Questions

MCD2160 - T3 - 2025 Part One - General Journal Entries.

Multiple fill-in-the-blank

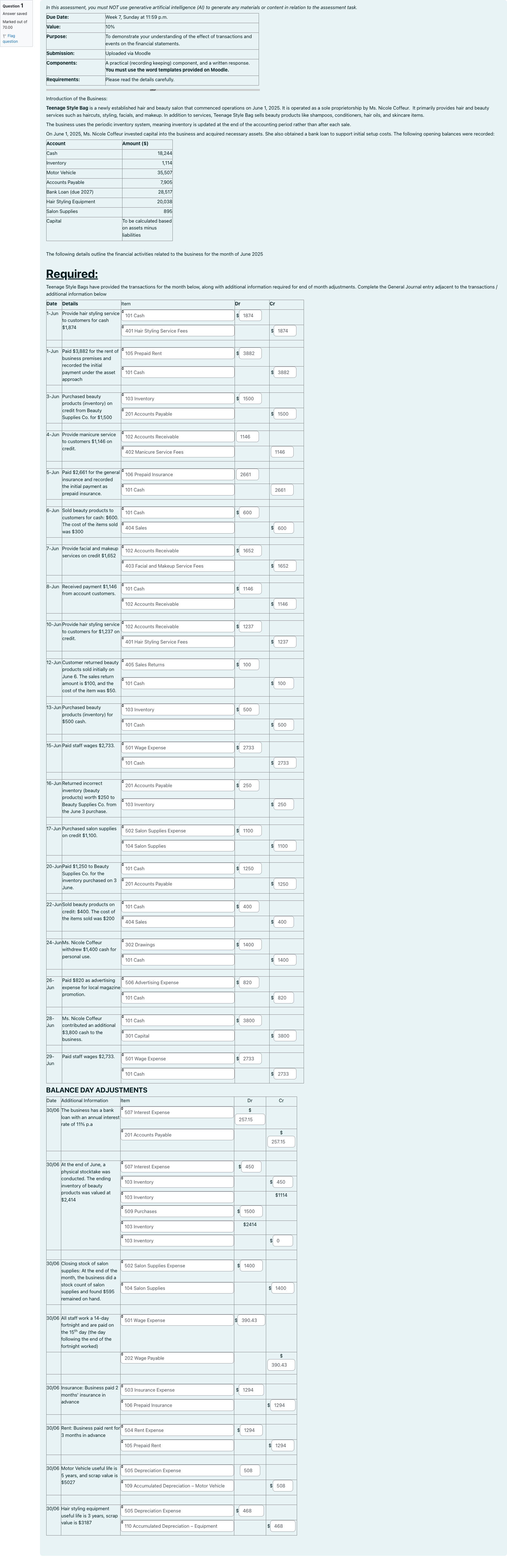

Question textIn this assessment, you must NOT use generative artificial intelligence (AI) to generate any materials or content in relation to the assessment task. [table] Due Date: | Week 7, Sunday at 11:59 p.m. Value: | 10% Purpose: | To demonstrate your understanding of the effect of transactions and events on the financial statements. Submission: | Uploaded via Moodle Components: | A practical (recording keeping) component, and a written response. You must use the word templates provided on Moodle. Requirements: | Please read the details carefully. [/table] Introduction of the Business: Teenage Style Bag is a newly established hair and beauty salon that commenced operations on June 1, 2025. It is operated as a sole proprietorship by Ms. Nicole Coffeur. It primarily provides hair and beauty services such as haircuts, styling, facials, and makeup. In addition to services, Teenage Style Bag sells beauty products like shampoos, conditioners, hair oils, and skincare items. The business uses the periodic inventory system, meaning inventory is updated at the end of the accounting period rather than after each sale. On June 1, 2025, Ms. Nicole Coffeur invested capital into the business and acquired necessary assets. She also obtained a bank loan to support initial setup costs. The following opening balances were recorded: [table] Account | Amount ($) Cash | 18,244 Inventory | 1,114 Motor Vehicle | 35,507 Accounts Payable | 7,905 Bank Loan (due 2027) | 28,517 Hair Styling Equipment | 20,038 Salon Supplies | 895 Capital | To be calculated based on assets minus liabilities [/table] The following details outline the financial activities related to the business for the month of June 2025 Required: Teenage Style Bags have provided the transactions for the month below, along with additional information required for end of month adjustments. Complete the General Journal entry adjacent to the transactions / additional information below [table] Date | Details | Item | Dr | Cr 1-Jun | Provide hair styling service to customers for cash $1,874 | Answer 1 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 2 Question 1 | Answer 3 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 4 Question 1 | | | | 1-Jun | Paid $3,882 for the rent of business premises and recorded the initial payment under the asset approach | Answer 5 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 6 Question 1 | Answer 7 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 8 Question 1 | | | | 3-Jun | Purchased beauty products (inventory) on credit from Beauty Supplies Co. for $1,500 | Answer 9 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 10 Question 1 | Answer 11 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 12 Question 1 | | | | 4-Jun | Provide manicure service to customers $1,146 on credit. | Answer 13 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | Answer 14 Question 1 | Answer 15 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | Answer 16 Question 1 | | | | 5-Jun | Paid $2,661 for the general insurance and recorded the initial payment as prepaid insurance. | Answer 17 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | Answer 18 Question 1 | Answer 19 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | Answer 20 Question 1 | | | | 6-Jun | Sold beauty products to customers for cash: $600. The cost of the items sold was $300 | Answer 21 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 22 Question 1 | Answer 23 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 24 Question 1 | | | | 7-Jun | Provide facial and makeup services on credit $1,652 | Answer 25 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 26 Question 1 | Answer 27 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 28 Question 1 | | | | 8-Jun | Received payment $1,146 from account customers. | Answer 29 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 30 Question 1 | Answer 31 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 32 Question 1 | | | | 10-Jun | Provide hair styling service to customers for $1,237 on credit. | Answer 33 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 34 Question 1 | Answer 35 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 36 Question 1 | | | | 12-Jun | Customer returned beauty products sold initially on June 6. The sales return amount is $100, and the cost of the item was $50. | Answer 37 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 38 Question 1 | Answer 39 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 40 Question 1 | | | | 13-Jun | Purchased beauty products (inventory) for $500 cash. | Answer 41 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 42 Question 1 | Answer 43 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 44 Question 1 | | | | 15-Jun | Paid staff wages $2,733. | Answer 45 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 46 Question 1 | Answer 47 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 48 Question 1 | | | | 16-Jun | Returned incorrect inventory (beauty products) worth $250 to Beauty Supplies Co. from the June 3 purchase. | Answer 49 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 50 Question 1 | Answer 51 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 52 Question 1 | | | | 17-Jun | Purchased salon supplies on credit $1,100. | Answer 53 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 54 Question 1 | Answer 55 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 56 Question 1 | | | | 20-Jun | Paid $1,250 to Beauty Supplies Co. for the inventory purchased on 3 June. | Answer 57 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 58 Question 