Questions

FINS5547-Cryptocurrency & Decentralised Finance - T3 2025

Single choice

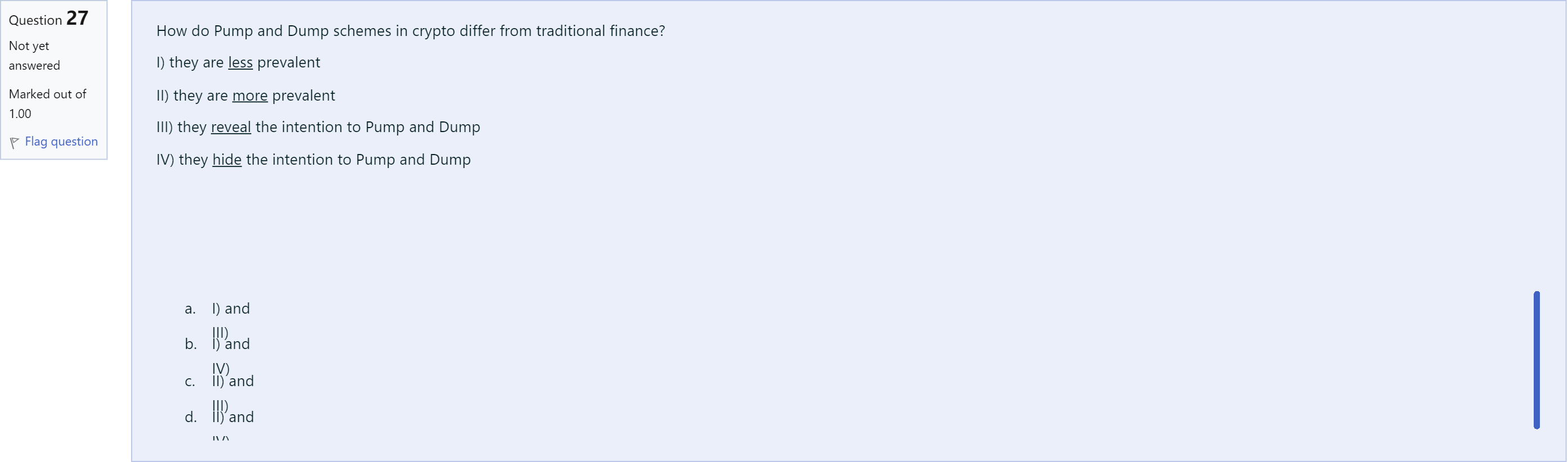

How do Pump and Dump schemes in crypto differ from traditional finance? I) they are less prevalentII) they are more prevalentIII) they reveal the intention to Pump and DumpIV) they hide the intention to Pump and Dump

Options

A.a. I) and III)

B.b. I) and IV)

C.c. II) and III)

D.d. II) and IV)

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Start by listing what each option is claiming about the statements I–IV.

Option a) says I and III are true together. That would mean crypto pump-and-dump schemes are less prevalent (I) and they reveal the intention to pump and dump (III). The combination is inconsistent because the rest of the statements in the prompt suggest different prevalence and intentions, and the claim about revealing intent (III) is not inherently tied to I being true. So this......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

NQ4 Why might someone want to engage in wash trading?I) It can increase the perceived value of NFTsII) It can increase the perceived market share of an exchangeIII) The trading activity by itself is profitable (excluding any exchange rebates)IV) It is used in Ransomware attacks

Question12 Santos trades digital coins on cryptocurrency exchanges for both his own account and as an investment strategy for clients who have indicated an interest in such speculative trading and for whom it is appropriate. The cryptocurrency exchanges are unregulated markets. Santos is a member of “EasyCoin,” a chatroom in which coin traders gather that has thousands of members. EasyCoin is a private chatroom accessible by invitation only and is overseen by an anonymous moderator. Generally, the chatroom moderator announces a date, time, and exchange for members to initiate trading. At the set time, the moderator informs the chatroom of the particular cryptocurrency to be traded. Traders, including Santos, buy that digital coin creating a surge in the price with the intention of attempting to sell before the price collapses. Over the past several months, 47 different cryptocurrencies have been promoted on EasyCoin and generated $357 million in trades. Santos often profits from the rise in the price of the cryptocurrency by timing his trades correctly, but occasionally he buys and holds the digital coin too long and the price drops steeply before he can sell, causing him to lose money for himself and his clients. Santos actions are:Select one alternative: acceptable because Santos, unlike the moderator of the EasyCoin chatroom, is not actively organizing the trading of the digital coin. acceptable because he voluntarily engages in this speculative trading based on information in a private chatroom. unacceptable because Santos is engaged in market manipulation. unacceptable because speculative trading cryptocurrency in unregulated markets for client accounts is unethical. ResetMaximum marks: 1 Flag question undefined

Roy is a fund manager. Due to a shift of portfolio strategy towards ESG (Environmental, Social, and Governance) investing, he needs to divest the excessive holdings of E-Cigarette Inc (ticker: EC). Reduction of the EC holdings would not be easy, because the stock has very low liquidity. Therefore, Roy decides to sell the EC holdings gradually over the next three months, rather than dump all EC holdings within a short period of time. This gradual selling-off attracts other market participants’ attention, boosting the price and trading volume of EC. Based on Ethical Standard II(B) on Market Manipulation, which of the following statements best describes his conduct?

HMN is an investment firm providing both advisory and investment banking services. ALP (a listed firm), one of HMN’s investment banking clients, seeks to conduct a seasoned equity offering using HMN as its placement agent, but it would like to do so at a valuation above the current price. To assist in this effort, George, an investment adviser for HMN, convinces some of his clients to purchase the company stock and others to sell. He frequently matches these orders among his customers. These trades represent 28% of the total market volume and increase the stock price by $8.50 a share. Based on Ethical Standard II on Material Non-public Information and Market Manipulation, which of the following statements best describes George’s trades?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!