Questions

Multiple fill-in-the-blank

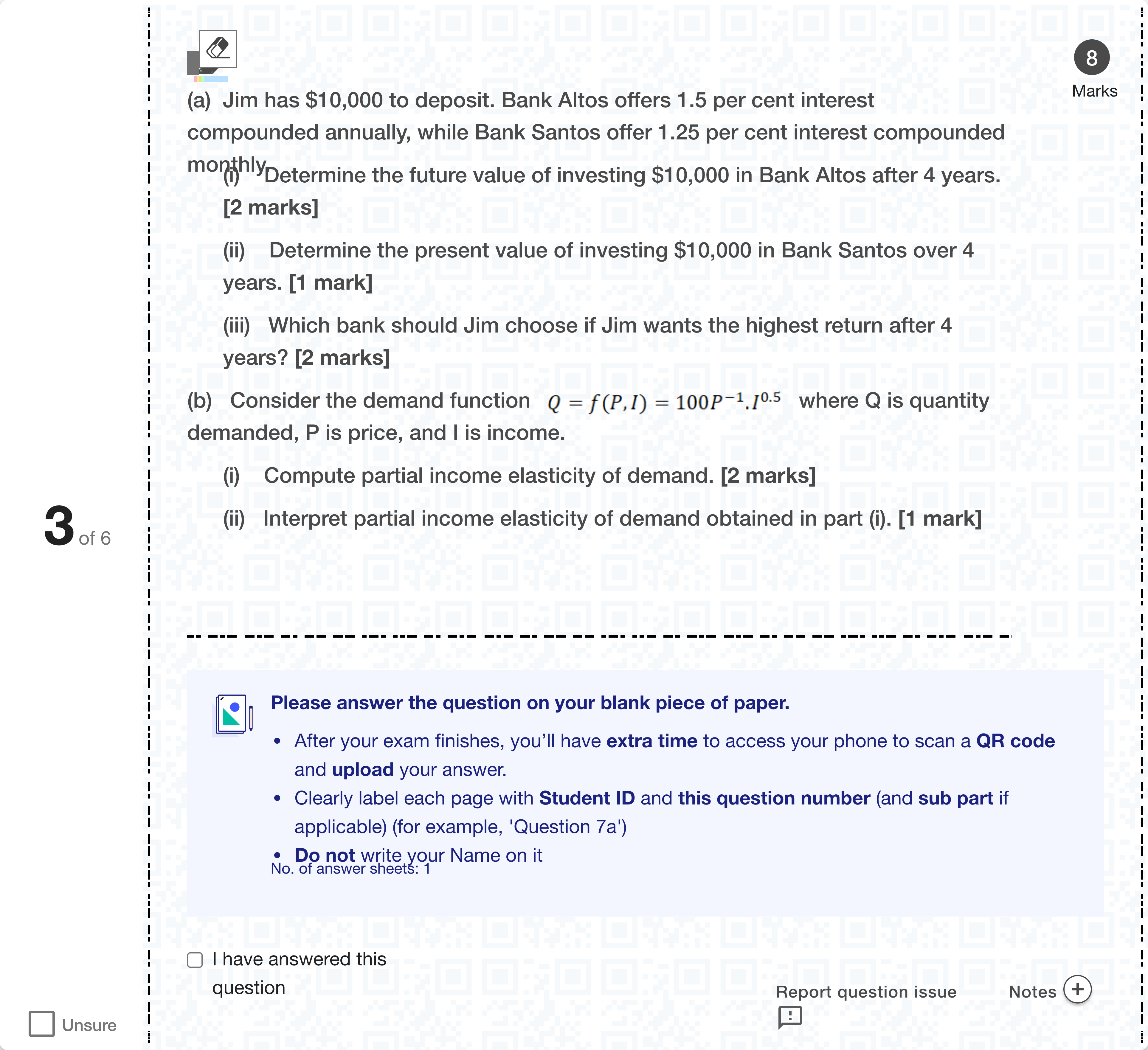

(a) Jim has $10,000 to deposit. Bank Altos offers 1.5 per cent interest compounded annually, while Bank Santos offer 1.25 per cent interest compounded monthly. (i) Determine the future value of investing $10,000 in Bank Altos after 4 years. [2 marks] (ii) Determine the present value of investing $10,000 in Bank Santos over 4 years. [1 mark] (iii) Which bank should Jim choose if Jim wants the highest return after 4 years? [2 marks] (b) Consider the demand function where Q is quantity demanded, P is price, and I is income. (i) Compute partial income elasticity of demand. [2 marks] (ii) Interpret partial income elasticity of demand obtained in part (i). [1 mark][Fill in the blank]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To approach this question, I will tackle each blank in turn and explain the reasoning behind the calculated values and interpretations.

(i) Future value of $10,000 in Bank Altos after 4 years at 1.5% annually

- The problem states annual compounding, so we use the formula FV = P(1 + r)^t with P = 10000, r = 0.015, t = 4.

- Compute: (1 + 0.015)^4 ≈ 1.061364; multiply by 10000 to get approximately 10613.64.

- Therefore, the future value is about 10613.64.

(ii) Present value of $10,000 in Bank Sant......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Two complements , shoes and socks will have a negative value of income elasticity of demand.

(a) Jim has $10,000 to deposit. Bank Altos offers 1.5 per cent interest compounded annually, while Bank Santos offer 1.25 per cent interest compounded monthly. (i) Determine the future value of investing $10,000 in Bank Altos after 4 years. [2 marks] (ii) Determine the present value of investing $10,000 in Bank Santos over 4 years. [1 mark] (iii) Which bank should Jim choose if Jim wants the highest return after 4 years? [2 marks] (b) Consider the demand function where Q is quantity demanded, P is price, and I is income. (i) Compute partial income elasticity of demand. [2 marks] (ii) Interpret partial income elasticity of demand obtained in part (i). [1 mark][Fill in the blank]

Part 1When income increases by 55 percent and all prices remain the same, the quantity of smartphones demanded increases by 1010 percent. Calculate the income elasticity of demand of smartphones. Part 1The income elasticity of demand of smartphones is [input]enter your response here . >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign.

If the income elasticity of demand for airline tickets is 1.8, this implies that:

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!