Questions

My home Progress Check

Single choice

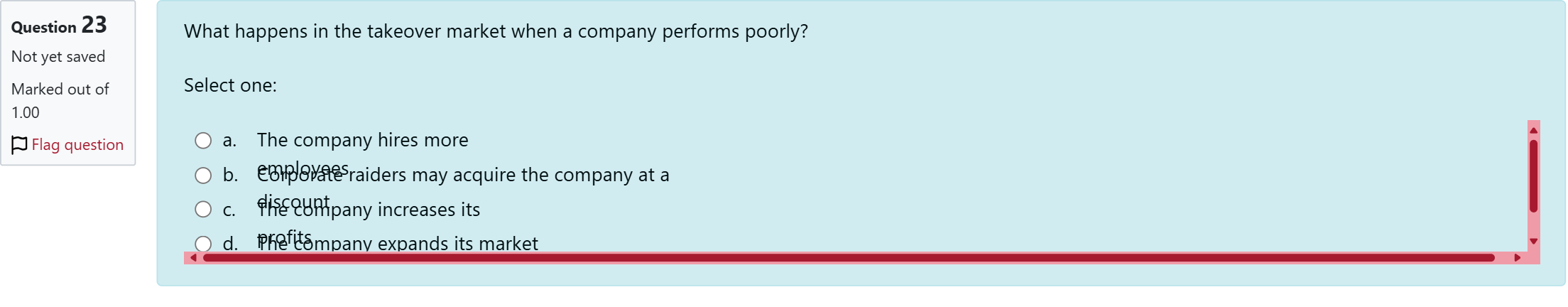

What happens in the takeover market when a company performs poorly?

Options

A.a. The company hires more employees

B.b. Corporate raiders may acquire the company at a discount

C.c. The company increases its profits

D.d. The company expands its market share

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

When evaluating how the takeover market behaves for a poorly performing company, it helps to consider the incentives and mechanisms at play.

Option a: 'The company hires more employees.' This describes internal organizational actions rather than a market response to underperformance. Hiring more staff would typically occur in an attempt to improve operatio......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

In the context of M&A, which of the following statements is correct?

Question18 Firm X is being acquired by Firm Y for $62,000 worth of Firm Y stock. The incremental value of the acquisition is $4,300. Firm X has 2,700 shares of stock outstanding at a price of $22 per share. Firm Y has 10,400 shares of stock outstanding at a price of $31 per share. What is the actual cost of the acquisition using company stock? A. $62,000 B. $62,076 C. $62,274 D. $63,780 E. $62,620 ResetMaximum marks: 2 Flag question undefined

Which of the following statements is CORRECT?

Which of the following best explains why M&A activity tends to cluster in waves:

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!