Questions

BFC3240 - S2 2025 Mock Exam

Single choice

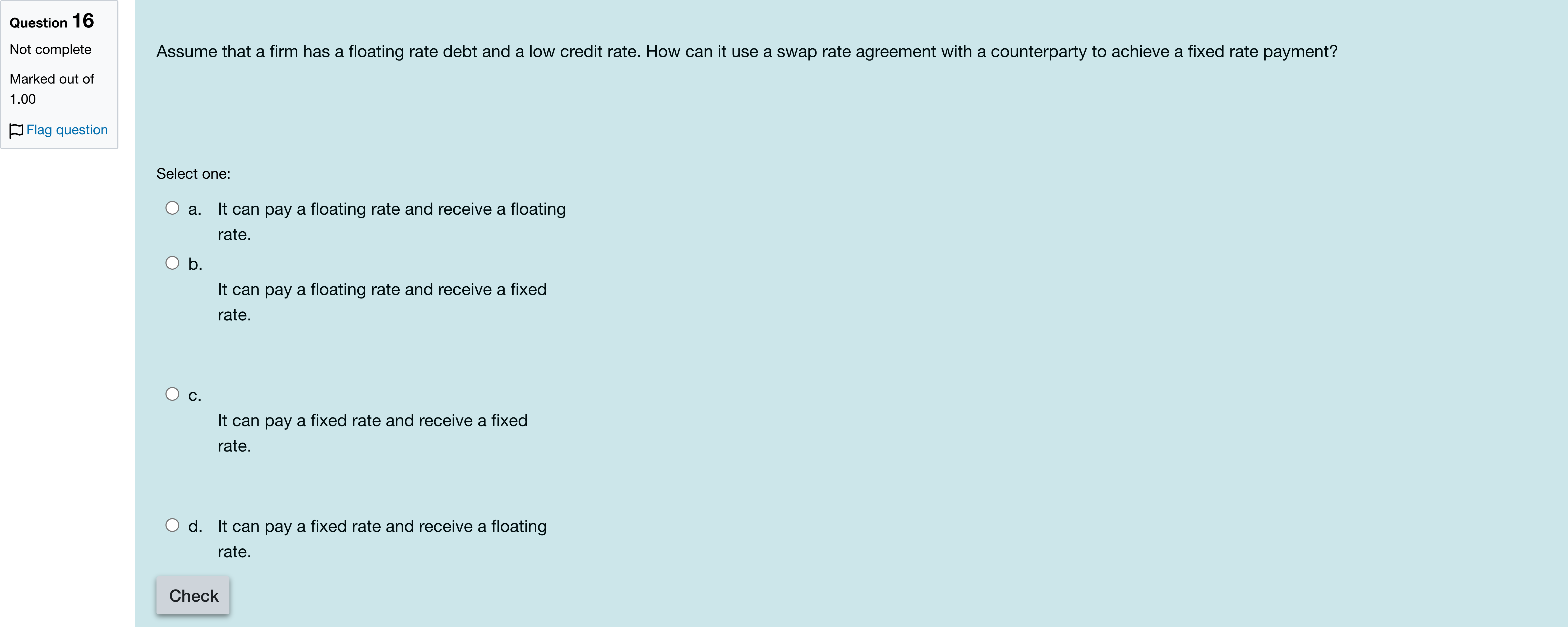

Assume that a firm has a floating rate debt and a low credit rate. How can it use a swap rate agreement with a counterparty to achieve a fixed rate payment?

Options

A.a. It can pay a floating rate and receive a floating rate.

B.b. It can pay a floating rate and receive a

fixed rate.

C.c. It can pay a fixed rate and receive a

fixed rate.

D.d. It can pay a fixed rate and receive a floating rate.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The scenario involves a firm with floating-rate debt and a low credit spread, seeking to lock in a fixed payment via a swap.

Option a: It can pay a floating rate and receive a floating rate. This would leave the net cash flows unchanged with respect to the debt and does not convert floating debt into a fixed stream. It do......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

A firm with variable-rate debt that expects interest rates to rise may engage in a swap agreement to:

An interbank-traded contract to buy or sell interest rate payments on a notional principal is called a/an:

Part 1A swap agreement calls for Durbin Industries to pay interest annually, based on a rate of 1.501.50% over the one year T-bill rate, currently 7.007.00%. In return, Durbin receives interest at a rate of 7.007.00% on a fixed-rate basis. The notional principal for the swap is $ 50,000$50,000. What is Durbin's net interest payment for the year after the agreement?Part 2 A. $ 3,500$3,500. B. $ 750$750. C. $ 4,250$4,250. D. $ 2,125$2,125.

Why would a company that owns a floating rate asset enter into a vanilla swap as a fixed rate receiver?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!