Questions

BFX3301 - S2 2025 Week 9 - Pre-class test (10 minutes) - 3%

Numerical

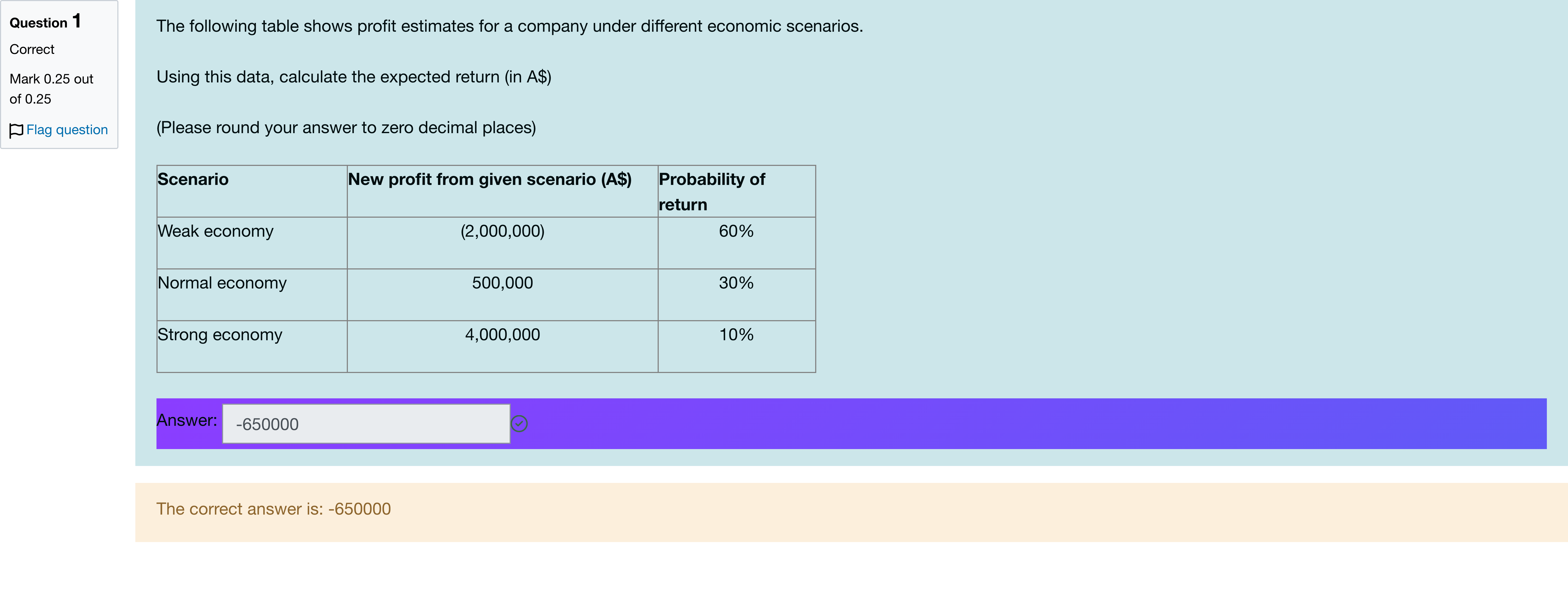

The following table shows profit estimates for a company under different economic scenarios. Using this data, calculate the expected return (in A$) (Please round your answer to zero decimal places) [table] Scenario | New profit from given scenario (A$) | Probability of return Weak economy | (2,000,000) | 60% Normal economy | 500,000 | 30% Strong economy | 4,000,000 | 10% [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To determine the expected return, we need to weight each scenario's profit by its probability and sum the results.

First, multiply the profit for each scenario by ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Note that that the probability that the stock market goes up is 75%. For this question only, we assume that this probability does not have to be 75%. What should this probability be such that the investor is indifferent between the choices in her decision? (Hint: Let p be the probability of U. Then the probability of D is (1-p). Find the value of p such that the EMV associated with B is the same as the EMV associated with S.)

Young screenwriter Carl has just finished his first script. It has action, drama, and humor, and he thinks it will be a blockbuster. He takes the script to every motion picture studio in town and tries to sell it but to no avail. Finally, ACME studio offers to buy the script for either $30,000 today or 1.75 percent of the movie’s profits. There are two decisions the studio have to make. The first is to decide if the script is good or bad; the second is to decide if the movie is good or bad. First, there is a 90 percent chance that the script is bad. If it is bad, the studio does nothing more and throws the script out. If the script is good, it will shoot the movie. After the movie is shot, the studio will review it, and there is a 60 percent chance that the movie is bad. If the movie is bad, the movie will not be promoted and will not make a profit. If the movie is good, the studio will promote it heavily; the average profit for this type of movie is $55 million. Assume Carl is risk neutral (i.e. not risk averse or risk loving), which one should Carl pick?

Based on your spreadsheet model, given the baseline information in the setup, which of the three options has the best expected value for the company, including considerations of financing costs or net-revenue impacts from stopping some operations?

An investment has four possible payoffs: -1000, 0, 600, 3000. Each possible payoff is equally likely. The EMV (to the nearest integer) is

More Practical Tools for International Students

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!