Questions

Multiple fill-in-the-blank

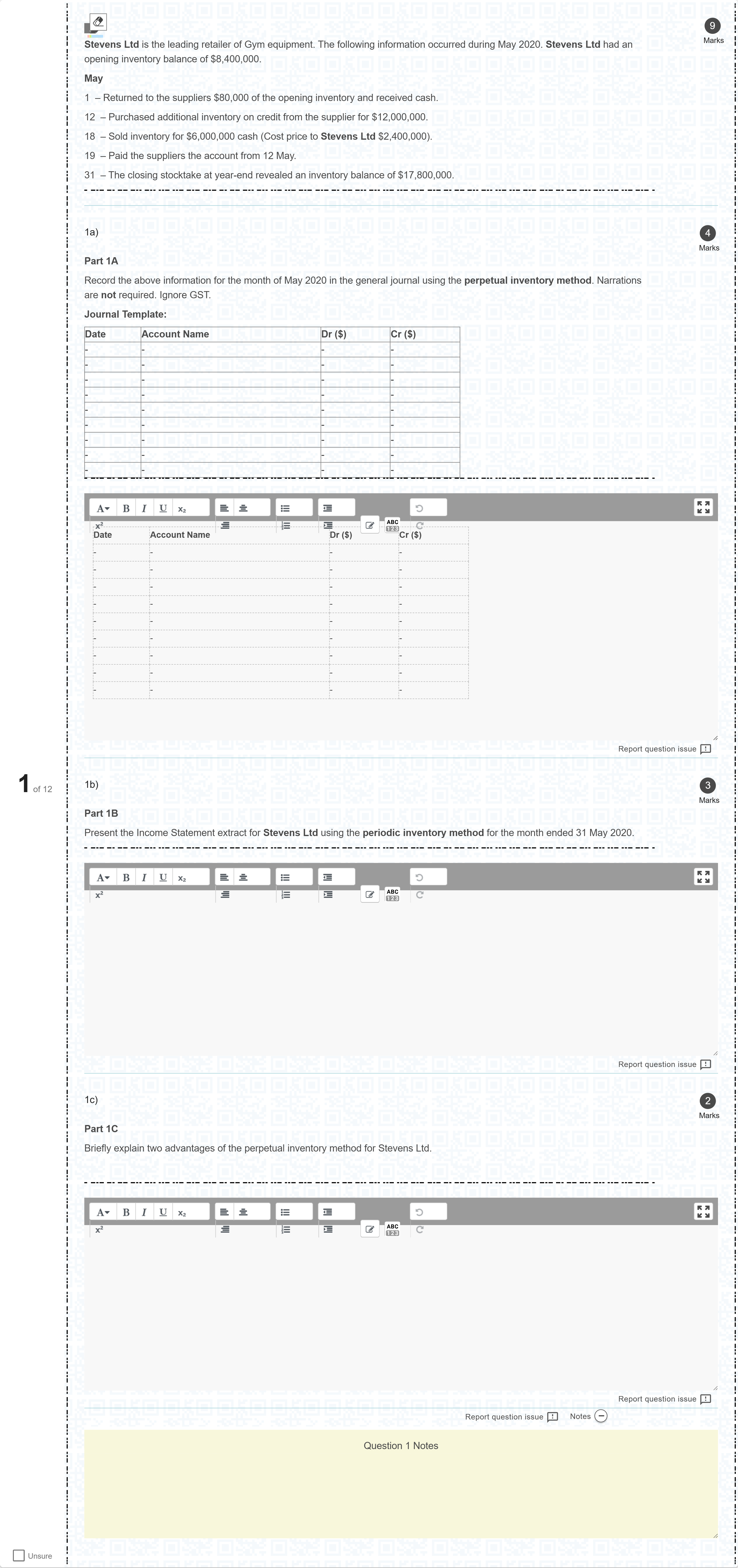

Stevens Ltd is the leading retailer of Gym equipment. The following information occurred during May 2020. Stevens Ltd had an opening inventory balance of $8,400,000.May1 – Returned to the suppliers $80,000 of the opening inventory and received cash.12 – Purchased additional inventory on credit from the supplier for $12,000,000.18 – Sold inventory for $6,000,000 cash (Cost price to Stevens Ltd $2,400,000).19 – Paid the suppliers the account from 12 May.31 – The closing stocktake at year-end revealed an inventory balance of $17,800,000.[Fill in the blank] Part 1A Record the above information for the month of May 2020 in the general journal using the perpetual inventory method. Narrations are not required. Ignore GST. Journal Template: [table] Date | Account Name | Dr ($) | Cr ($) - | - | - | - - | - | - | - - | - | - | - - | - | - | - - | - | - | - - | - | - | - - | - | - | - - | - | - | - - | - | - | - [/table][Fill in the blank] Part 1B Present the Income Statement extract for Stevens Ltd using the periodic inventory method for the month ended 31 May 2020.[Fill in the blank] Part 1C Briefly explain two advantages of the perpetual inventory method for Stevens Ltd.[Fill in the blank]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The prompt asks you to analyze the given May 2020 data for Stevens Ltd under a perpetual inventory system and to address Part 1A, Part 1B, and Part 1C. The provided answer content covers three parts, with Part 1A showing a journal entry table, Part 1B an income statement under the periodic method, and Part 1C two advantages of perpetual inventory. Below I walk through each option and the reasoning behind its correctness or incorrectness. Note: the instruction requires examining each option before indicating which is correct; since the provided material presents only one set of entries (and no explicit multiple-choice options), the analysis will treat each presented item as a candidate approach and point out strengths and potential issues. I will also flag any inconsistencies or typical pitfalls you could encounter when recording these transactions under a perpetual system.

Part 1A — Journal entries for May 2020 under a perpetual inventory method

- May 1: Returned to suppliers $80,000 of the opening inventory and received cash.

- Provided entry: "May 1 | Accounts Payable/Cash | 80,000 | Inventory 80,000"

- Reasoning: In a perpetual system, returning inventory to suppliers typically reduces Inventory and reduces Accounts Payable (or increases Cash if you had already paid). If you indeed receive cash for the return, you would record an increase in Cash and a decrease in Inventory for the return value, but you must also offset the Accounts Payable balance relating to the opening inventory return. The single line attempting to combine Cash and Inventory with a single Accounts Payable/Cash account is ambiguous and does not clearly show the proper separation of the two effects (reduction of inventory and recovery of cash). A ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Using a periodic inventory system, the entry to record the purchase of $30,000 of merchandise on account would include a

Which account CANNOT be linked to an inventory item?

When entering historical information for inventory items, which data can be entered as opening balances? Choose one of the options listed below.

A company’s year-end inventory on December 31 was $343,000 (at cost) based on a physical count, before any necessary adjustment for the following: Inventory costing $48,000, shipped f.o.b. shipping point from a vendor on December 30, was received at the company’s location on January 5 of the following year. Inventory costing $40,000, shipped f.o.b. destination from a vendor on December 28, was received at the company’s location on January 3 of the following year. Inventory costing $56,000, shipped f.o.b. destination to a customer on December 28, arrived at the customer's location on January 6 of the following year. Inventory costing $30,000 was being held on consignment by Traynor Company. What amount should the company report as inventory in its December 31 balance sheet?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!