Questions

MCD2160 - T3 - 2025 MCD2160: Mid Test Practice Quiz

Multiple fill-in-the-blank

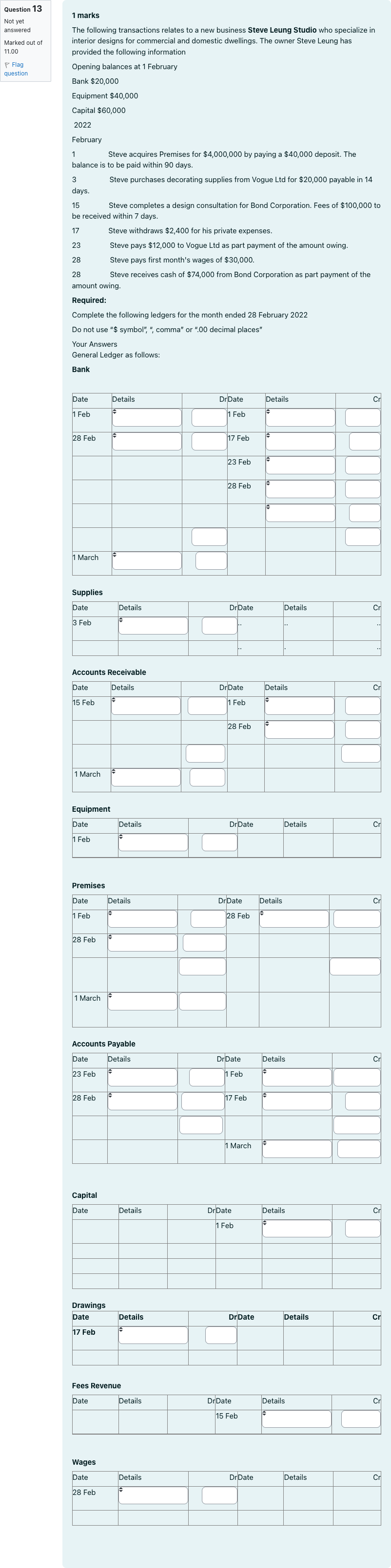

Question text1 marksThe following transactions relates to a new business Steve Leung Studio who specialize in interior designs for commercial and domestic dwellings. The owner Steve Leung has provided the following informationOpening balances at 1 FebruaryBank $20,000Equipment $40,000Capital $60,000 2022February1 Steve acquires Premises for $4,000,000 by paying a $40,000 deposit. The balance is to be paid within 90 days.3 Steve purchases decorating supplies from Vogue Ltd for $20,000 payable in 14 days.15 Steve completes a design consultation for Bond Corporation. Fees of $100,000 to be received within 7 days.17 Steve withdraws $2,400 for his private expenses.23 Steve pays $12,000 to Vogue Ltd as part payment of the amount owing.28 Steve pays first month's wages of $30,000.28 Steve receives cash of $74,000 from Bond Corporation as part payment of the amount owing.Required:Complete the following ledgers for the month ended 28 February 2022Do not use “$ symbol”, “, comma” or “.00 decimal places”Your AnswersGeneral Ledger as follows:Bank[table] Date | Details | Dr | Date | Details | Cr 1 Feb | Answer 1 Question 13 SuppliesBankPremisesEquipmentA/c ReceivableFees RevenueA/c PayableWagesBalanceDrawingsno entry | Answer 2 Question 13 | 1 Feb | Answer 3 Question 13 DrawingsBankno entryFees RevenueA/c PayableWagesEquipmentA/c ReceivableSuppliesBalancePremises | Answer 4 Question 13 28 Feb | Answer 5 Question 13 A/c ReceivableEquipmentBalanceDrawingsA/c PayableBankPremisesFees RevenueWagesSuppliesno entry | Answer 6 Question 13 | 17 Feb | Answer 7 Question 13 BankSuppliesPremisesFees RevenueDrawingsBalanceA/c PayableEquipmentWagesA/c Receivableno entry | Answer 8 Question 13 | | | 23 Feb | Answer 9 Question 13 PremisesFees RevenueSuppliesEquipmentBalanceDrawingsA/c PayableBankA/c Receivableno entryWages | Answer 10 Question 13 | | | 28 Feb | Answer 11 Question 13 DrawingsWagesA/c ReceivableFees RevenueSuppliesBankEquipmentno entryBalancePremisesA/c Payable | Answer 12 Question 13 | | | | Answer 13 Question 13 BankPremisesDrawingsWagesA/c ReceivableFees RevenueEquipmentno entrySuppliesA/c PayableBalance | Answer 14 Question 13 | | Answer 15 Question 13 | | | Answer 16 Question 13 1 March | Answer 17 Question 13 WagesDrawingsFees RevenueBalanceA/c Receivableno entryA/c PayableBankPremisesEquipmentSupplies | Answer 18 Question 13 | | | [/table]Supplies[table] Date | Details | Dr | Date | Details | Cr 3 Feb | Answer 19 Question 13 BankWagesA/c ReceivableA/c PayableBalanceSuppliesFees Revenueno entryPremisesDrawingsEquipment | Answer 20 Question 13 | .. | .. | .. | | | .. | . | .. [/table]Accounts Receivable[table] Date | Details | Dr | Date | Details | Cr 15 Feb | Answer 21 Question 13 no entryFees RevenueBankSuppliesDrawingsA/c PayableBalanceEquipmentWagesPremisesA/c Receivable | Answer 22 Question 13 | 1 Feb | Answer 23 Question 13 BankEquipmentno entryFees RevenuePremisesA/c ReceivableA/c PayableBalanceDrawingsWagesSupplies | Answer 24 Question 13 | | | 28 Feb | Answer 25 Question 13 SuppliesWagesDrawingsPremisesno entryFees RevenueBankA/c PayableA/c ReceivableBalanceEquipment | Answer 26 Question 13 | | Answer 27 Question 13 | | | Answer 28 Question 13 1 March | Answer 29 Question 13 WagesSuppliesA/c PayableA/c ReceivableEquipmentBankBalancePremisesFees Revenueno entryDrawings | Answer 30 Question 13 | | | [/table]Equipment[table] Date | Details | Dr | Date | Details | Cr 1 Feb | Answer 31 Question 13 SuppliesBankFees RevenueWagesBalanceDrawingsA/c PayableA/c Receivableno entryPremisesEquipment | Answer 32 Question 13 | | | | | | | | [/table]Premises[table] Date | Details | Dr | Date | Details | Cr 1 Feb | Answer 33 Question 13 WagesBankEquipmentno entryDrawingsA/c PayableFees RevenuePremisesA/c ReceivableSuppliesBalance | Answer 34 Question 13 | 28 Feb | Answer 35 Question 13 BankSuppliesA/c PayableFees