1 | Answer 59 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 60 Question 1 | | | | 22-Jun | Sold beauty products on credit: $400. The cost of the items sold was $200 | Answer 61 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 62 Question 1 | Answer 63 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 64 Question 1 | | | | 24-Jun | Ms. Nicole Coffeur withdrew $1,400 cash for personal use. | Answer 65 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 66 Question 1 | Answer 67 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 68 Question 1 | | | | 26-Jun | Paid $820 as advertising expense for local magazine promotion. | Answer 69 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 70 Question 1 | Answer 71 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 72 Question 1 | | | | 28-Jun | Ms. Nicole Coffeur contributed an additional $3,800 cash to the business. | Answer 73 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 74 Question 1 | Answer 75 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 76 Question 1 | | | | 29-Jun | Paid staff wages $2,733. | Answer 77 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 78 Question 1 | Answer 79 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 80 Question 1 [/table] BALANCE DAY ADJUSTMENTS [table] Date | Additional Information | Item | Dr | Cr 30/06 | The business has a bank loan with an annual interest rate of 11% p.a | Answer 81 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 82 Question 1 | Answer 83 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 84 Question 1 | | | | 30/06 | At the end of June, a physical stocktake was conducted. The ending inventory of beauty products was valued at $2,414 | Answer 85 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 86 Question 1 | Answer 87 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 88 Question 1 Answer 89 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $1114 Answer 90 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 91 Question 1 | Answer 92 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $2414 | Answer 93 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 94 Question 1 | | | | 30/06 | Closing stock of salon supplies: At the end of the month, the business did a stock count of salon supplies and found $595 remained on hand. | Answer 95 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 96 Question 1 | Answer 97 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 98 Question 1 | | | | 30/06 | All staff work a 14-day fortnight and are paid on the 15th day (the day following the end of the fortnight worked) | Answer 99 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 100 Question 1 | | | Answer 101 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 102 Question 1 | | | | 30/06 | Insurance: Business paid 2 months' insurance in advance | Answer 103 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 104 Question 1 | Answer 105 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 106 Question 1 | | | | 30/06 | Rent: Business paid rent for 3 months in advance | Answer 107 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 108 Question 1 | Answer 109 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 110 Question 1 | | | | 30/06 | Motor Vehicle useful life is 5 years, and scrap value is $5027 | Answer 111 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | Answer 112 Question 1 | Answer 113 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 114 Question 1 | | | | 30/06 | Hair styling equipment useful life is 3 years, scrap value is $3187 | Answer 115 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | $Answer 116 Question 1 | Answer 117 Question 1 101 Cash102 Accounts Receivable103 Inventory104 Salon Supplies105 Prepaid Rent106 Prepaid Insurance107 Motor Vehicle108 Hair Styling Equipment109 Accumulated Depreciation – Motor Vehicle110 Accumulated Depreciation – Equipment201 Accounts Payable202 Wage Payable203 Interest Payable204 Bank Loan301 Capital302 Drawings401 Hair Styling Service Fees402 Manicure Service Fees403 Facial and Makeup Service Fees404 Sales405 Sales Returns501 Wage Expense502 Salon Supplies Expense503 Insurance Expense504 Rent Expense505 Depreciation Expense506 Advertising Expense507 Interest Expense508 Cost of Goods Sold509 Purchases510 Purchase Returns | | $Answer 118 Question 1 [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The provided data set appears to be a very large, multi-part accounting assessment prompt with extensive tables of transactions, journal entries, and a separate BALANCE DAY ADJUSTMENTS section. However, when it comes to the multiple-choice framing you requested, there is a mismatch in the supplied content: the item is labeled as a fill-in/multiple-blank style task, not a standard multiple-choice question with a discrete list of options to evaluate.

What I can restate from the given material:

- The scenario describes Teenage Style Bag (a sole proprietorship) with opening balances, a month of June 2025 activity, and a set of journal entries that students must complete. There is also a balance day adjustments section to be analyzed at 30/06.

- The “question ty......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Company A provided $300 service to a customer today. The customer paid $100 cash today and will pay $200 in 10 days. Which entry is correct for the company A?

Company A provided $300 service to a customer today. The customer paid $100 cash today and will pay $200 in 10 days. Which entry is correct for the company A?

Select the journal entry to record the purchase.

Purchased $22,000 of cleaning equipment; paid $10,000 cash, with the remainder on account due within 30 days.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!