Questions

MCD2170 Foundations of Finance - Trimester 3 - 2025

Single choice

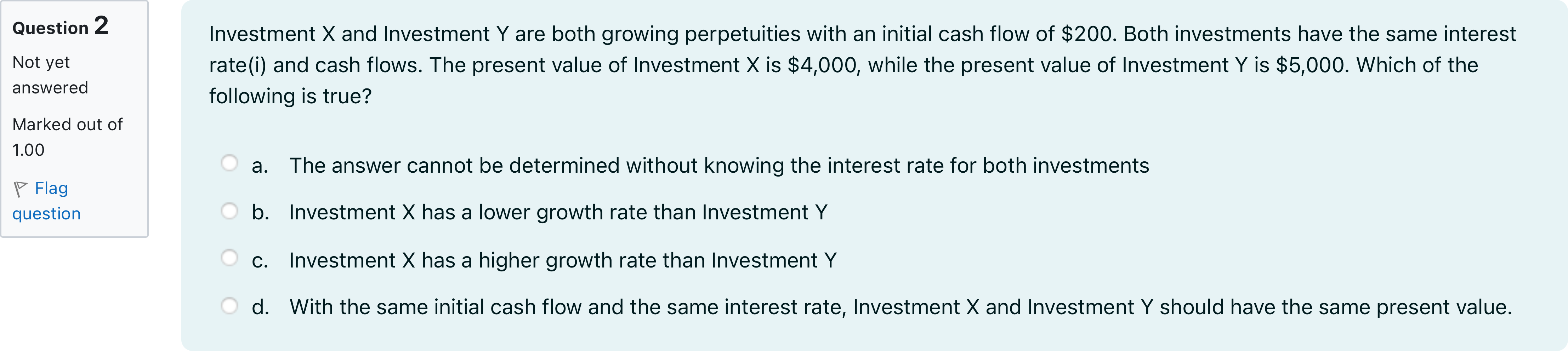

Investment X and Investment Y are both growing perpetuities with an initial cash flow of $200. Both investments have the same interest rate(i) and cash flows. The present value of Investment X is $4,000, while the present value of Investment Y is $5,000. Which of the following is true?

Options

A.a. The answer cannot be determined without knowing the interest rate for both investments

B.b. Investment X has a lower growth rate than Investment Y

C.c. Investment X has a higher growth rate than Investment Y

D.d. With the same initial cash flow and the same interest rate, Investment X and Investment Y should have the same present value.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Let’s break down what the problem says and how the present value of a growing perpetuity is determined.

Option a: 'The answer cannot be determined without knowing the interest rate for both investments.' In this setup, the two investments share the same interest rate i and the same cash flow pattern, only the growth rate g differs. Since PV of a growing perpetuity is PV = CF1 / (i − g), if CF1 and i are the same for both......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Five years from today, you hope to donate $10,000 to the alumni association. Thereafter, you intend for your annual contributions to grow at a rate of 3 percent per year, forever. If you can earn 7 percent per year on your investments, how much must you invest today to fund this donation?

The annual payment of growing perpetuity starts at $2,000 in year 4 and grows at a rate of 4% per year thereafter. If the discount rate is 8%, what is the present value of the perpetuity at time 0?

You just won the lottery! Your prize begins with a payment of $10,000, which you will receive one year from today. Every year forever after, the payments will increase by 4 percent annually. What is the present value of your prize at a discount rate of 6 percent per year?

A wealthy donor invests $500,000 into an endowment fund that will pay a growing annual scholarship in perpetuity, starting one year from today. The fund earns an annual return of 6%, and the scholarship amount will grow by 2% each year to keep up with inflation. What will be the scholarship payment paid in year 3?[Fill in the blank]

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!