RevenueBalanceno entryPremisesEquipmentWagesDrawingsA/c Receivable | Answer 36 Question 13 28 Feb | Answer 37 Question 13 SuppliesDrawingsEquipmentA/c ReceivableBankA/c PayableWagesPremisesno entryFees RevenueBalance | Answer 38 Question 13 | | | | | Answer 39 Question 13 | | | Answer 40 Question 13 1 March | Answer 41 Question 13 A/c ReceivablePremisesDrawingsSuppliesBalanceFees Revenueno entryWagesEquipmentA/c PayableBank | Answer 42 Question 13 | | | [/table]Accounts Payable[table] Date | Details | Dr | Date | Details | Cr 23 Feb | Answer 43 Question 13 Fees RevenueA/c Payableno entryWagesPremisesBalanceEquipmentDrawingsBankA/c ReceivableSupplies | Answer 44 Question 13 | 1 Feb | Answer 45 Question 13 EquipmentA/c ReceivableDrawingsno entryWagesBalancePremisesFees RevenueSuppliesA/c PayableBank | Answer 46 Question 13 28 Feb | Answer 47 Question 13 DrawingsFees RevenuePremisesSuppliesEquipmentA/c ReceivableBalanceno entryA/c PayableBankWages | Answer 48 Question 13 | 17 Feb | Answer 49 Question 13 DrawingsBalancePremisesBankFees RevenueA/c Payableno entryA/c ReceivableWagesSuppliesEquipment | Answer 50 Question 13 | | Answer 51 Question 13 | | | Answer 52 Question 13 | | | 1 March | Answer 53 Question 13 Balanceno entryDrawingsBankA/c ReceivableWagesPremisesEquipmentFees RevenueA/c PayableSupplies | Answer 54 Question 13 [/table]Capital[table] Date | Details | Dr | Date | Details | Cr | | | 1 Feb | Answer 55 Question 13 A/c PayableEquipmentno entryDrawingsSuppliesPremisesBalanceBankFees RevenueA/c ReceivableWages | Answer 56 Question 13 | | | | | | | | | | | | | | | [/table]Drawings[table] Date | Details | Dr | Date | Details | Cr 17 Feb | Answer 57 Question 13 Fees RevenueBankDrawingsA/c ReceivableSuppliesEquipmentBalanceA/c PayablePremisesWagesno entry | Answer 58 Question 13 | | | | | | | [/table]Fees Revenue[table] Date | Details | Dr | Date | Details | Cr | | | 15 Feb | Answer 59 Question 13 no entryDrawingsSuppliesA/c PayablePremisesBalanceEquipmentFees RevenueBankA/c ReceivableWages | Answer 60 Question 13 | | | | | [/table]Wages[table] Date | Details | Dr | Date | Details | Cr 28 Feb | Answer 61 Question 13 A/c ReceivableDrawingsFees RevenuePremisesno entryBalanceA/c PayableSuppliesEquipmentBankWages | Answer 62 Question 13 | | | | | | | | [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The material you provided for this item is not a typical multiple-choice question but a complex bookkeeping task that asks you to complete general ledgers for a month. However, there are no answer options to evaluate, so I cannot identify a correct option. Below is a detailed, step-by-step approach to understanding the transactions and how you would populate the ledgers. This will help you create the correct ledger entries even though no MCQ choices are given.

First, establish the opening balances as given on 1 February: Bank 20000 (Dr), Equipment 40000 (Dr), Capital 60000 (Cr). These form the starting point for the trial balances and each ledger balance.

Then process each transaction in date order, deciding which accounts are debited and which are credited. I’ll outline the effects in a readable sequence so you can translate them into the tabular ledgers you were asked to prepare.

1 February – Opening balances

- Bank Dr 20000 (balance brought forward)

- Equipment Dr 40000 (balance brought forward)

- Capital Cr 60000 (owner’s equity)

1 February – Not a separate transaction beyond opening......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Referring to the Invoice Posting Journal printed in Step 22 of the Practical Exam, which G/L Account is used by the distribution code SALES?

Referring to the G/L Transactions report printed in Step 29 of the Practice Exam, what G/L Account is used for the Cloud Space credit?

The posting date is the date that a document is posted to the General Ledger.

Referring to Step 25 of the Practical Exam, what Source Code was used in Batch 000003?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!