Questions

Single choice

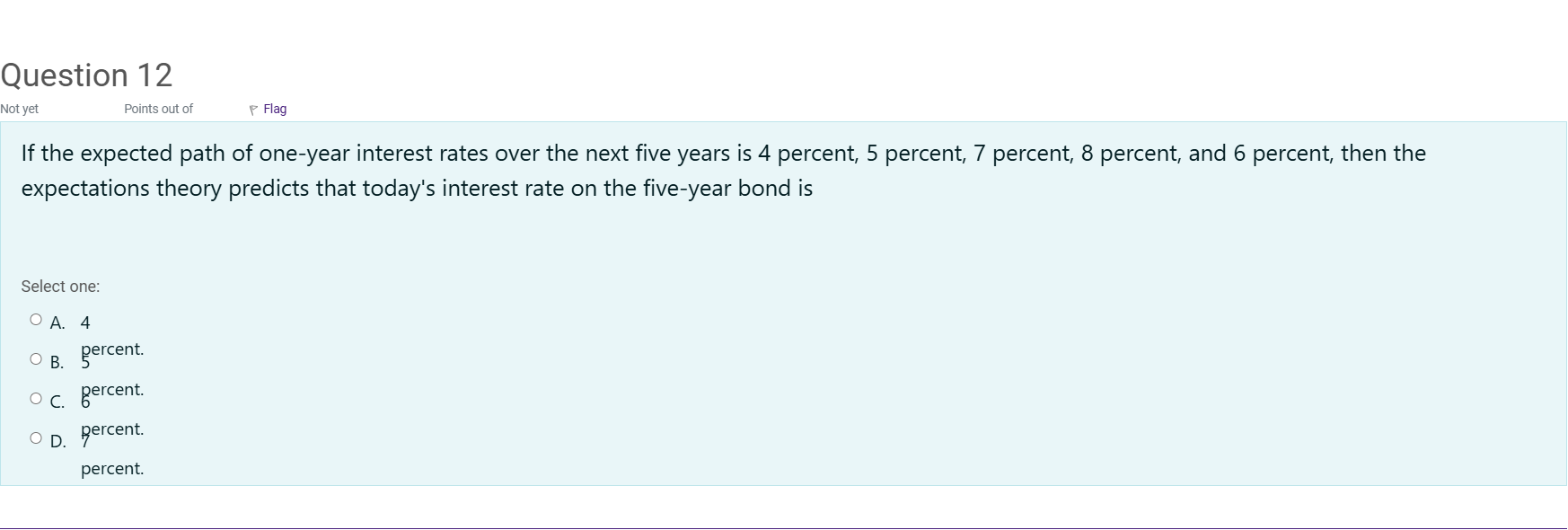

If the expected path of one-year interest rates over the next five years is 4 percent, 5 percent, 7 percent, 8 percent, and 6 percent, then the expectations theory predicts that today's interest rate on the five-year bond is

Options

A.A. 4

percent.

B.B. 5

percent.

C.C. 6

percent.

D.D. 7

percent.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this question, I’ll break down what the expectations theory implies and then evaluate each choice.

Option A: 4 percent. If the five-year rate were 4 percent today, that would suggest the market expects each of the next five consecutive one-year rates to average to 4 percent. However, th......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Part 1"According to the expectations theory of the term structure, it is better to invest in one-year bonds, reinvested over two years, than to invest in a two-year bond, if interest rates on one-year bonds are expected to be the same in both years." Is this statement true, false, or uncertain? A. False: These investments are almost of the same profitability. B. True: The expected return on one-year bonds, reinvested over two years, is always higher at amount i Subscript t minus i Subscript t plus 1 Superscript eit−iet+1. C. Uncertain: The answer depends on whether we can ignore the left parenthesis i Subscript 2 t Baseline right parenthesis squaredi2t2 and i Subscript t minus i Subscript t plus 1 Superscript eit−iet+1 values.

Which of the following statements is CORRECT?

According to the Unbiased Expectations Theory

The unbiased expectations theory assumes that investors do not consider securities with different maturities as perfect substitutes.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!