Questions

BFC3240 - S2 2025 Mock Exam

Single choice

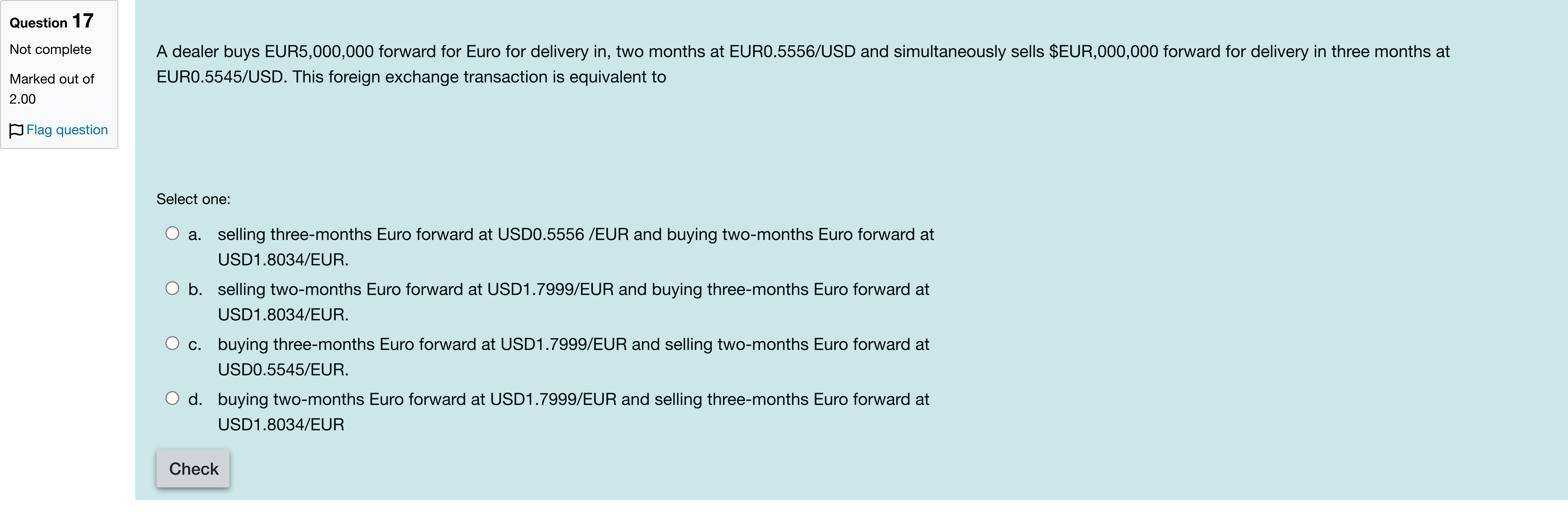

A dealer buys EUR5,000,000 forward for Euro for delivery in, two months at EUR0.5556/USD and simultaneously sells $EUR,000,000 forward for delivery in three months at EUR0.5545/USD. This foreign exchange transaction is equivalent to

Options

A.a. selling three-months Euro forward at USD0.5556 /EUR and buying two-months Euro forward at USD1.8034/EUR.

B.b. selling two-months Euro forward at USD1.7999/EUR and buying three-months Euro forward at USD1.8034/EUR.

C.c. buying three-months Euro forward at USD1.7999/EUR and selling two-months Euro forward at USD0.5545/EUR.

D.d. buying two-months Euro forward at USD1.7999/EUR and selling three-months Euro forward at USD1.8034/EUR

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

First, restate the scenario to ensure we understand the positions involved. The dealer buys EUR5,000,000 forward for Euro for delivery in two months at EUR0.5556/USD and simultaneously sells EUR5,000,000 forward for delivery in three months at EUR0.5545/USD. The question asks which foreign exchange transaction this combination is equivalent to, expressed in USD per EUR terms for the two forwards.

Option a says: selling three-months Euro forward at USD0.5556/EUR and buying two-months Euro forward at USD1.8034/EUR. This mixes a forward price for EUR in terms of USD but uses the wrong direction for the two-month leg and mismatches the given two quoted rates (0.5556 and 0.5545) with 1.8034; moreover, 0.5556 and 1.8034 are not consistent units. In essence, this option treats the two-month leg as a sale and postpones the USD pricing in a way ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

A company has just sold a large amount of their product to another company over in France. In order to be competitive, they were forced to price in EUR. The sale total was for EUR 2 million, and will be payable in 60 days. The company has decided to hedge this transaction in the forward market and obtained a quote of EUR/USD1.4010-75. Given this information, how much will the company receive from this transaction in USD?

Question13 Singapore Airlines Ltd has decided to enter into an agreement to exchange foreign currencies in the future at an exchange rate determined today. This transaction will be conducted in the over-the-counter market. Singapore Airlines Ltd has entered into a _____________________ with a counterparty. futures contract written on foreign currency cross-currency swap currency options contract forward foreign exchange contract foreign exchange transaction in the spot market ResetMaximum marks: 1 Flag question undefined

Question10 Singapore Airlines Ltd has decided to enter into an agreement to exchange foreign currencies in the future at an exchange rate determined today. This transaction will be conducted in the over-the-counter market. Singapore Airlines Ltd has entered into a _____________________ with a counterparty. futures contract written on foreign currency foreign exchange transaction in the spot market currency options contract cross-currency swap forward foreign exchange contract ResetMaximum marks: 1 Flag question undefined

Question11 A dealer at Credit Suisse is quoting a spot rate of AUD/USD of 0.6912 - 56 and the nine-month forward points are 17 to 29. (a) What is the nine-month forward bid rate for the AUD/USD currency pair? [2 marks] [input] Your response must be entered as a numerical value with 4 decimal places and excluding the dollar sign ($). Maximum marks: 2 Flag question undefined

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!