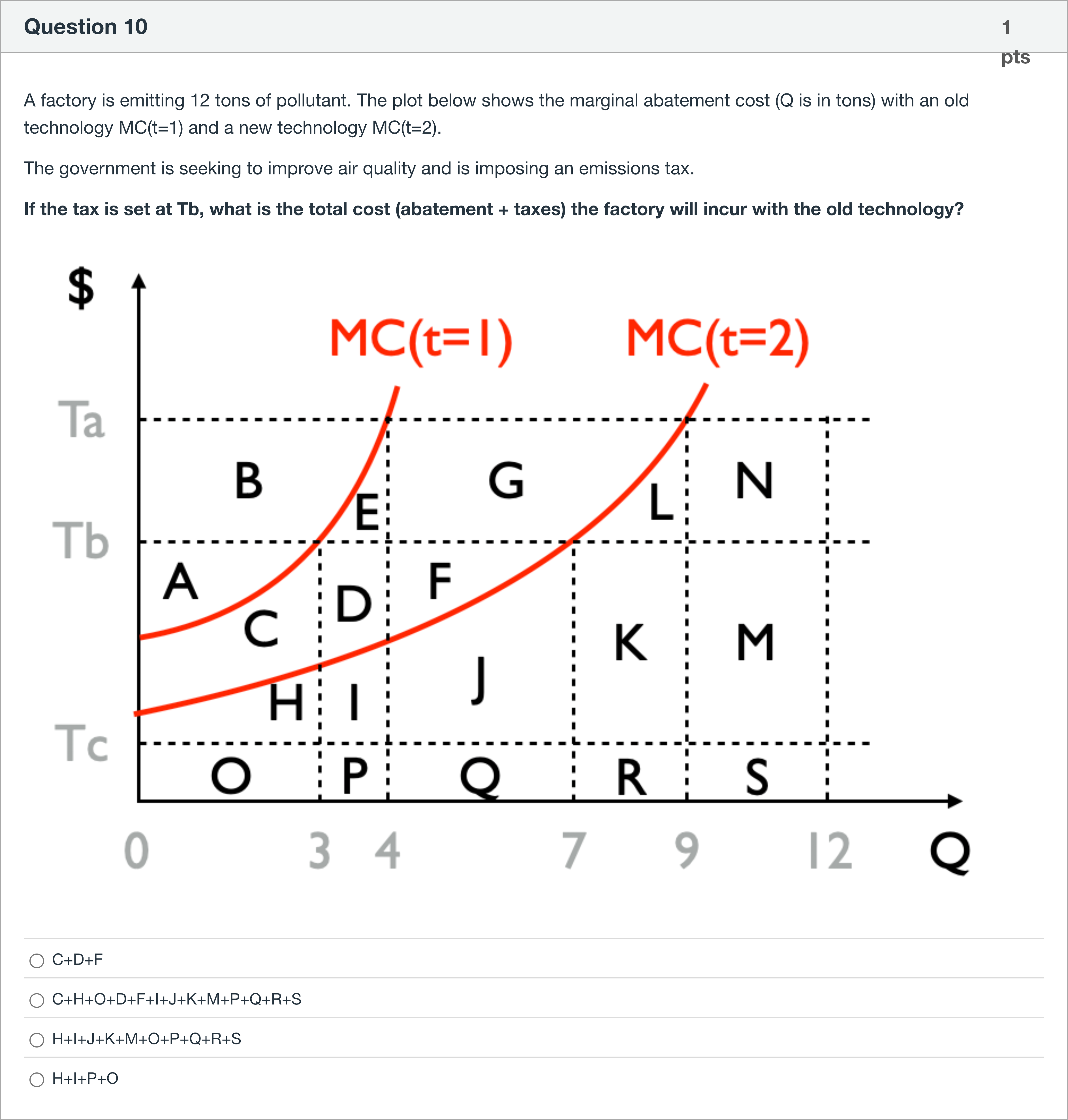

A factory is emitting 12 tons of pollutant. The plot below shows the marginal abatement cost (Q is in tons) with an old technology MC(t=1) and a new technology MC(t=2). The government is seeking to improve air quality and is imposing an emissions tax. If the tax is set at Tb, what is the total cost (abatement + taxes) the factory will incur with the old technology?

选项

A.C+D+F

B.C+H+O+D+F+I+J+K+M+P+Q+R+S

C.H+I+J+K+M+O+P+Q+R+S

D.H+I+P+O

查看解析

标准答案

Please login to view

思路分析

We start by restating what the question asks and identifying the components involved in the total cost under the old technology when a tax Tb is imposed. The factory emits 12 tons of pollutant initially. With the old technology, the marginal abatement cost curve is MC(t=1). The tax Tb per ton creates an external cost per unit abated, and the total cost to the firm (abatement cost plus taxes paid) depends on the quantity of abatement chosen by the firm, which in turn is determined by where the MC(t=1) curve intersects the tax level Tb. In the diagram, the regions labeled with letters (A, B, C, … S, O, P, Q, R, S, etc.) correspond to specific areas under or between the MC curves and the tax lines. The four answer choices propose different sums of these lettered regions as representing the total cost the firm incurs under the old technology when the tax Tb is in place.

Option 1: C+D+F

- This set comprises only three areas. If you picture abatement cost under MC(t=1) up to the tax quantity and add the tax revenue (or tax......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

In a consumer society, many adults channel creativity into buying things

Economic stress and unpredictable times have resulted in a booming industry for self-help products

People born without creativity never can develop it

A product has a selling price of $20, a contribution margin ratio of 40% and fixed cost of $120,000. To make a profit of $30,000. The number of units that must be sold is: Type the number without $ and a comma. Eg: 20000

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!