Questions

Single choice

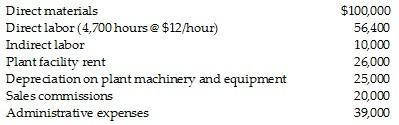

Question at position 8 Franklin Inc. manufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect-cost rate of $15 per direct labor-hour. The following data are obtained from the accounting records for June 2020:For June 2020, manufacturing overhead is: overallocated by $29,500underallocated by $9,500underallocated by $29,500overallocated by $9,500题目解析

Options

A.overallocated by $29,500

B.underallocated by $9,500

C.underallocated by $29,500

D.overallocated by $9,500

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To analyze overhead, first identify the components that comprise manufacturing overhead and the method used to apply it.

Step 1: Determine the overhead rate and applied overhead.

- Budgeted indirect-cost rate: $15 per direct labor-hour.

- Direct labor-hours incurred: 4,700 hours.

- Overhead applied to product......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following is considered an element of manufacturing overhead?

Which of the following costs would not be considered part of the manufacturing overhead of a furniture manufacturer?

Which of the following is not included in factory overhead?

Question at position 15 Which of the following statements is correct?When the manufacturing overhead cost was overapplied, it means that the unadjusted cost of goods sold is equal to the adjusted cost of goods sold.When the manufacturing overhead cost was overapplied, it means that the unadjusted cost of goods sold is higher than the adjusted cost of goods sold.When the manufacturing overhead cost was underapplied, it means that the unadjusted cost of goods sold is higher than the adjusted cost of goods sold.When the manufacturing overhead cost was overapplied, it means that the adjusted cost of goods sold is higher than the unadjusted cost of goods sold.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!