Questions

FNDN Accounting 2025 STD O2

Single choice

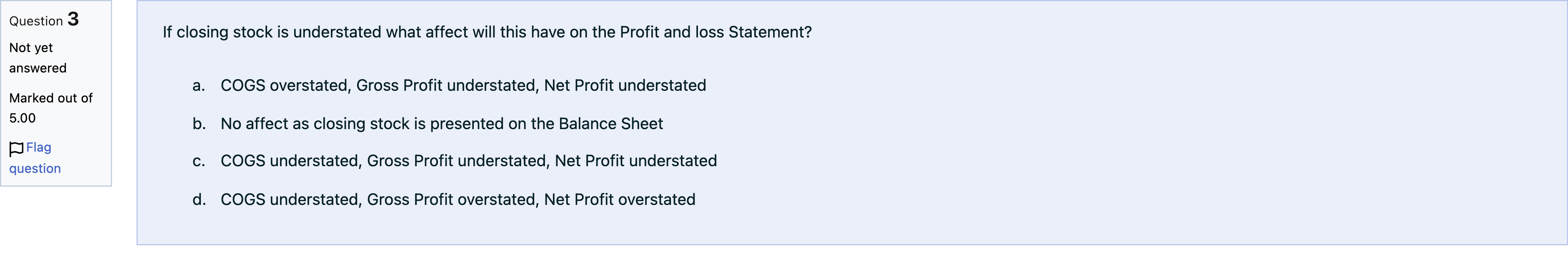

If closing stock is understated what affect will this have on the Profit and loss Statement?

Options

A.a. COGS overstated, Gross Profit understated, Net Profit understated

B.b. No affect as closing stock is presented on the Balance Sheet

C.c. COGS understated, Gross Profit understated, Net Profit understated

D.d. COGS understated, Gross Profit overstated, Net Profit overstated

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Let’s break down what happens when closing stock (ending inventory) is understated in the calculation of cost of goods sold (COGS) and the resulting effect on the income statement.

Option a: COGS overstated, Gross Profit understated, Net Profit understated

- This is correct reasoning. If ending inventory is understated, the cost of goods available for sale minus a smaller endin......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

The inventory data for an item for November are: Nov. 1 Inventory 20 units at $19 4 Sold 10 units 10 Purchased 30 units at $20 17 Sold 20 units 30 Purchased 10 units at $21 Using a perpetual system, what is the cost of the merchandise sold for November if the company uses LIFO?

During a period of increasing prices, which of the following inventory methods generally results in the lowest balance sheet amount for inventory?

During a period of consistently rising prices, the method of inventory that will result in reporting the smallest cost of goods sold is

Companies using LIFO are required to disclose the amount at which inventory would have been reported had the company used FIFO. The difference between LIFO and FIFO inventories is called the LIFO reserve.

More Practical Tools for International Students

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!