Still overwhelmed by exam stress? You've come to the right place!

We know exam season has you totally swamped. To support your studies, access Gold Membership for FREE until December 31, 2025! Normally £29.99/month. Just Log In to activate – no strings attached.

Let us help you ace your exams efficiently!

Questions

Single choice

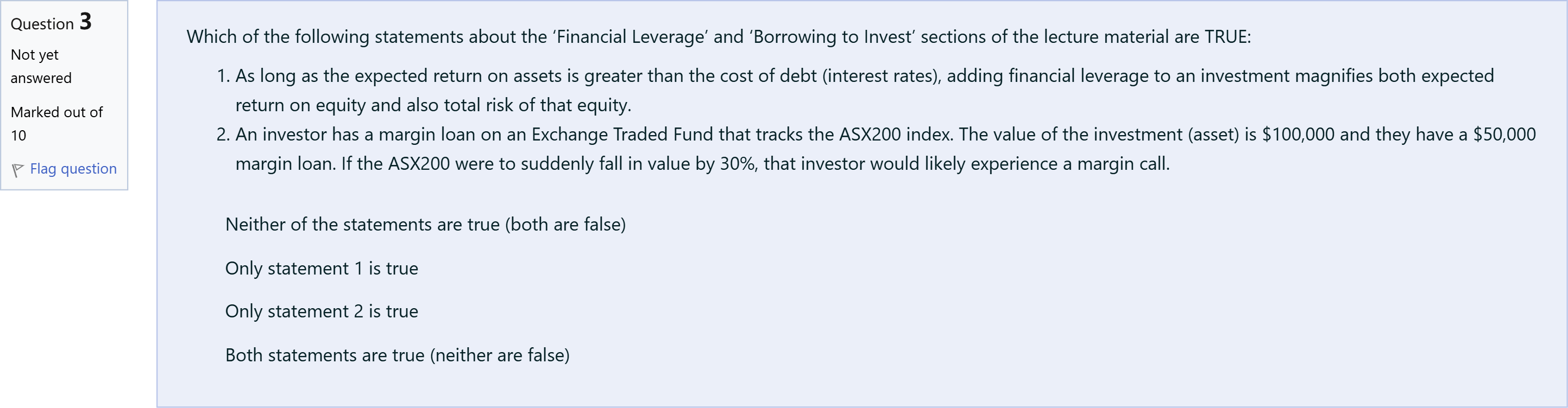

Which of the following statements about the ‘Financial Leverage’ and ‘Borrowing to Invest’ sections of the lecture material are TRUE: As long as the expected return on assets is greater than the cost of debt (interest rates), adding financial leverage to an investment magnifies both expected return on equity and also total risk of that equity. An investor has a margin loan on an Exchange Traded Fund that tracks the ASX200 index. The value of the investment (asset) is $100,000 and they have a $50,000 margin loan. If the ASX200 were to suddenly fall in value by 30%, that investor would likely experience a margin call.

Options

A.Neither of the statements are true (both are false)

B.Only statement 1 is true

C.Only statement 2 is true

D.Both statements are true (neither are false)

View Explanation

Standard Answer

Please login to view

Approach Analysis

Question restatement: You are asked about two statements regarding Financial Leverage and Borrowing to Invest. The answer options present four possible judgments about those statements.

Option A: Neither of the statements are true (both are false). Here, we would be claiming that neither the leverage effect on ROE/ risk, nor the margin-call scenario, holds under the given conditions. In standard leverage theory, if the return on assets exceeds the cost of debt, financial leverage tends to amplify both......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

When a company's ROE is greater than its ROA for a given time-period, it could be that

Sun Corp and Tri Corp have similar business operations, but Tri Corp always maintains a much higher debt-to-equity ratio than Sun Corp. If next year both firms experience an increase in their profit margins, then Tri Corp’s accounting return on equity (ROE) will likely increase much less than Sun Corp’s ROE, because Tri Corp's equity is more risky.

Which of the following statements about the ‘Financial Leverage’ and ‘Borrowing to Invest’ sections of the lecture material are TRUE: As long as the expected return on assets is greater than the cost of debt (interest rates), adding financial leverage to an investment magnifies both expected return on equity and also total risk of that equity. An investor has a margin loan on an Exchange Traded Fund that tracks the ASX200 index. The value of the investment (asset) is $100,000 and they have a $50,000 margin loan. If the ASX200 were to suddenly fall in value by 30%, that investor would likely experience a margin call.

Question at position 9 Leverage refers tothe use of an easement to limit land use.the use of a lease to increase yield to the owner.the use of borrowed funds to increase or decrease equity return.the use of an architectural tool to build improvements with doors and windows.

More Practical Tools for International Students

Making Your Study Simpler

To make preparation and study season easier for more international students, we've decided to open up Gold Membership for a limited-time free trial until December 31, 2025!