Questions

Homework:Final Practice

Multiple fill-in-the-blank

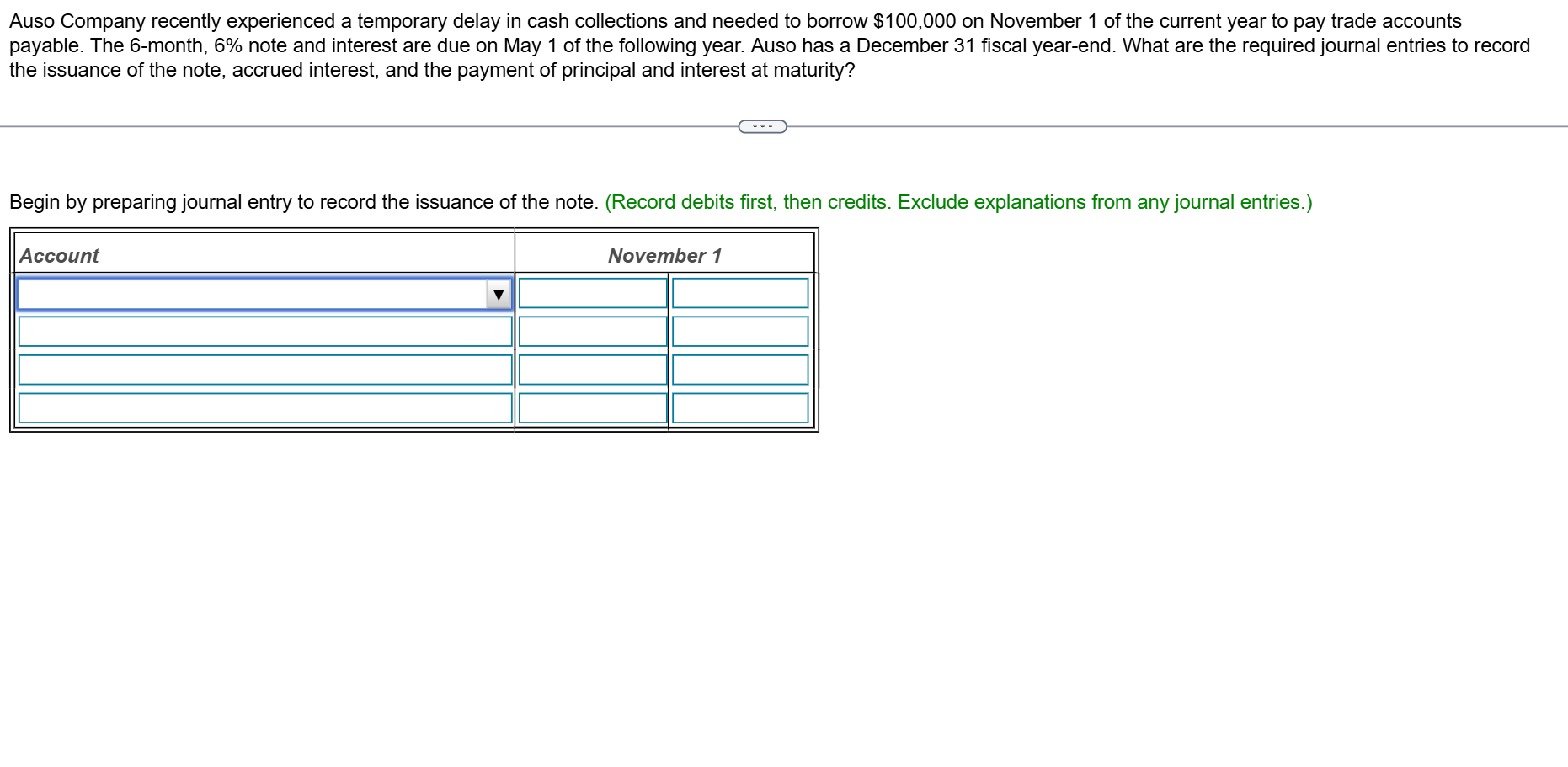

Part 1Auso Company recently experienced a temporary delay in cash collections and needed to borrow $ 100,000$100,000 on November 1 of the current year to pay trade accounts payable. The 6-month, 6 %6% note and interest are due on May 1 of the following year. Auso has a December 31 fiscal year-end. What are the required journal entries to record the issuance of the note, accrued interest, and the payment of principal and interest at maturity? Part 1Begin by preparing journal entry to record the issuance of the note. (Record debits first, then credits. Exclude explanations from any journal entries.) [table] | Save Accounting Table... | | + | Copy to Clipboard... | | + [/table] [table] Account | November 1 | | | | | | | | [/table] Save Accounting Table...+Copy to Clipboard...+AccountNovember 1[Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank][Account][Fill in the blank][Fill in the blank] [IMPORTANT INSTRUCTION] When returning answers, provide an array for [Fill in the blank] positions ONLY. Skip [Account] cells (these are dropdowns). If a [Fill in the blank] should be empty, return an empty string "" as a placeholder. The array length should equal the number of [Fill in the blank] cells, not total cells.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The scenario involves Auso Company borrowing to cover a temporary cash delay, with a 6-month, 6% note issued on November 1 and due May 1 of the following year, and a December 31 year-end. To answer, we walk through the journal entries step by step and explain why each part is recorded as shown.

First, when the note is issued on November 1, the company receives cash from the loan and incurs a note payable to reflect the obligation. The correct recording is a debit to Cash for the amount received and a credit to Notes Payable for the same amount, recognizing the liability created by borrowing. In this case: Debit Cash 100,000; Credit Notes Payable 100,000. No other accounts are affected at this ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

An asset is acquired using a noninterest-bearing note payable for $225,000 due in three years. Which of the following statements most likely is correct?

Part 1Pegasus Corp. signed a threeminus−month, 99% note on November 1, 2023 for the purchase of $ 293,000$293,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. debit to Interest Expense for $ 4,395$4,395 B. debit to Interest Expense for $ 6,593$6,593 C. debit to Note Payable for $ 293,000$293,000 D. credit to Note Payable for $ 293,000$293,000

Part 1Pegasus Corp. signed a threeminus−month, 1010% note on November 1, 2023 for the purchase of $ 210,000$210,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. credit to Note Payable for $ 210,000$210,000 B. debit to Interest Expense for $ 3,500$3,500 C. debit to Note Payable for $ 210,000$210,000 D. debit to Interest Expense for $ 5,250$5,250

Part 1Pegasus Corp. signed a threeminus−month, 77% note on November 1, 2023 for the purchase of $ 280,000$280,000 of inventory. If Pegasus makes adjusting entries only at the end of the year, the entry made at January 31, 2024 will include a ________. (Do not round any intermediary calculations. Round your final answer to the nearest dollar.) Part 1 A. credit to Note Payable for $ 280,000$280,000 B. debit to Interest Expense for $ 3,267$3,267 C. debit to Interest Expense for $ 4,900$4,900 D. debit to Note Payable for $ 280,000$280,000

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!