Questions

Dashboard ACCT 211 Financial Accounting (Fall 2025)

Multiple fill-in-the-blank

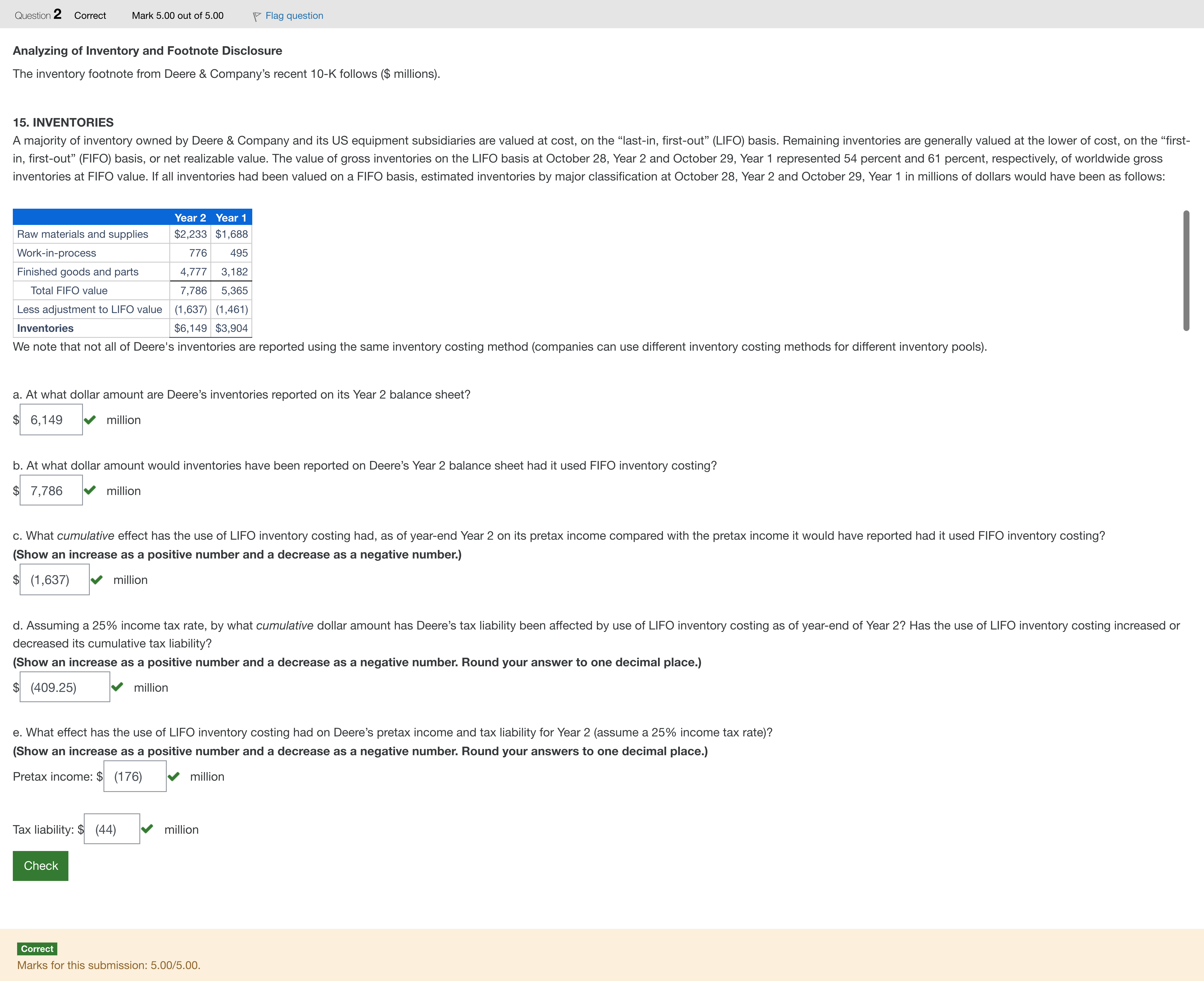

Question textAnalyzing of Inventory and Footnote Disclosure The inventory footnote from Deere & Company’s recent 10-K follows ($ millions). 15. INVENTORIES A majority of inventory owned by Deere & Company and its US equipment subsidiaries are valued at cost, on the “last-in, first-out” (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the “first-in, first-out” (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 28, Year 2 and October 29, Year 1 represented 54 percent and 61 percent, respectively, of worldwide gross inventories at FIFO value. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 28, Year 2 and October 29, Year 1 in millions of dollars would have been as follows: [table] | Year 2 | Year 1 Raw materials and supplies | $2,233 | $1,688 Work-in-process | 776 | 495 Finished goods and parts | 4,777 | 3,182 Total FIFO value | 7,786 | 5,365 Less adjustment to LIFO value | (1,637) | (1,461) Inventories | $6,149 | $3,904 [/table] We note that not all of Deere's inventories are reported using the same inventory costing method (companies can use different inventory costing methods for different inventory pools). a. At what dollar amount are Deere’s inventories reported on its Year 2 balance sheet? $Answer 1[input]CorrectMark 1.00 out of 1.00 million b. At what dollar amount would inventories have been reported on Deere’s Year 2 balance sheet had it used FIFO inventory costing? $Answer 2[input]CorrectMark 1.00 out of 1.00 million c. What cumulative effect has the use of LIFO inventory costing had, as of year-end Year 2 on its pretax income compared with the pretax income it would have reported had it used FIFO inventory costing? (Show an increase as a positive number and a decrease as a negative number.) $Answer 3[input]CorrectMark 1.00 out of 1.00 million d. Assuming a 25% income tax rate, by what cumulative dollar amount has Deere’s tax liability been affected by use of LIFO inventory costing as of year-end of Year 2? Has the use of LIFO inventory costing increased or decreased its cumulative tax liability? (Show an increase as a positive number and a decrease as a negative number. Round your answer to one decimal place.) $Answer 4[input]CorrectMark 1.00 out of 1.00 million e. What effect has the use of LIFO inventory costing had on Deere’s pretax income and tax liability for Year 2 (assume a 25% income tax rate)? (Show an increase as a positive number and a decrease as a negative number. Round your answers to one decimal place.) Pretax income: $Answer 5[input]CorrectMark 1.00 out of 1.00 million Tax liability: $Answer 6[input]CorrectMark 1.00 out of 1.00 million

