Questions

25_2 FIN376 Formative Online Test 7

Multiple dropdown selections

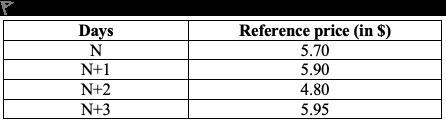

Suppose there is a future contract on stocks “ABC”. An investor bought one future contract on stocks “ABC” with a settlement date of 4 months, with a price of $5.65. The evolution of the reference price for future contracts on stocks “ABC” since the purchase day (day N) and during the following 3 days was as follows:Knowing that each future contract on stocks “ABC” has as underlying asset 100 stocks “ABC”, and the initial margin and the maintenance margin are, respectively, $500 and $400, determine the financial movement following the price changes on those days regarding the future’s buyer and the future’s seller, by filling in the tables below:Buyer: [table] Day | Price | Initial amount | Result | Interim result | Deposit | Withdrawal | Final amount N | $5.65 | ------ | ------ | $0 | Blank 1 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | ------ | Blank 2 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N | $5.70 | Blank 3 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 4 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 5 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 6 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 7 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 8 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+1 | $5.90 | Blank 9 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 10 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 11 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 12 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 13 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 14 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+2 | $4.80 | Blank 15 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 16 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 17 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 18 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 19 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 20 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+3 | $5.95 | Blank 21 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 22 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 23 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 24 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 25 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 26 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 [/table] Seller:[table] Day | Price | Initial amount | Result | Interim result | Deposit | Withdrawal | Final amount N | $5.65 | ------ | ------ | $0 | Blank 27 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | ------ | Blank 28 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N | $5.70 | Blank 29 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 30 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 31 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 32 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 33 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 34 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+1 | $5.90 | Blank 35 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 36 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 37 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 38 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 39 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 40 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+2 | $4.80 | Blank 41 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 42 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 43 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 44 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 45 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 46 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 N+3 | $5.95 | Blank 47 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 48 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 49 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 | Blank 50 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 51 Question 2 $128$115$110$90$20$5$0-$5-$20-$110-$115-$150 | Blank 52 Question 2 $615$600$590$550$520$505$500$495$480$470$450$400$390$385$250 [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by clearly restating the scenario and what needs to be tracked for both the Buyer and the Seller.

- Each futures contract on ABC has an underlying asset of 100 shares of ABC.

- The investor buys one futures contract with a settlement date 4 months ahead at a price of 5.65 per share (the reference price at purchase day N is 5.70, which affects P&L as the price moves).

- Initial margin (deposit) required is 500 and the maintenance margin is 400. This means the trader must maintain at least 400 in the margin account; if the balance falls below this, a margin call would be triggered (not specified here, but the concept is key).

- We track, for each day, the change in the contract value due to the change in the reference price, and how this affects the buyer’s and the seller’s margin accounts. A long futures position gains when the reference price increases and loses when it decreases, relative to the purchase price.

Option-by-option analysis approach (without presuming the exact listed options):

- For any day ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following is NOT a contract specification for currency futures trading on an organized exchange?

Question29 (b) What is the gain or loss for Myles on this futures contract after the first trading day? [1 mark] 0[input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 2 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 1 Flag question undefined

Question23 Mohamad shorted futures contracts on a US stock at $61.50 per share. Each contract is for the sale of 200 shares. The stock price at the end of the contract is $57. Mohamad has to pay a flat fee of $8000 as well as a trading commission of $7 per contract. If he has shorted 100 contracts, what is the net profit/loss to him? [4 marks] [input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 0 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 4 Flag question undefined

Question29 (b) What is the gain or loss for Myles on this futures contract after the first trading day? [1 mark] Invalid input. Enter a numerical value.[input] Your response must be entered as a positive (profit)/negative (loss) numerical value with 2 decimal places and excluding the dollar sign ($) and any commas (,). Maximum marks: 1 Flag question undefined

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!