Questions

FINS5512-Financial Markets & Institutions - T3 2025

Single choice

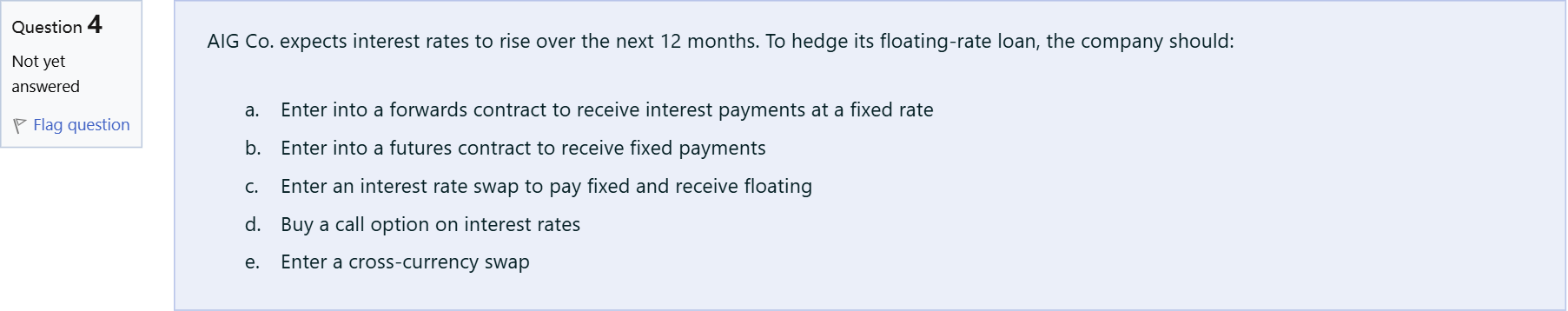

AIG Co. expects interest rates to rise over the next 12 months. To hedge its floating-rate loan, the company should:

Options

A.a. Enter into a forwards contract to receive interest payments at a fixed rate

B.b. Enter into a futures contract to receive fixed payments

C.c. Enter an interest rate swap to pay fixed and receive floating

D.d. Buy a call option on interest rates

E.e. Enter a cross-currency swap

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

When a company has a floating-rate loan, its interest payments rise as market rates rise. The goal of hedging is to offset this exposure by gains on another instrument.

Option a: A forwards contract to receive a fixed rate would lock in fixed payments, but forwards on interest rates are typically used to hedge or speculate on the level of rates directly, not to convert a floating borrowing into a fixed payment stream in a standard corp......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

GHI Industries has issued $180 million worth of long-term bonds at a fixed rate of 14%. GHI Industries then enters into an interest rate swap where it will pay LIBOR and receive a fixed 6% on a notional principal of $180 million. After all these transactions are considered, GHI's cost of funds is:

Two corporate borrowers enter into an interest swap agreement with a notional amount of $25M and annual net payments. Party A takes the fixed side of the swap at a rate of 3.25%, while Party B takes the floating rate side of the swap at a rate of LIBOR plus 125 bp. If at the end of the year, LIBOR is at 1.5%, who will owe money to the other party and how much?

The interest rate swap strategy of a firm with fixed rate debt and that expects rates to go up is to:

An agreement to swap a fixed interest payment for a floating interest payment would be considered a/an:

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!