Questions

Single choice

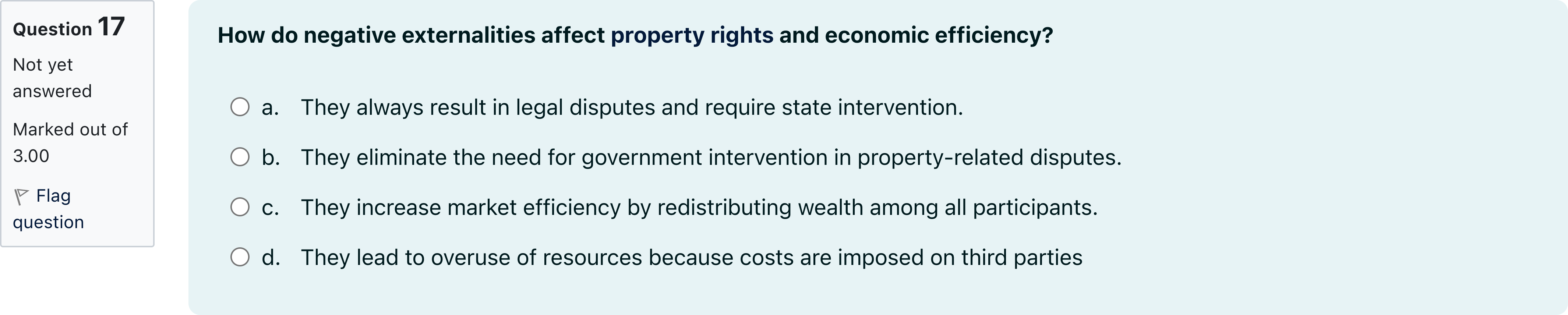

How do negative externalities affect property rights and economic efficiency?

Options

A.a. They always result in legal disputes and require state intervention.

B.b. They eliminate the need for government intervention in property-related disputes.

C.c. They increase market efficiency by redistributing wealth among all participants.

D.d. They lead to overuse of resources because costs are imposed on third parties

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Topic focus: negative externalities and property rights, and their impact on economic efficiency.

Option a: 'They always result in legal disputes and require state intervention.' While negative externalities can lead to disputes and may motivate state intervention in some cases, it is not accurate to say they always result in legal disputes or require intervention. Some negative externalities are internalized t......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

The above diagram shows the private and social marginal costs (PMC and SMC) associated with the production of a fossil fuel energy (such as natural gas, oil, or coal). The demand curve shows the private marginal benefit (PMB) curve for users of fossil-fuel based energy (FFE). There are no demand side externalities so the Demand curve is both the PMB and the SMB curve. The government provides a subsidy to fossil-fuel makers of $s per unit. There are no other policies in place. The [ Select ] vertical horizontal distance between the PMC and SMC curves corresponds to the [ Select ] abatement negative externality positive externality imposed by each unit of fossil-fuel energy (FFE) production. The socially optimal quantity of FFE is [ Select ] Q3 Q1 Q2 The deadweight-loss from the FFE subsidy is [ Select ] R+F+H D+E F+H O+P The deadweight-loss from no intervention (competitive equilibrium under laissez faire) [ Select ] D+E+I+N+O+P R R+F+H D The price the consumer pays net of the subsidy is [ Select ] P3-s P3 greater than P2 The price that firms receive per unit they produce (in the presence of the subsidy) is [ Select ] less than P3 greater than P2 P2 P1 If the government eliminated the subsidy and replaced it with the socially optimal tax on each unit of FFE, then [ Select ] the new deadweight loss would be area R consumer surplus would fall by the amount shown in area L the price consumers pay (including the tax) would rise to P1 the new deadweight loss would be area D+E Self-interest predicts that a producer economic interest group would lobby for [ Select ] the optimal tax laissez faire (no intervention) the subsidy s Friedman's theory of Corporate Social Responsibility implies that, when the government provides the subsidy, [ Select ] it is socially responsible for firms to lobby for the optimal tax it is socially responsible for firms to produce output Q2 it is socially responsible for firms to produce Q3 under the subsidy

If a positive externality exists in the consumption of a good, the private market equilibrium quantity will be

Which is true of a market that has allocational inefficiency (DWL) due to negative externalities? The competitive equilibrium output of that good is lower than the social optimum. [ Select ] The competitive equilibrium output of that good his higher than the social optimum. [ Select ] Social marginal costs at the competitive equilibrium are lower than private marginal costs. [ Select ] Property rights are well defined and transaction costs are low. [ Select ]

Consider the following statements about externalities and environmental policy, which of the following are true/false? The effect of a carbon tax on prices will be lower when demand is price-ineleastic. False The market distortions from a negative externality could be eliminated by the creation of a market, where tradable permits allocate pollution rights'' that can be priced and traded. [ Select ] The optimal tax is smaller than the negative externality because taxes create deadweight losses. [ Select ] Since abatement creates positive externalities its optimal level is always positive. [ Select ] When taxing negative externalities, the government gets revenues while reducing deadweight losses. [ Select ]

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!