Questions

COMM_V 295 101 102 2025W1 2025W1 COMM 295 Final (December 13, 2025)- Requires Respondus LockDown Browser

Single choice

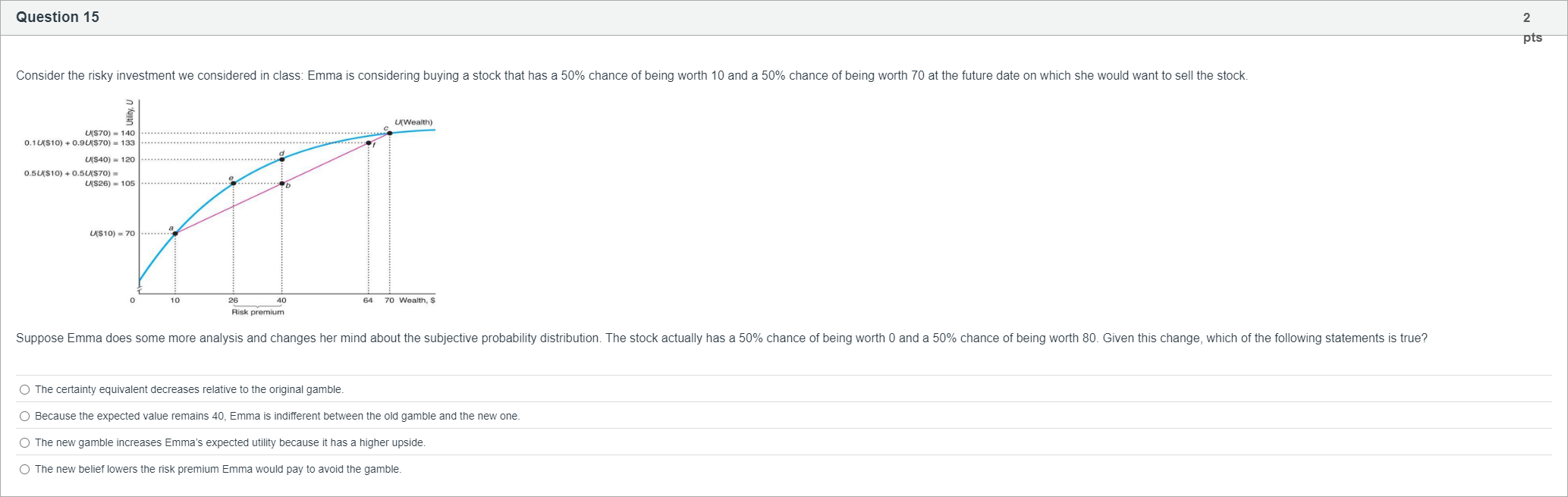

Consider the risky investment we considered in class: Emma is considering buying a stock that has a 50% chance of being worth 10 and a 50% chance of being worth 70 at the future date on which she would want to sell the stock. Suppose Emma does some more analysis and changes her mind about the subjective probability distribution. The stock actually has a 50% chance of being worth 0 and a 50% chance of being worth 80. Given this change, which of the following statements is true?

Options

A.The certainty equivalent decreases relative to the original gamble.

B.Because the expected value remains 40, Emma is indifferent between the old gamble and the new one.

C.The new gamble increases Emma’s expected utility because it has a higher upside.

D.The new belief lowers the risk premium Emma would pay to avoid the gamble.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The scenario presents two risky gambles with the same expected value (EV = 40):

Old gamble: 50% chance of 10 and 50% chance of 70.

New gamble: 50% chance of 0 and 50% chance of 80.

Option 1: The certainty equivalent decreases relative to the original gamble.

- This is the key idea. The certainty equivalent (CE) is the guaranteed amount that yields the same utility as the risky gamble. Although both gambles have the s......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which bets would a rational person definitely want to take, assuming they maximize expected utility: I. Win $1.5 if a coin comes up heads and lose $1 if a coin comes up tails II. Win $1.5 million if a coin comes up heads and lose $1 million if a coin comes up tails III. Win $1.5 if the S&P 500 rises by more than 10% next year; lose $1 if the S&P falls by more than 10% next year

[continues question 5] Then, given Jordan utility function,

Consider the risky investment we considered in class: Emma is considering buying a stock that has a 50% chance of being worth 10 and a 50% chance of being worth 70 at the future date on which she would want to sell the stock. Suppose Emma does some more analysis and changes her mind about the subjective probability distribution. The stock actually has a 50% chance of being worth 0 and a 50% chance of being worth 80. Given this change, which of the following statements is true?

Consumers always make decisions rationally and select brands/products with the mostexpected utility.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!