Questions

Single choice

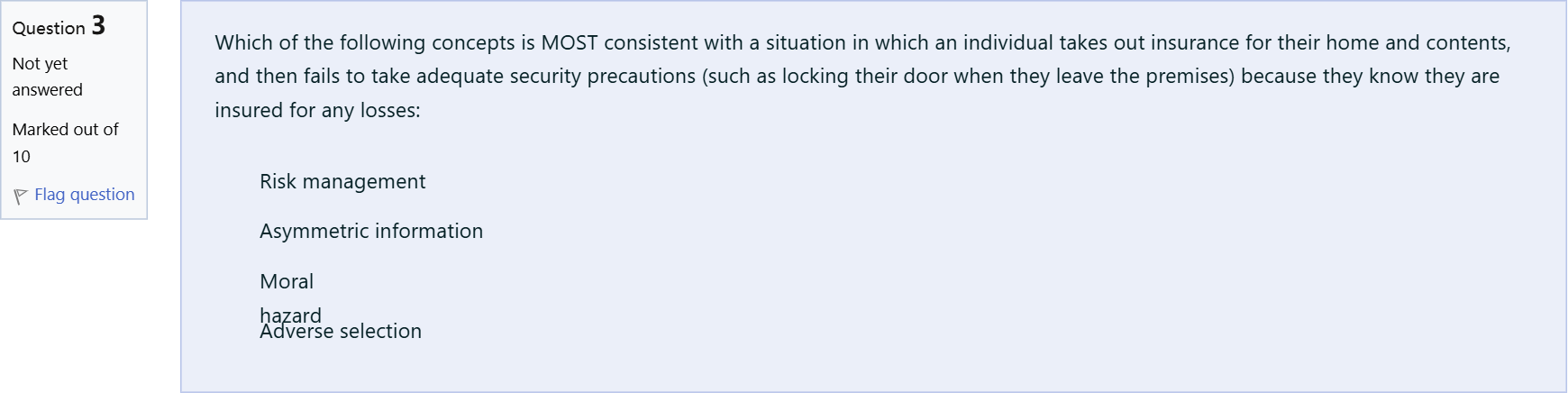

Which of the following concepts is MOST consistent with a situation in which an individual takes out insurance for their home and contents, and then fails to take adequate security precautions (such as locking their door when they leave the premises) because they know they are insured for any losses:

Options

A.Risk management

B.Asymmetric information

C.Moral hazard

D.Adverse selection

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks which concept best fits a scenario where someone buys home and contents insurance and then reduces precautionary behavior, such as not locking the door, because they expect insurance to cover losses.

Option 1: Risk management. This term refers to the overall process of identifying, assessing, and mitigating risks to minimize their impact. While relevant to the broad topic of prote......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Question16 Which of the following statements is true? Select one alternative: a. Information asymmetry between lenders and borrowers is eliminated if lenders can perfectly assess borrowers' creditworthiness before loans are originated. b. If information asymmetry is completely resolved, individuals can function as financial intermediaries. c. Moral hazard issues can be resolved if lenders can assess borrower's creditworthiness perfectly before loans are originated. d. The moral hazard issue primarily concerns borrowers, who may misuse borrowed funds. e. All of the statements are correct. f. None of the statements is correct. ResetMaximum marks: 2 Flag question undefined

Question14 A drawback of unemployment benefits is that: it affects human capital accumulation because it increase the college premium they always lengthen the time spent unemployed. they cost taxpayers over 50 percent of their incomes. the payments are too large. they give workers a disincentive to find work. ResetMaximum marks: 1 Flag question undefined

Part 1Would you be more willing to lend to a friend if she put all of her life savings into her business than you would if she had not done so? Part 2 A. You would be less willing because putting her life savings into a business that can potentially fail makes it more risky for you to loan her money. If the business fails, she will protect her investment before she considers repaying you B. You would be more willing because putting her life savings into her business provides you protection against the problem of moral hazard C. Whether or not she puts her life savings into her business has no bearing on whether she repays the loan or not. Therefore, it should have no effect on your decision to loan her money D. You would be more willing because putting her life savings into her business provides you protection against the problem of adverse selection

Part 1Suppose a country has weak institutions, prevalent corruption, and an ineffectively regulated financial sector.Part 2Would you recommend the adoption of a system of deposit insurance, like the FDIC in the United States, for this country? [input] ▼ empty selection Part 3Based on the information given above, which of the following is likely to be a reason for not recommending the adoption of a system of deposit insurance for this country? A. It might increase the moral hazard incentives for banks to engage in risky lending. B. It might increase the economy's dependency on big financial institutions. C. It might increase the problem of adverse selection of potential customers by banks.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!