Questions

Single choice

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $300,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $6000 (paid at the end of each month). Your firm can borrow at 8.00% APR with quarterly compounding. The monthly discount rate that you should use to evaluate the truck lease is closest to ________.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

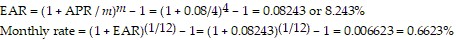

First, identify what the question is asking: we need the monthly discount rate that is consistent with an 8.00% APR with quarterly compounding, to evaluate a monthly lease payment.

Next, determine the effective per-quarter rate implied by the given APR with quarterly compounding......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

What effective interest rate per quarter is equivalent to 8% p.a. compounding semi-annually?

If the nominal per annum interest rate is 6%, then the interest rate per quarter is:

Complete the following calculations: 1: A 12% APR compounded monthly equates to an semi-annual effective rate of: 2: A 10% APR compounded semi-annually equates to an annual effective rate of: 3: An 8% APR compounded annually equates to an monthly effective rate of:

An interest rate is 5% per annum with continuous compounding. What is the equivalent rate with semi-annual compounding?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!