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We are analyzing Deere & Company's inventory.Let's go through each requested item and explain what the numbers represent and why they are or are not appropriate given the table and notes.

a) At what dollar amount are Deere’s inventories reported on its Year 2 balance sheet? 6,149 million

- This figure corresponds to the Total FIFO value minus the LIFO adjustment as presented in the table: Total FIFO value = 7,786; Less adjustment to LIFO value = 1,637; 7,786 − 1,637 = 6,149. The balance sheet for Year 2 would report inventories using the LIFO method as the company values most inventories at LIFO but discloses the FIFO value and the LIFO adjustment separately. Since the question asks for the amount reported on the Year 2 balance sheet (i.e., the amount under the costing method actually used by Deere for reporting), this aligns with the calculated 6,149. A note: some regional inventories may still be reported under different pools, but the consolidated reported amount given in the prompt matches 6,149.

- This matches the line item labeled 'Inventories' under Year 2 in the table after applying the LIFO a......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Question31 On 1 April 2022 GoldNova Mining Ltd (GoldNova) assessed that its Mollymook area of interest contained economically recoverable reserves of 70,000 ounces of gold. On the same day the entity installed the following assets (with zero residual values): Machineries and equipment (portable): cost $15,000,000, useful life 20 years Mining site building (non-portable): cost $4,000,000 useful life 10 years Mining equipment (non-portable): cost $2,500,000 useful life 15 years The above assets were ready for use on 1 July 2022. GoldNova expects to extract the entire reserves in 5 years. For the year ending 30 June 2023, the entity had extracted 15,000 ounces of gold. Production cost of $150,000 was incurred during the production period. What is the cost of the gold inventory for the year ending 30 June 2023? Select one alternative: $ 4,639,286 $ 21,650,000 $ 2,142,857 $ 4,789,286 $ 2,292,857 ResetMaximum marks: 3

Choose one of the options listed below. Which are the two inventory costing methods available in Sage 50 Premium Accounting?

For which type of inventory would a company most likely use the specific identification method of inventory costing?

Inventory costs do not include ________.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!