Questions

ECN 001B B01-B04 FQ 2025 Final Examination

Single choice

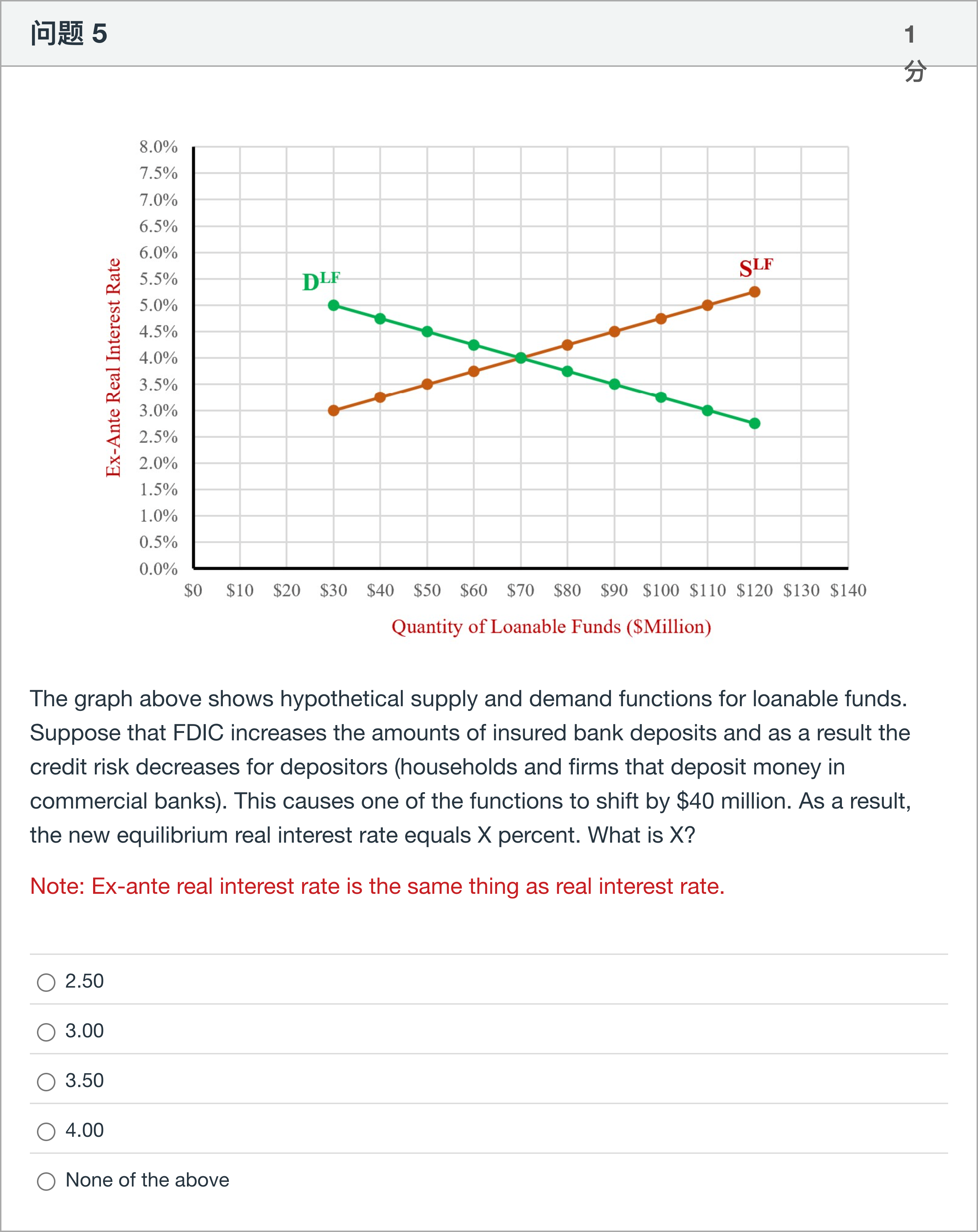

The graph above shows hypothetical supply and demand functions for loanable funds. Suppose that FDIC increases the amounts of insured bank deposits and as a result the credit risk decreases for depositors (households and firms that deposit money in commercial banks). This causes one of the functions to shift by $40 million. As a result, the new equilibrium real interest rate equals X percent. What is X? Note: Ex-ante real interest rate is the same thing as real interest rate.

Options

A.2.50

B.3.00

C.3.50

D.4.00

E.None of the above

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

First, restating the setup: the graph shows hypothetical loanable funds with a downward-sloping demand for loanable funds (DLF) and an upward-sloping supply of loanable funds (SLF). An increase in insured bank deposits lowers credit risk for depositors, which effectively makes savers more willing to supply funds to banks. This causes the loanable funds supply curve to shift.

Option-by-option analysis:

- 2.50%: If the supply increases (shift to the right) while demand stays the same, the equilibrium interest ra......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Consider the Loanable Funds Model: Which of the following is consistent with the graph depicted below?

The supply of loanable funds curve is _____ sloping because _____ respond to lower interest rates by _____ their quantity supplied of loanable funds.

A decrease in household savings due to higher consumer spending will generally cause a ___________ the ___________for loanable funds.[Fill in the blank]

Question2 According to the loanable funds approach, an increase in inflation expectations will have the following immediate effect: Shift both the demand and supply curves to the right Only the supply curve shifts to the left, while the demand curve remains unchanged. Shift both the demand and supply curves to the left Shift the demand curve to the right and the supply curve to the left Only the demand curve shifts to the right, while the supply curve remains unchanged. Shift the demand curve to the left and the supply curve to the right ResetMaximum marks: 0.59 Flag question undefined

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!