Questions

ECN 001B C01-C06 WQ 2025 Homework 6 - Loanable Funds Market

Multiple fill-in-the-blank

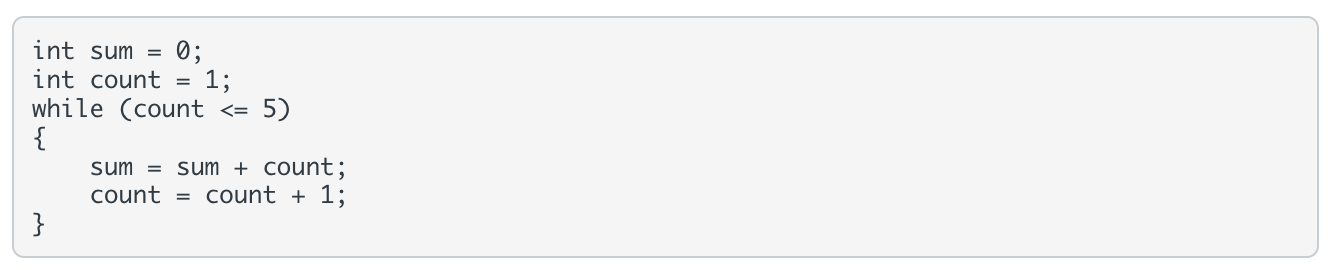

The graph above shows a hypothetical loanable funds market. Currently the market is in equilibrium and the equilibrium real interest rate is [Fill in the blank], percent. There is no government borrowing so that total borrowing by the private sector (firms and households) and total lending by the private sector both equals [Fill in the blank], million dollars. The government comes to the loanable funds market and borrows $50 million by selling bonds in order to finance an infrastructure project. This causes the real rate to change to [Fill in the blank], percent. Now, the private sector lending equals [Fill in the blank], million dollars and the private sector borrowing equals [Fill in the blank], million dollars, so that [Fill in the blank], million dollars of private sector borrowing is crowded out.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The problem presents a loanable funds market with multiple fill-in-the-blank values. Here is a structured way to reason through each blank and how the provided numbers fit.

1) First equilibrium real interest rate (before government borrowing):

- The correct initial rate is 4.00 percent. This is the baseline price of loanable funds at which the quantity supplied equals the quantity demanded in the private sector when there is no government borrowing. The value 4.00% indicates the starting point before any crowding-out effects occur.

2) Total borrowing by the private sector when th......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Consider the Loanable Funds Model: Which of the following is consistent with the graph depicted below?

The graph above shows hypothetical supply and demand functions for loanable funds. Suppose that FDIC increases the amounts of insured bank deposits and as a result the credit risk decreases for depositors (households and firms that deposit money in commercial banks). This causes one of the functions to shift by $40 million. As a result, the new equilibrium real interest rate equals X percent. What is X? Note: Ex-ante real interest rate is the same thing as real interest rate.

The supply of loanable funds curve is _____ sloping because _____ respond to lower interest rates by _____ their quantity supplied of loanable funds.

A decrease in household savings due to higher consumer spending will generally cause a ___________ the ___________for loanable funds.[Fill in the blank]

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!