Questions

My home Practice Quiz [non-assessed]

Single choice

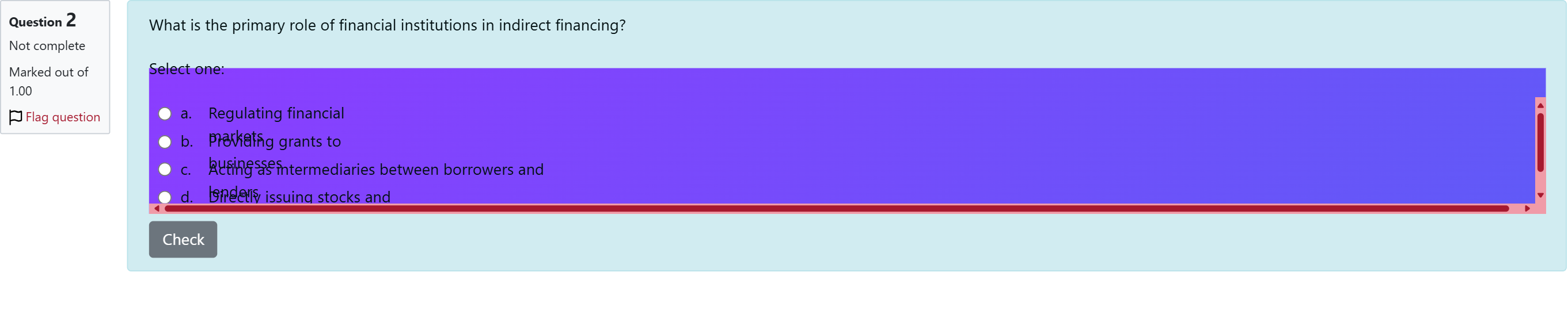

What is the primary role of financial institutions in indirect financing?

Options

A.a. Regulating financial markets

B.b. Providing grants to businesses

C.c. Acting as intermediaries between borrowers and lenders

D.d. Directly issuing stocks and bonds

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks about the primary role of financial institutions in indirect financing.

Option a: 'Regulating financial markets' — While financial institutions operate within regulated markets, their primary role in indirect financing is not to regulate; regulation is typically the role of government agencies and central banks. This option conflates i......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following is NOT one of the special functions thatfinancial institutions provide?

Which of the following can be described as involving indirect finance?

Question3 How many of the following statements are correct in regards to intermediated financing arrangements? I. Users of funds obtain financing directly from money and capital marketsII. Financial instruments are issued directly between savers and borrowersIII. A commercial bank stands between savers and borrowers, with two separate contractual agreementsIV. Borrowers avoid the costs of intermediation and have increased flexibility in issuing securitiesV. There are higher search costs for suppliers of funds Two statements are correct Three statements are correct Four statements are correct All five statements are correct One statement is correct ResetMaximum marks: 1 Flag question undefined

Question3 How many of the following statements are correct in regards to intermediated financing arrangements? I. Users of funds obtain financing directly from money and capital marketsII. Financial instruments are issued directly between savers and borrowersIII. A commercial bank stands between savers and borrowers, with two separate contractual agreementsIV. Borrowers avoid the costs of intermediation and have increased flexibility in issuing securitiesV. There are higher search costs for suppliers of funds All five statements are correct One statement is correct Four statements are correct Three statements are correct Two statements are correct ResetMaximum marks: 1 Flag question undefined

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!